23 Ways to Cut Your Expenses and Have More Money for Travel

Get out a sheet of paper and write down all your set expenses: rent/mortgage, car payments, cable/streaming bill, cell phone, insurance, school payments, etc. Tally them up.

Then write down all your discretionary spending. This is what you spend on food, movie nights, drinks, shopping, that daily coffee from Starbucks, cigarettes, sports tickets, your daily midday snack, and other similar things. If you don’t know what you spend money on, go track your expenses for a two-week period, see what you spend, and come back.

Add that all up — what did you get? Probably a large sum of money.

And I bet there will be many expenses you didn’t realize were there. Financial experts call these “phantom expenses” — we never know they are there because the expenses are so small. People bleed money without realizing it. A dollar here and a dollar there adds up. Even a daily bottle of water or candy bar can make a substantial difference over the course of a year.

What does this have to do with travel?

One of the main reasons why you think you can’t travel the world is money. “I can’t afford it,” people say to me, “I have too many expenses.” Most of us certainly have expenses we can’t cut (though remember when you travel the world long-term, many of those expenses disappear), but if we cut our phantom expenses, reduce our set costs, and find other ways to save we can build our travel fund much more quickly.

In short, if you want to start traveling more or save up for a specific trip, you need to create a budget. This will let you see where you can make cuts and where every penny you earn is being spent.

Cutting your daily expenses, being more frugal, and downgrading to a simpler way of living will allow you to save money for your trip around the world without having to find extra sources of income. I know these tips work because I used them before my first round-the-world trip (and still use them to keep my living expenses low).

Of course, the lower your income, the longer it will take to save enough to travel. But longer doe not mean never . A little bit every day adds up to a lot over a long period of time.

Here are some simple and creative ways to cut your expenses, make money, and get on the road sooner:

1. Track your spending

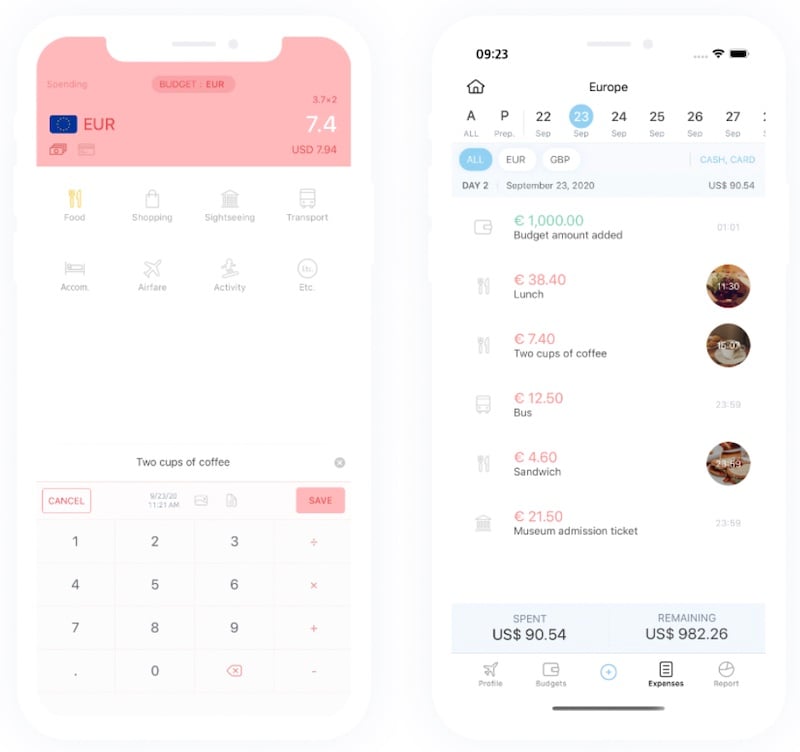

As mentioned in the introduction, most people don’t have a budget so the first thing you need to do to save money is to know where you’re spending it. In an age where you tap an app and a car comes, it’s easy to not think about how much we spend. Create a spreadsheet or use a service like Mint and track all your expenses. You’ll probably be surprised at where your money goes once you start paying attention. I live in Austin and I found myself realizing I was spending close to $100 USD a month on escooter rides. The distances I take them aren’t that far and, since the weather is usually nice, I decided to start walking more. It’s healthier and cheaper. That’s a $1,200 a year savings (i.e. a few months in Southeast Asia!)

Start tracking your expenses – and keep doing so – so you can keep cutting out the low hanging fruit and find where you’re spending money. You can use a spreadsheet or website like Mint or Onomy to do so.

2. Set up a separate bank account

Financial experts have long recommended this. Set up a separate bank account and have money automatically deposited into that account each pay cycle. No matter how much you put away there, putting that money in a separate bank account means it’s away from your spending and you won’t overspend. Think of this like a piggy bank. Don’t raid it. It’s your travel fund.

3. Cut the coffee

Love your Starbucks? Well, Starbucks loves your money. Coffee is a daily expense that quietly drains your bank account without you even noticing. That daily $5 USD coffee costs you $150 USD per month. At $1,800 USD per year, that’s two months in Southeast Asia .

What’s more important: your daily cup of Joe or spending more time on the beaches of Thailand or exploring the jungles of Borneo?

Sure, giving up your cup of coffee seems like a “duh” thing. And, yes, there is utility in the time saved from buying one. Under normal circumstances, this would be “small thinking” financial advice that isn’t worth the time or effort.

But, right now, you have a travel goal to reach and every penny counts.

4. Learn to cook

We all need to eat but restaurants are expensive. To keep your food bill low, cook more often. I learned to cook while in college (a skill that has helped me ever since) and before I left for my first trip, I cut down my eating out to two times per week. Every other meal I cooked myself. I would save the leftovers from dinner for lunch the next day, thus saving more money.

You don’t need to be a whiz in the kitchen, either. There are a million and one cooking sites, YouTube videos, and recipe blogs that will teach you how to cook fast and healthy meals. I never spend more than 20-30 minutes making a meal.

Here are some sites to check out to get the ball rolling:

- Deliciously Ella

- Bon Appétit

- Jessica in the Kitchen

5. Lose the car

Between insurance, repairs, loan payments, and filling your tank with gas, cars are crazy expensive to own. Get rid of your car if you can. Learn to love the bus, take the subway, bike, or walk. It may take longer to get to work using public transportation, but you can use that time to plan your trip, read, write, or do other productive tasks.

I understand that this tip may not be feasible for everyone, especially those in smaller towns that don’t have an extensive public transportation system, but an alternative is to sell your car and buy a cheaper used one, which you will only need until you leave for your trip. Buying a throwaway car will allow you to pocket the money from your more expensive car and put it toward your travels.

Additionally, with the proliferation of Uber, Lyft, and other ride-sharing services, it’s never been easier, even in small towns, to find transportation. Do the math on it but it may be cheaper to get Lyfts around town than to own a car. (Plus, if you need a car for long distances, you can easily rent one.)

6. Save on Gas

Gas adds up! Luckily, there’s plenty of ways to save on gas! First, use the app GasBuddy to find cheap gas near you. Second, sign up for all the major gas station loyalty programs. By default, they save you around 5 cents per gallon. Shell’s Fuel Rewards is the best because you attached it to a dining program leading to savings up to 50 cents a gallon. Moreover, use GasBuddy’s credit card, which can be tied to any of these loyalty programs and then used for an additional savings of 25 cents per gallon. Most supermarkets also have loyalty programs that offer gas savings. And, if you sign up for Costco, they have huge savings too.

