Available in :

- Savings Bank Account

- Canara Angel

- Canara Premium Payroll Package Silver

- Canara Premium Payroll Package Gold

- Canara Premium Payroll Package Diamond

- Canara Premium Payroll Package Platinum

- Canara SB Select

- Canara Jeevandhara

- Canara Jeevandhara Diamond

- Canara Jeevandhara Platinum

- Canara SB Power Plus

- Canara SB Galaxy