In the age of Hulu and free (and legal) streaming TV, there’s no reason for you to be spending $50 USD per month on cable television. Get rid of it and just watch everything online for free. You can also start sharing your streaming costs with friends or family. Standard Netflix is $12.99 USD per month. If you can cut that in half by splitting it with a friend, you’ll save a few bucks.

8. Downgrade your phone

The average American phone bill is over $100 USD per month. While smartphones are handy devices, getting a cheap phone without any fancy apps will cut your monthly phone bill in half (if not more). You might get bored on the train not being able to read the news, but saving an extra $600-800 USD a year will allow you to spend a few more weeks in Europe , buy fancier meals, or learn to scuba dive in Fiji.

Consider buying a simple flip phone or even a refurbished phone. You’ll waste less time online and save money. Double win!

9. Get a new credit card

A travel credit card can give you free money, free rooms, and free flights. After accruing miles and rewards points with your card on everyday purchases, you can redeem them for free travel on your trip. Travel credit cards are a big weapon in a budget traveler’s arsenal. You’ll even earn huge sign-up bonuses when you get a new card.

When used properly, these cards generate free money so start early. As soon as you decide to travel the world, get a travel-related credit card and begin earning points on your daily purchases. A few credit cards worth checking out are:

- Chase Sapphire Reserve – The best card on the market, offering 3x points on restaurants and travel, lounge access, and over $300 in travel credit.

- Chase Sapphire Preferred – A more affordable version of the Reserve with 2x points on restaurants and travel as well as no foreign transaction fees.

- Capital One Venture – An easy-to-use card with a $100 credit for Global Entry over 10 airline partners you can transfer points to.

- Chase Freedom Unlimited – A simple cash-back card with 5% cash-back on travel.

For more credit card suggestions, check out this list of the best travel credit cards .

And, for more information on travel credit cards in general, here is my comprehensive guide on how to pick a good travel credit card .

10. Open an online savings account

While saving, you can have your money grow a little bit more by putting it in a high-yield online savings account. I’ve done this since the time when I was preparing to go away on my first trip and I netted hundreds of dollars in extra money thanks to interest (and a bit more while I was traveling too as the money was sitting there while it was being spent down). Interest rates are very high these days and you can earn around 4% on your savings account! Take advantage of that!

Not from the US? Check out these websites for more local information:

- New Zealand

11. Get a Charles Schwab account

Charles Schwab bank refunds all your ATM fees and has no account fees. With this card, you’ll never pay an ATM fee again. When you think about how often you take out money — both at home and abroad — this is a game changer. For more on saving money when you bank, read this article .

Note: This is only available to Americans.

12. Sign up for travel newsletters

No one likes to clutter up their inbox, but by signing up for mailing lists from airlines and travel companies, you’ll be able to get updates about all the last-minute sales or special deals happening. I would have missed out on a round-trip ticket to Japan for $700 USD (normally $1,500) if it wasn’t for the American Airlines mailing list.

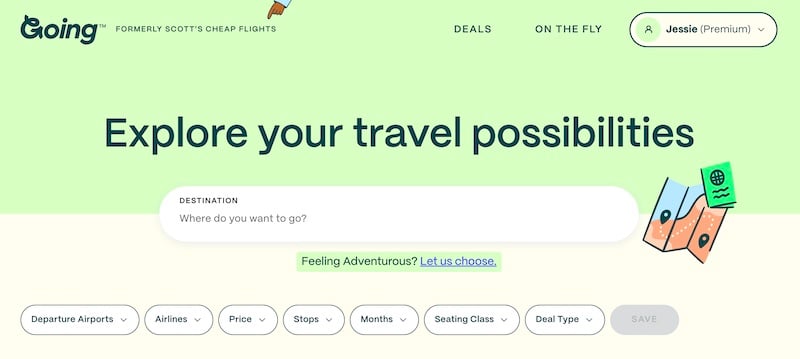

Additionally, consider signing up for a website like Going (formerly Scott’s Cheap Flights). They hunt down deals and send them directly to your inbox — for free! They also offer a premium service that offers more (and better) deals but at the very least join their free newsletter. Chances are you’ll find some awesome deals!

13. Build a network on Couchsurfing

Building a network on Couchsurfing can help you make friends with locals and get free accommodation when you do travel.

However, if you’ve never used it before you might not get many responses. After all, someone who hasn’t been vouched for and has no reviews isn’t an appealing candidate. Before you go away, sign up for Couchsurfing, find a local meetup (there should always be at least one in your area), and attend. You’ll make friends, be added to people’s profiles and vouched for, and have a network you can utilize when it is time to actually go away.

Of course, if you have space in your apartment you can also host travelers before you depart (or just meet up with them for coffee). This is the best way to build your network, get familiar with the platform, and earn reviews that will help you down the road when you’re looking for a host.

If possible, verify your account as well. Having a verified account will boost the chances of a host accepting your request.

14. Replace your light bulbs

Electricity costs money and since every penny counts, using energy-efficient light bulbs will cut down on your utility bills. Fluorescent light bulbs are cheap and replacing just five bulbs can cut $75 USD per year off your electric bill.

Moreover, due to energy efficiency initiatives in certain states, many electric companies will give you a rebate if you buy fluorescent bulbs! Be sure to check out which rebates your local energy company offers no matter where you live in the world.

Going green can save you green!

For US readers, check out EnergyStar or the DSIRE database . For Canadian readers, check out this page run by the government . For everyone else, check your local government or utility company’s website for information!

15. Buy second-hand

Why pay full price when you can pay half? Use websites like Amazon (discounted books and electronics), wholesale websites, Facebook Marketplace, and Craigslist. Towns big and small usually have thrift stores like Goodwill where you can pick up clothing and odds and ends. Sure, you don’t want to buy everything used, but you can definitely buy most things used!

Plus, it’s good for the environment since you’re giving stuff an added use life rather than having it end up in a landfill!

16. Cut coupons

The Entertainment Book, grocery coupons, Groupon, and loyalty cards all reduce the price you pay at the register. Clipping coupons might make you feel like an 80-year-old grandmother, but the goal here is to be frugal and save money, and coupons definitely help with that.

Many grocery stores also offer electronic coupons based on your shopping habits. Sign up at your local grocery store for their loyalty program and you can lower your weekly grocery bill with discounts either sent via email or added directly to your loyalty card. Here are some discount and coupon websites worth checking out are:

- Don’t Pay Full

- RetailMeNot

Additionally, check out Mr. Rebates and Rakuten , which give you cashback for purchases made via their website. They simply redirect to the retailer’s website and use a cookie to track everything. You can also use this for booking travel while still getting points and miles too. I use this when I book accommodation. You can get up to 8% back!

17. Sell your stuff

Before I started long-term travel, I looked around my apartment and saw just a lot of stuff I had no need for anymore: TVs, couches, tables, stereo equipment. Instead of keeping it in storage (which costs money), I decided to just get rid of everything. I sold it all and used the money to travel. After all, I’m not going to need my couch while eating pasta in Rome!

Sites like Craigslist , Amazon , and Gumtree are excellent places to sell your unneeded consumer goods.

Personally, I love the app OfferUp. It’s easy to use and people are less flakey than on Craigslist (and they don’t try to haggle you down as much). Definitely check it out.

If you’ve got a ton of stuff, consider having a yard sale. That’s the fastest way to clear out your house and make a few bucks in the process.

18. Skip the movies

I don’t know about you, but I find movies ridiculously expensive. It can cost up to $20 USD for a ticket, and that much again for the popcorn and soda. Cut out the movies or rent them online via Netflix or iTunes. Whatever you do, cutting out trips to the movies will save you a bundle.

If you do want to see the occasional movie, go on the cheap night (most theaters have one) and sign up for their loyalty program to earn free movies.

19. Stop drinking alcohol

Alcohol is expensive. Cutting down the amount you drink is going to have a big impact on your budget. While this might not apply to everyone, those of you who are carefree might go out with your friends on the weekend. Drink before you go out to the bar or simply don’t drink at all. Cutting down the amount of alcohol you consume is considered low-hanging fruit — an easy way to save money.

20. Quit smoking

Smoking kills not only you but also your wallet. A $10 USD pack per day amounts to $3,650 USD per year. Even half that amount would still yield enough money for close to two months in Central America . If you don’t want to stop smoking for your health, do it for your trip.

21. Stop snacking

A snack here and there not only adds calories to your waistline but also empties your wallet — another example of phantom expenses. We don’t think much of them because they cost so little, but they add up over time and eat into our savings. Eat fuller meals during lunch and dinner and avoid snacks.

If you do want to snack, bring snacks from home and plan your snacks in advance. That way, you can buy cheaper (and healthier snacks) and avoid buying chips, chocolate bars, and other expensive junk.

22. Earn extra money on the side

The sharing economy has made it really easy to earn extra money on the side. You can rent your spare room out on Airbnb, become a Taskrabbit, work for Instacart, drive with Lyft, cook dinner on EatWith, or lead personalized tours through Get Your Guide.

No matter what skill or unused asset you have, there is a moneymaking service for you. Use these websites to boost your trip savings and travel cheaper.

Here is a full list of sharing economy websites you can use to earn some extra cash on the site .

23. Buy a reusable water bottle

Single-use water bottles are not only harmful to the environment, they are also harmful to your wallet. One or two water bottles a day at $1 USD per bottle will add up to at least $30 USD a month. That’s $360 USD a year! You can spend a week in France with that much money!

Instead of plastic, buy a reusable water bottle and fill it with tap water. You’ll want one for your trip anyway, so buy one now and get in the habit of using it. I like Lifestraw as it also has a water filter.

These tips will help save you thousands of dollars and will make your dream trip seem less like a dream and more like a reality . I know some of them are obvious but it’s the obvious things we rarely think about.

The most important thing you can do though is to track your expenses as everyone’s situation is different. For me, the biggest “Wow! I can’t believe I’m spending money on this” were Lyft and escooters. Hundreds of dollars a month were being wasted on those two things with me realizing it.

Track your spending so you can keep cutting what is discretionary spending. The more you do that, the more you’ll save money, the quicker you’ll be able to get on the road!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- InsureMyTrip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

GET YOUR FREE TRAVEL STARTER KIT

Enter your email and get planning cheatsheets including a step by step checklist, packing list, tips cheat sheet, and more so you can plan like a pro!

Protect Your Trip »

12 Unconventional Ways to Save on Travel

Points and miles are major, but there are other cheap ways to travel too.

Getty Images

Consider setting up airfare alerts, housesitting and traveling midweek to help stay in budget.

Traveling can be expensive, and even when you rely on widely known savings tactics – such as traveling in off-peak seasons or staying at a hostel or a rental with a kitchen – the costs inevitably add up. If you're looking for ways to save on your next trip, add these unconventional tips provided by travel industry experts to your hat of travel tricks.

Get a set of packing cubes

Traveling with just a carry-on bag is a cost-effective option since it's typically free on most major airlines, but it's often easier said than done. That's why packing cubes are a good investment. They don't cost much – you can get a quality set like this one by Bagail for less than $25 – and they inevitably allow you to save space and fit more in your carry-on (or checked luggage ).

[Read: Guide: Carry-on Luggage Sizes by Airline .]

Choose the flight, then the destination

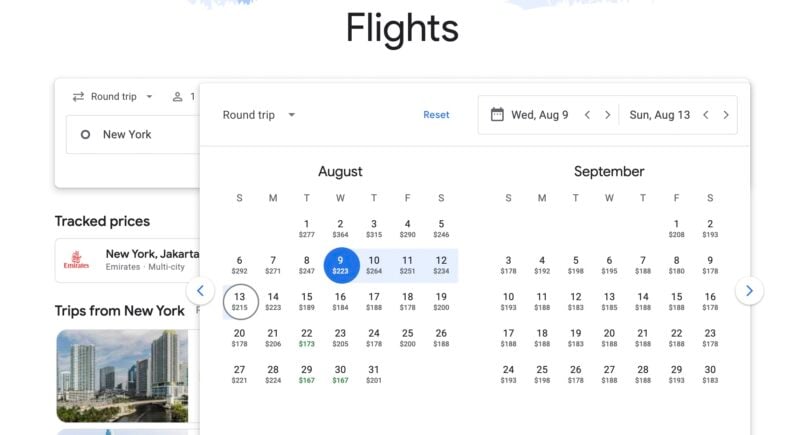

Scott Keyes, flight expert and founder of Scott's Cheap Flights , recommends changing the way you search for flights to save on airfare . Instead of looking for flights to a specific destination, use a flight comparison tool like Google Flights , Momondo or Skyscanner to browse a variety of airfares from your preferred airport(s). Maybe a trip to Barcelona wasn't what you originally had in mind, but if the price is right, why not head there instead?

Consider alternate airports

While flying from the airport closest to home is always the most convenient option, Keyes also suggests comparing fares from other airports, even those that are a few hours away. You may find prices are hundreds of dollars less to get to the same location, making the combined cost of gas, parking and driving time an excellent investment.

If you can drive a few hours to a larger airport with more flight options in general, that may be even better. Not only do you have the potential to save money, but you're more likely to find a direct flight or a route with fewer layovers.

[Read: What to Do If Your Flight Is Canceled or Delayed .]

Set up airfare alerts

If you're eager to travel far and want to save big on airfare, keep an eye out for short-term airfare offers on websites like Hopper and Trip.com . These sites offer deals that usually last a short time, meaning you have to strike while the iron is hot. "I do this every time I book a flight and I usually save at least 10%, but sometimes up to 75%," says Josh Band of A Backpacker's World . "I once got a flight that should have been $200-plus for just over $50 by setting up an alert."

Go to Europe for Thanksgiving

Many Americans opt to head to Grandma's house or another domestic destination for turkey dinner. However, not as many escape to the Caribbean and Mexico, and even less go to Europe – which means you're more likely to find flight deals to Paris , London and other European vacations you've been wanting to cross off your bucket list.

Travel midweek

There's no set day of the week to book the cheapest airfare, but there are less expensive days to travel, says Keyes. He recommends flying on Tuesdays, Wednesdays and Thursdays since most business travelers fly on Sundays and Mondays (and consequently drive up the cost of airfare on those days).

Consider a 'bleisure' trip

If you have an upcoming business trip in a unique or new-to-you destination, consider tacking on a few personal days to the journey. This way, you can enjoy a mini-vacation sans airfare (assuming your company will cover that portion).

[Read: The Best Garment Bags for Travel, According to Reviews .]

Buy travel insurance

It may sound counterintuitive, but purchasing travel insurance can save your bank account (and your sanity) in the event that you or a family member falls ill or has another emergency that forces you to change your vacation plans before or during the trip. A basic and cheap travel insurance policy will suffice, though there are coverage options for a wide variety of needs – including cancel for any reason travel insurance (which is exactly what it sounds like).

Housesit for free accommodations

Did you know you can enjoy free accommodations in exchange for housesitting? Sites like House Sitters America and Mind My House offer housesitting opportunities for a small annual fee (less than $50). Many of the homeowners have pets who need TLC while they're gone, too, making this a fun and budget-friendly alternative to traditional rentals like Airbnb. No matter where you travel, it doesn't get much better than living like a local and playing with pups.

Similarly, you can try couch surfing, which allows you to stay with a local for free. Services like the site Couchsurfing charge a negligible monthly or annual fee to sign up and get verified for safety purposes, while others such as BeWelcome are free. These services also provide exclusive meetups with other travelers.

Read: The Best Vacation Rental Travel Insurance Plans

Sign up for a family loyalty program

Did you know there are loyalty programs that allow family members or groups to pool rewards or freely transfer rewards to others?

"This can be a great option for infrequent travelers who may not rack up enough points or miles for a free flight or hotel room individually – but can reach those rewards when combined," says Nick Ewen, director of content for The Points Guy . "In some cases, it's a single, pooled account that automatically combines points (like JetBlue). In other cases, you can simply transfer points from one account to another (like Hilton Honors, World of Hyatt, or Marriott Bonvoy)." He recommends reading the full terms and conditions of these programs, as some impose time limits, maximum transfer amounts and other restrictions.

Use travel rewards on experiences

Don't forget that both airline credit cards and airline rewards programs can be used to cover more than flights and hotels. Programs like Chase Ultimate Rewards make it easy to redeem points for sporting events, dining (including reservations, exclusive culinary experiences and takeout orders) and more.

You can also use points earned on hotel credit cards as well as hotel rewards programs to pay for fun experiences in hundreds of destinations around the world. Options range from cooking classes and concerts to outdoor activities and spa experiences .

Book a refundable car rental

While some companies offer discounts for prepaid car rentals, many travelers say they've had better luck with booking refundable car rentals , allowing them to secure a reasonable rate while keeping a watchful eye for price drops. If a better price pops up, simply cancel your original reservation and book at the lower rate. Frequent traveler Pamela Howard, who writes about her experiences on Our Adventure Is Everywhere , says she's consistently able to save anywhere from $25 to $100 using this tactic on Costco Travel car rentals. "It's simple and that little bit of time rechecking rates pays substantially in savings."

Ewen says you can do the same when you book a flight or hotel using points since many loyalty programs have flexible cancellation policies. "If you lock in a flight at 35,000 miles and see that your same ticket is 30,000 miles just a week later, you should be able to rebook and get those 5,000 miles back into your account," he explains.

You might also be interested in:

- The Best Cruise Lines for the Money

- The Top Cheap All-Inclusive Resorts

- The Top Cheap Weekend Getaways in the U.S.

- The Top All-Inclusive Resorts Where Kids Stay Free

- Cruise Lines That Let Kids Sail Free

Tags: Travel , Budget Travel , Travel Tips

World's Best Places To Visit

- # 1 South Island, New Zealand

- # 4 Bora Bora

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

You May Also Like

Adults-only all-inclusive mexico resorts.

Sept. 13, 2024

Romantic Getaways in Texas

Marisa Méndez Sept. 13, 2024

The Best NYC Food Tours

Ann Henson Sept. 12, 2024

Top Indoor Water Park Resorts

Holly Johnson and Amanda Norcross Sept. 11, 2024

The Best Tower of London Tours

Laura French Sept. 11, 2024

Romantic Getaways in Florida

Alissa Grisler and Gwen Pratesi Sept. 9, 2024

The Best Weekend Getaways From NYC

Alissa Grisler and Jessica Colley Clarke Sept. 5, 2024

The Best Beach Resorts in the World

Sept. 5, 2024

The Best Rome Food Tours

Laura Itzkowitz Sept. 4, 2024

Top Things to Do in Hershey, PA

Amanda Norcross Aug. 30, 2024

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Best ways to save money on travel in 2024

Sarah Sharkey

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 4:47 a.m. UTC Jan. 31, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

surasaki, Getty Images

Americans are tingling with wanderlust, which may result in a hangover for your wallet if you’re not careful.

The Transportation Security Administration screened nearly 3 million passengers the Sunday after Thanksgiving last year, which is a record, as Americans continue to make up for lost time after government shutdowns in response to the coronavirus pandemic.

With a little planning, though, you can enjoy a relaxing vacation at a reasonable price.

1. Build a budget in advance

Before you start planning your vacation, build a budget. Decide how much you can afford to spend without derailing your other financial goals. If you start picking out vacation stays and activities beforehand, it could be tempting to spend more than you can truly afford.

You shouldn’t dip into your retirement fund, use your emergency savings or get a personal loan to take a vacation.

Once you have a clear idea of how much you can comfortably spend on a trip, use that amount as a framework for your travel plans.

2. Plan ahead

“One of the best ways to save money on travel is by planning and booking your trip well in advance,” said Nadia Podrabinek, founder of Why This Place, a travel advice company based in Valencia, Spain. “[Planning ahead] gives you ample time to compare prices, look for deals and discounts, and make informed decisions.”

You can put more dollars towards what you really want to do rather than having to shell out for full-price items or last-minute upcharges.

Eleventh-hour bookings are often more expensive, especially during a peak season.

3. Pick the right time

When it comes to saving money, a little bit of flexibility on your travel dates can go a long way.

“Consider traveling during off-peak seasons when prices are lower,” said Podrabinek. If you’re able to travel in a different season, you might be surprised by how much you can save.

Traveling off season isn’t always in the cards though. It’s probably not possible to go skiing in Colorado in June, for example. In that case, “look for cheaper mid-week flights than weekend ones,” Podrabinek suggested.

Some travel apps, such as Skyscanner and Hopper, feature a calendar view that shows prices, so you can quickly see how costs fluctuate without doing multiple searches.

4. Be flexible with your destination

Some destinations are undeniably more expensive than others. Everything from accommodations to snacks may be more expensive in a huge urban center or resort area.

Consider how to get what you want from a place that may not be top of mind.

For example, plane tickets to Puerto Rico tend to be hundreds of dollars less expensive than flights to the Bahamas and both places have beautiful, tropical beaches.

If you’re traveling internationally, “look for countries with favorable exchange rates, affordable accommodation options and low-cost activities,” said Podrabinek.

Ultimately, choosing the right destination can be the key factor in planning a high-quality trip on a budget.

5. Compare accommodation costs

Whether you want a private hot tub or you’re happy with a closet-sized room, check out your options, including hotels, motels, hostels and private rental spaces.

“Especially if you are going with friends or family it can be cheaper to split an Airbnb than for each to get a hotel room,” said Kendall Meade, a certified financial planner (CFP) at SoFi based in Charleston, S.C. “Make sure to shop around for your accommodations.”

6. Consider travel rewards

Loyalty programs and travel rewards credit cards can maximize your savings via discounts and travel perks.

“Personally, I’ve used travel rewards credit cards with great success,” said Ross Loehr, a CFP based in Jacksonville. “For example, on my last trip, I was able to snag two round trip tickets to Europe for only the cost of taxes and fees.”

With the right rewards strategy, you could see the world at a fraction of the cost.

7. Scope out free fun

“While it’s natural to want to explore paid attractions and experiences at your destination, don’t overlook the abundance of free and low-cost activities available,” said Hammer Tsui, cofounder of the travel blog A Fun Couple .

Most destinations offer a wide range of free activities — visits to parks, monuments, art galleries, local markets, cultural centers and boardwalks don’t have to cost a dime. Many museums have hours of gratis admission and you can almost always find free live music, whether you’re out in the country or the city.

Taking advantage of these things will not only give you a chance to see the sights, but can also leave some extra breathing room in your budget.

8. Pack your own snacks

Food courts, fast food chains and street vendors aren’t known for providing the least expensive and most nutritious meals. To avoid spending money on subpar sustenance, consider packing your own snacks.

“You can easily spend $20 just on snacks in between flights that would cost you $5 or less if you brought it from home,” said Meade.

9. Cook some meals yourself

Going beyond snacks, if you’re willing to cook or at least slap a sandwich together, you can tap into savings.

For example, Meade generally cooks breakfast and packs sandwiches for lunch when she travels and only goes out for dinner.

“By not eating out for those two meals per day, I estimate we are able to save $510 on a week’s vacation,”she said.

Prepping your own meals can be easy if your hotel room has a minifridge and it can even be convenient if you’re renting a place with a kitchen.

10. Travel light

Since most airlines charge passengers a fee for checked baggage, those fees can add up fast.

“Packing light and sticking to carry-on luggage can lead to significant savings,” said Tsui. “By packing only the essentials and adhering to airline carry-on size restrictions, you not only save on baggage fees but also have the convenience of not waiting for your luggage at the carousel upon arrival.”

Where travel can get a bit pricey

The biggest single-ticket items in travel are often the accommodations and the traveling itself — the airfare, the rental car or even just the cost of gas. When it comes down to making a trip more affordable, many travelers are willing to forgo smaller-ticket items that add up.

A recent study by Destination Analysts found that 60% of American travelers would be likely or very likely to make money-saving compromises. Almost half of the compromisers intended to cut back on dining and food expenses. Others are planning to cut back on shopping or even cut the length of their trip to stay on budget.

What makes a vacation worthwhile varies by individual. Skipping a Broadway show when you’re in New York may be unthinkable, but not going out to a fancy dinner afterwards might be acceptable.

As a traveler, take an honest look about your spending tendencies before heading out on your next vacation. If you’re looking for ways to cut back, you’ll likely spot a solution.

Other tips to prepare before you travel

Seasoned travelers tend to have built-in strategies to keep their trip on a smooth course. A few ways to set yourself up for a successful trip include:

- Notify your bank of your intended destination. This can prevent your debit card from being frozen on suspension of fraud.

- Share your itinerary. Let someone you trust know where you’ll be when and set up check-in times. Apple users can also use the share location feature.

- Withdraw cash. You might need some cold, hard cash for cab fare or simply to negotiate a better price on a special souvenir, even if you’re staying in the country.

- Have the right travel medical insurance . Whether you’re going to Paris or climbing Mont Blanc, make sure that you and your family will be covered if anything happens.

Best travel rewards credit cards to help you save

Travel rewards credit cards can help you turn your regular spending into rewards that can offset some of your vacation costs. The right card should give you an opportunity to make the most of your spending — whether you get one that’s tied to a specific airline that you frequent or a hotel chain you prefer.

As you explore your top rewards credit card options, there are several factors to consider:

- Welcome bonus. To entice you to sign up for a credit card, many companies offer a welcome bonus, which, while often having a spending requirement, can represent a big score for vacation budget.

- Annual fee. While there are travel rewards cards with no-annual-fee , many have an annual fee attached. Make sure you are comfortable with any fee before signing up.

- Rewards potential. Every card has different rules on how it rewards your spending. Some might offer extra points per dollar based on the type of purchase. Seek out a card that offers the best rewards potential for your spending preferences.

- Redemption options. Before you sign up for a card, make sure you’re comfortable with the redemption options. Some cards allow you to spend points anywhere, but others only offer redemption options at a specific brand.

Frequently asked questions (FAQs)

The amount you should save for travel depends on your preferred destinations. A trip to a nearby town will likely require less savings than a jaunt around the world. You could research the costs of your ideal itinerary and have that amount (plus maybe 10% extra, just in case) be your savings goal.

The 50/30/20 budgeting rule dictates that you’ll put 50% of your income toward things you absolutely need, 30% toward wants and 20% toward savings. Travel typically falls within the want category.

Using a credit card while traveling abroad can offer a safer way to spend. Many come with no foreign transaction fees and have built-in fraud protection. But only opt for a credit card if you can trust yourself to spend responsibly.

A few ways you can slash your travel costs include planning your trip for the off-season, looking for affordable accommodations, choosing to cook some of your own meals and opting for some free activities. Also, reward programs offered by credit cards and major businesses, such as airlines and hotel chains, can help you lower your travel costs.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Sarah Sharkey is a personal finance writer who enjoys diving into the details to help readers make savvy financial decisions. She covered mortgages, insurance, money management, and more. She lives in Florida with her husband and dogs. When she's not writing, she's outside exploring the coast.

Jenn Jones is the deputy editor for banking at USA TODAY Blueprint. She brings years of writing and analytical skills to bear, as she was previously a senior writer at LendingTree, a finance manager at World Car dealerships and an editor at Standard & Poor’s Capital IQ. Her work has been featured on MSN, F&I Magazine and Automotive News. She holds a B.S. in commerce from the University of Virginia.

CD vs. money market account: Which is the better option?

Banking Nina Godlewski

Chase vs Bank of America: Which bank is right for you?

Banking Kim Porter

How to open an LLC business bank account

Chase vs. Wells Fargo: Which bank is better for you?

Banking Lauren Ward

Are online banks safe?

Banking Mallika Mitra

Fed interest rate: What can banking consumers expect?

Banking Wayne Duggan

What Americans would do if they won the lottery

Our methodology for rating the best budgeting apps

Banking Jenn Jones

Surprise! Americans actually like their banks

Banking Taylor Tepper

Best national banks of September 2024

Banking Dori Zinn

Capital One bonuses and promotions of September 2024

Banking Emily Batdorf

How to make a budget

Banking Jacqueline DeMarco

Best bank bonuses & promotions of September 2024

Best credit unions of September 2024

The 7 best budgeting apps of September 2024

- Search Search Please fill out this field.

- Credit Cards

- Credit Cards 101

How to Budget for a Trip

Plan ahead, save up, and make the most of credit card rewards

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

Plan for the Big Expenses

Account for the little costs of traveling, redeem rewards and bonuses, make a travel budget savings plan.

The Balance

Whether you’re planning an international vacation or a long-weekend road trip, the idea of escaping your daily life for the promise of relaxation and adventure is intoxicating. But while planning a big trip can be exciting, it can also be overwhelming—especially when you’re trying to figure out how much it’s going to cost.

We’ve created a simple Google spreadsheet to help you plan and budget for your next trip. The Balance’s Travel Budget Worksheet includes common expenses (large and small), plus space to enter credit card or other loyalty program rewards that defray some of the cash costs. It’s free to download and use (but you will need a Google account).

The last thing you want is to arrive at your destination and realize you’re out of money. That’s why it’s important to make a travel budget that includes everything from rental car costs to seat selection fees. As part of “ Our Money’s on Travel ”—our series on getting back to travel—we’re taking a look at how to budget for a trip, whether it’s the big costs or the small, plus a few travel hacks to help you save money along the way.

Most trips involve significant expenses such as transportation and lodging. How significant they are depends on your plans—transportation could include plane tickets or gas for your car, and lodging could mean a five-star hotel or a cabin in the woods. Websites such as Budget Your Trip can help you plan for these costs, but don’t factor in any tips or tricks for saving money. So while this kind of budgeting site can be a good starting point, there’s a lot more that goes into planning your travel budget. Here are a few strategies for saving money on these major travel expenses.

- If you have access to multiple airports, like New York City residents, check prices out of all of them: LaGuardia (LGA), John F. Kennedy (JFK), and Newark (EWR).

- If you only have one local airport, consider booking a separate, cheaper ticket to a major hub, which may offer cheaper flights.

- Be flexible with your dates and aim to travel during off-peak times.

- In pre-Covid times, there was evidence that you could get the best fares by booking 20-115 days in advance and flying on Tuesdays or Wednesdays. But those bets are off because airlines’ pricing formulas are in transition as they cautiously ramp up for more travel. For now, you’ll just have to look for deals and grab them when you see them.

- Follow airfare deal sites such as Scott’s Cheap Flights , Secret Flying , and Dan’s Deals to find out about cheap flights as soon as they’re available.

- Check multiple sources before booking hotels to find the best rates and deals. For example, Hotels.com offers a free night for every 10 nights you book. Large hotel chains often advertise best rate guarantees and will give you up to 25% off your stay if you find a better rate elsewhere.

- Consider shared lodging, such as a private room or dorm in a hostel or a private room in a local’s house on Airbnb, rather than renting an entire home.

- Take advantage of any deals through membership programs such as AAA and AARP.

Transportation

- If you’re planning to rent a car, use sites like Autoslash to compare rental car costs across a wide variety of programs and get a quote for the cheapest rates available.

- Train passes, like the Eurail Pass , offer discounted or unlimited travel for a fixed price so you’ll never be surprised by last-minute ticket costs.

- Electric scooter companies such as Bird and Lime allow you to purchase daily or monthly ride passes in certain cities.

Is Travel Insurance Worth It?

Travel insurance protects you in case of unexpected delays, cancellations, or medical costs in covered situations. But before you buy it from your airline or another carrier, check to see whether you’re covered by the credit card you’re using to book your trip.

In addition, many airlines have eliminated change fees for flights, while many hotels have begun allowing flexible cancellations on their bookings. If you won’t face financial consequences for changing those big-ticket bookings, travel insurance may not be worth the cost.

The big costs aren’t the only ones to consider beforehand. Your travel budget should also consider expenses like tipping, entertainment, souvenirs, food, and even cellphone fees.

Plan for as many of these costs in advance as possible so you aren’t surprised during your trip—or when you return home to larger-than-expected bills.

Watch out for these costs and minimize or eliminate them with these smart strategies:

- Rental car additional driver fees : If you need a second driver on your booking, book through a service that includes them for free, such as Costco Travel .

- Rental car insurance : If you already have car insurance, check to see whether it extends to rental cars. If you don’t own a car, look into a non-owner car insurance policy that will cover you when you drive a rental, which generally costs far less than traditional rental car insurance policies. Also, check whether the credit card you’re using offers its own rental car insurance.

- Debit card holds : Hotels and rental car companies will put a hold on your card when you arrive. If you’re paying with a debit card, the money they put on hold will not be available to you until the hold drops, which could take some time. If possible, make your bookings with a credit card instead, or include the hold in your travel budget.

- Cellphone coverage : If you’re with Google Fi or T-Mobile, you’re in luck, as most locations are covered for free by your cellphone plan. Otherwise, consider purchasing a local prepaid SIM card, which can cost significantly less than the international roaming fees charged by most cellphone companies. Or plan to leave your phone on airplane mode and only use it when connected to Wi-Fi.

- Entertainment costs : Many major cities offer tourist cards, which bundle tickets to a number of attractions onto a card that’s valid for a set number of days. If you plan to hit all the highlights, these cards could save you a bundle over individually purchased tickets.

After diligently earning rewards on your travel credit cards, now’s the time to cash them in for free flights and hotel stays. You can choose to redeem points directly through your card’s travel portal, or transfer them over to hotel or airline chains to book awards.

We recommend crunching the numbers to find the best way to redeem credit card points . For example, hotel chains such as Hilton and Marriott offer the fifth night free on award bookings, so it may make sense to transfer your points to your hotel rewards account. This can also be a good strategy for buying expensive flights, as airlines will sometimes charge a set amount of miles for a ticket even if the cash price is high.

Now that you’ve got a handle on how to save money on travel expenses, it’s time to do the heavy lifting: actually saving money for your trip. Consider these ways to save up for your trip:

- Set up an automatic transfer from your checking account into a dedicated “travel fund” account. This strategy keeps your travel budget separate, so you’re not tempted to spend it elsewhere before your trip.

- If you receive a tax refund, put as much as you can straight into your travel fund.

- If you have extra cash left over from the stimulus checks, move it into your travel fund.

- Work bonuses or side hustles could offer unexpected ways to boost your travel account.

- If your family exchanges gifts, consider letting them know that you’re saving up for a vacation. Cash is always an option, and gift cards for hotels, airlines, and restaurants can also make a significant contribution to your travel budget. They could even give you frequent flyer points if they’d like.

CheapAir.com. " CheapAir.com’s 5th Annual Airfare Study Reveals the Best Time to Buy Airline Tickets ."

Hotels.com. " Instant Savings. Reward Nights. And more ."

Marriott. " Best Rate Guarantee Claim Form ."

Hilton Honors. " What Is an Example of How the 5th Night Free Is Calculated? "

Save money on your long-awaited 2022 holiday with these 11 tips

Feb 18, 2022 • 6 min read

A little planning can help you make the most of your long awaited travel this year. © Westend61 / Getty Images

Starting 2022 with the intention of booking that bucket-list trip, only to find your pockets don’t run as deep as you had hoped? Don’t despair – there are countless ways to save money, from home swaps to being savvy when it comes to food choices.

Here's our guide to making your travel money go further, so you have more to spend when you get there.

Sign up for loyalty programs & credit card bonuses

“It may seem tedious, but it’s worth joining every loyalty program you can find,” says Toronto-based financial and travel expert Barry Choi. According to Choi, most hotel loyalty programs will instantly give you early check-in just for signing up and you can earn points with airlines as long as you’re a loyalty member. For example, Expedia gives holidaymakers up to two points for every $1 spent on flights, hotels, cars, packages and things to do.

Now is also a great time to put your points to good use, according to The Points Guy ’s Senior News Editor, Clint Henderson: “Use those points and miles you’ve been hoarding during the pandemic."

Some credit cards offer generous sign-up bonuses too. “If a bonus is worth at least US$200, it’s a good card,” says Choi. “You may also consider a credit card that doesn’t charge the standard 2.5% fee when buying abroad. It may not sound like a lot but 2.5% certainly adds up over time.”

Get a package deal

You can get some deep discounts by booking vacation packages rather than purchasing flights and hotels individually. Packages also help to save time by simplifying your travel planning overall. While many people go to sites like Expedia or Kayak to book packages, some of the best prices can be found by booking directly through the airlines, many of whom now offer their own vacation packaging options. Sites like American Airlines’ AAVacations.com can be a great place to find deals that help you save money and time.

Avoid unnecessary frills

You might be lured by the promise of low-cost flights, but it’s worth considering whether you really need that priority boarding, extra legroom or seat selection, which can vastly inflate the overall price of your journey. Similarly, you may have to forfeit the in-room massage, as hotel add-ons can rack up your bill significantly.

Setting aside ‘fun money’ from alternative sources can help you cover some additional travel frills. For example, squirreling away earnings from online purchases on cash-back sites like Rakuten can help to build up a handy pot of vacation money.

Stay at someone else's place

Imagine a holiday with no hotel bill. Some might think you’re mad to invite strangers into your home, but you can’t argue with the money-saving aspect of a home swap, especially when it extends to assets such as cars and lifestyle services like gyms or ski equipment. You also get to live like a local with all the comforts of a home.

Members of the home exchange website Love Home Swap have reported annual savings of up to US$3500 on accommodation alone. Yes, you may need to scrub the bathroom and clean out those closets, but the risks are small versus the rewards.

Use price comparison websites

Gone are the days when you had to toggle 15 browsers to find the cheapest flights. Nowadays price comparison websites can do the legwork for you, guaranteeing the lowest price.

If you’re not in a rush to purchase your airfare, you can set up a price alert on sites such as Google Flights or KAYAK, which will then email you once there’s a price drop. Skyscanner is great for a quick overview of prices, AirfareWatchDog for alerts on cheap deals, and Trivago tops many when it comes to cheap rooms. However, be mindful of excessive card charges, which enable some operators to offer ‘cheaper’ deals.

Check out the best dates to fly

COVID-19 has changed a lot about flying, but some travel advice still holds true, the earlier the better is the mantra when it comes to booking.

The best time to book a short-haul flight is 70 days in advance. Look out for deals with the likes of Ryanair, who often roll out sales on routes two to three months prior to departure. Most Asian airlines set their prices according to their national holidays, which means flights at Christmas and Easter are cheaper.

Another tip is to purchase tickets for dates when tourism is slow. A little research can tell you when the shoulder season is for your destination, the time of the year where prices tend to be much lower. Booking during the winter months also tends to yield lower costs.

Consider an all-inclusive stay

The words ‘luxury’ and ‘cheap’ don’t often go together in the same sentence, but going all-inclusive can often mean reaping the reward of a well-planned vacation with plenty of luxury benefits for less. You might have to rub shoulders with other wristband-wearing guests doing the conga but paying for everything upfront means no sneaky surprises on your bill at the end of your stay.

Barry Choi recommends going a step further and booking a tour, since they often include ground transportation, accommodation, local guides, attractions and meals. He says that every tour operator is different, and suggests browsing through a comparison site such as TourRadar.com to help to find one that suits you.

Try split-ticketing your flights

There’s no rule to say you have to stay loyal to one airline, or train company for that matter. Two single flights can be cheaper than a return, and splitting your party can yield further savings. Calling the airline after booking to ensure they link your two reservations can minimize the chances of being split up.

Google Flights is a good go-to portal for mixing and matching airlines, as is Skyscanner’s ‘flexible’ search tool; it allows you to see the (sometimes cheaper) combined costs for separate flights in a way that a normal travel agency can't do.

Explore penny-pinching meal options

If breakfast is included in your rate then fill your boots with the buffet (and load up on snacks). But the cost of a hotel dinner, much like the mini bar, is notoriously inflated. You can also save quite a bit by booking an AirBnb and making your own meals.

Taking a five-minute walk down some back streets away from key tourist sites can invariably halve your bill and deliver a much more authentic experience. And there’s always street food for cheap, local, authentic fare.

Spring for annual insurance

According to Choi, if you travel three times a year or more, then purchasing annual travel insurance is likely to cost you less than buying separate single-trip policies.

“Keep in mind that you may already have ‘free’ travel insurance. Many travel credit cards as well as employers offer travel medical insurance, trip cancellation and lost or damaged luggage as a standard benefit. That said, it's important to read the details of your policy to ensure you have enough coverage.” For example, backpackers on extended trips longer than 31 days are often excluded from the annual insurance parameters.

Track your prices

Price tracking tools like Google Flights are a great way to snag unexpected deals on flights to a particular destination. Setting an alert for a particular destination will let you know when the best prices are available and alert you to any special offers.

In addition to tracking, Google Flights also offers extensive customization options that can save money for those without a specific destination in mind. For example, the site allows “flights to anywhere” searches that show prices from a single destination to cities all around the world, within a set date range.

You might also like: How to road trip the Southeastern US on a budget in 2022 How to save money for your next big trip 20 best free things to do in London

This article was first published Nov 20, 2019 and updated Feb 18, 2022.

Explore related stories

Architecture

Sep 10, 2024 • 4 min read

It’s easy to discover this fantastic city without spending a dime.

Sep 10, 2024 • 11 min read

Sep 12, 2024 • 7 min read

Sep 12, 2024 • 6 min read

Sep 14, 2024 • 9 min read

Sep 14, 2024 • 8 min read

Sep 14, 2024 • 4 min read

Sep 13, 2024 • 5 min read

Sep 13, 2024 • 8 min read

12 Proven Ways to Save Money for Travel

We take pride in providing authentic travel recommendations based on our own experiences such as unique images and perspectives. We may earn a commission when you purchase a product or book a reservation. Learn more ›

Written by Kyle Kroeger

Saving money is a challenge for most people. With inflation making the price of everything much more expensive than it used to be, everyone’s savings account has taken a hit in the last few years.

It’s not easy to save enough money for your dream vacation, but it’s not impossible , either. If you’re serious about traveling more, there are a lot of ways you can save money for travel that don’t involve earning extra income (though that helps).

We’ve got some of the best ways to start saving money for your travels plus a few tips to help you save money on your actual vacation.

Because once you’ve done the work of saving, you want to make sure you’re getting the best deals and stretching your vacation fund as far as it can go.

Here are some of our favorite ways to save money for travel and make your next trip one you’ll remember forever:

Want to Travel the World for Less?

- Going (Formerly Scott's Cheap Flights): Get cheap flights emailed directly to your inbox. Get 20% off a premium membership by using the promo code VIA20 Try Now for Free

- GetYourGuide: See more of every city by taking local tours and experiences. Find a Cheap Tour

- Skyscanner: Home to the easiest and most efficient way to book anything, including flights, cars, hotels and more. Search Now

- SafetyWing: Need to protect yourself and your trip? Use SafetyWing for affordable travel insurance and travel medical insurance. Protect Your Trip

How to Save Money for Travel

Let’s get into a step-by-step guide on how to save money for your big trip.

1. Know Your Numbers

First things first: crunch some numbers. How much money (after taxes) do you bring home every month? What about after the bills and other essential expenses are paid, how much is left over? How much of your savings account (if any) are you willing to allocate to your travel fund?

Regardless of whether you’re on a fixed income or your income changes from month to month, you’ll need to know what you’re working with before you start saving money for travel.

Factor in all of your bills into your overall monthly expenses. This includes utility bills, rent, and any other essential expenses like groceries, fuel, car notes, and insurance. Don’t forget to add in monthly subscription services like cable TV, Netflix, Hulu, or Spotify…you’d be surprised at how quickly those add up.

This is going to give you an idea of the potential savings. Of course, this isn’t a realistic number because life happens. Unexpected purchases are going to happen, we’re just looking for an estimate to see the potential.

2. Set Realistic Goals

Let’s set ourselves up for success, shall we? Saving $2,500 in 6 weeks to make it to Paris for Christmas may just not be in the cards. Trust me, I wish we could all buy a round-trip ticket to somewhere incredible at a moment’s notice, but realistically, that’s not the reality for many of us.

So often we give ourselves unrealistic goals and then beat ourselves up when we don’t reach them.

Get yourself a rough estimate of how much it’s going to cost to get you to your dream destination. And now, using the numbers you crunched earlier, how long do you think it would take you to save up enough money?

If your answer just took the wind out of your sail, don’t worry, we here at ViaTravelers have got your back.

This is a marathon, not a sprint. Remember, this should be a long-term type of goal. Most of us simply can’t save that much in such a short amount of time, even if we skipped every impulse buy, took public transit, and cooked every meal at home.

Be realistic with yourself and your financial situation, while still pushing yourself to meet your savings goals and growing your savings account is possible. I promise.

Check-in with yourself on a weekly basis to make sure you’re on the right track and monitor how much you spend. And don’t beat yourself up if you bought that coffee or enjoyed yourself on a night out with friends. This isn’t a punishment!

See Related: Incredible Bucket List Ideas of a Lifetime

3. Budget Ruthlessly

Now that we know our numbers and have set some realistic goals, it’s time to start slashing away at some unnecessary expenses. This is one of the best ways to reach your savings goal, but it can be a bit of a lifestyle change, depending on how intense you want to get.

Where can you cut costs in your life? Do you really need a monthly subscription for all of those streaming services? How often are you eating out, or having food delivered? If you’re a coffee drinker, I think we both know where we could see some huge savings.

You’re going to have to create a budget and stick to it, there’s no way around it. Now, I’m not telling you to stop doing things that bring joy to your life. I’m simply suggesting that maybe reel it in a little bit, or at least have a game plan.

Right off the bat, you could see huge savings by not eating out as much, limiting your drive-thru coffees, and maybe dialing back your nightlife a bit. These are all phantom expenses that we don’t think about at the moment, but they add up quickly to extra money in your checking account.

Start making a grocery list before you go to the store, and start meal prepping. Look for deals at the grocery, and stick to your list! This will prevent any impulse buys and unnecessary purchases.

Put a pause on those late-night Amazon shopping sprees for new clothes, limit yourself to one specialty coffee or cocktail a week, and watch how fast a few bucks here and there start adding up.

These changes don’t need to be drastic measures that completely change your life. They’re meant to make you more mindful about your daily expenses and everyday purchases so you can reach your savings goal and grow your bank account.

4. Start tracking your spending

Seeing exactly where you are spending money can be a game changer, especially if you’re a visual learner.

It’s critical to track your spending to determine where you may reduce or even eliminate it. With free personal finance tracking software such as Personal Capital , you can track your expenses.

When you track your spending habits and expenses, you can get smarter about where you can spend less and what monthly expenses are essential.

These days, your bank account online may even do it for you! I know I can check my Chase checking account online and it filters everything into nice little buckets so I can see exactly where my money is going.

If you don’t want to use software, that’s totally fine. There’s nothing wrong with tracking your spending old-school style with a pen and paper. This budget planner is less than $10 bucks and is easy to carry around with you.

5. Make extra money on the side

If you’re on a fixed income and are having trouble saving money for your travel fund, then finding ways to make some extra money can help you save money for travel much faster.

You could look into getting a side job, but there are many ways to get some extra cash into your account that don’t involve getting a side job.

Sometimes, finding ways to earn extra money can be as simple as having a yard sale or selling stuff in your house you no longer need. Other times, you may find that you can make some extra cash from some of your hobbies, like photography or traveling.

There are also many ways to make money while you travel . You can sell your photography and videography from drone footage on stock photo sites such as Shutterstock . Alternatively, you can write about your travel experiences by starting a blog .

While these may not be the cash cow you were banking on, every little bit helps grow that bank account!

See Related: Best Travel Jobs to Make Money Traveling

6. Create a Vision Board

Vision boards have been used by some of the most successful people on the planet, so don’t knock this one until you’ve tried it. They’re wonderful, tangible reminders of your goals, and you’ll be surprised at how effective they are.

As a visual person, I need to see my goals to help achieve them. While planning for my last trip, I made a list of my top three travel destinations and researched the approximate cost of it.

I then printed out a world map and colored it in those countries. I also put the dollar amount of the cost of the trip in bold red letters over each country. I then hung it up in my office, where I knew I would see it several times daily.

I found that this helped motivate me to save more money for travel and influenced my spending decisions throughout the day in a positive way.

7. Start A Vacation Savings Fund

From Kristy Marshall of MoneyBliss

In our household, traveling is a priority. It is something we enjoy, and we want to explore as much as possible. We set aside the same amount of money each month into our vacation fund.

My first money-saving tip on travel surprises most people when I tell them. This tip applies to bigger trips like all-inclusive vacations, Disney, Hawaii , or many international destinations.

Find a travel agent you trust and vet their price versus what you can get online. From our experience, we have gotten a better deal from our travel agent and have not spent hours scouring for the best prices. Plus, we can start our vacation sooner without all the vacation planning stress!!

For local travel within the US and quick getaways, I prefer to subscribe to a few travel deal newsletters like Going.com and Dollar Flight Club . This is a great way to explore a new place without paying full price. And you can get some screaming deals!

Lastly, we prefer the low-cost airline to save on air travel . However, the flight times are either super early in the morning or late at night. Since our airport is a hassle and expensive to park, we pay for a driver to and from the airport.

We pay less than getting preferred travel times and parking fees. For us, part of vacationing is enjoying the whole process. Save money where it makes sense, with little stress in planning, and enjoy the destination with quality time as a family .

Best Ways to Save Money While Travelling

Once you’ve reached your savings goal, now what? Well, it’s time to start planning your next big trip!

But you worked hard to save that money, so it’s important that you stretch those dollars as far as you can. If you’re willing to put in the time and do a little research, I guarantee you’ll end up saving money on your trip.

These travel tips will help you get the best deals so your hard-earned cash will go as far as possible.

7. Be Flexible

Flexibility is the best way to save money traveling, both when you’re booking and while you’re traveling.

Starting with the plane ticket, I’d recommend you check the flights a few days before/after the date you’re looking to go. You may find it significantly cheaper to fly out two days before you were planning, and these savings could be big!

That’s more money you can add to your travel budget and possibly use for a nicer hotel, a tour, or even a fancy restaurant.

Using travel companies like Skyscanner or Google Flights is perfect for this. All you need to do is put in your departure airport and it will tell you all of the cheapest destinations you can fly to within the next few months.

If you really want to get serious about traveling, sign up for a membership with going.com . These guys scour the internet for the best deals and send them straight to your inbox every day. There is a free version, but as someone who has been a premium member for about three years now, I can confirm the membership is worth it.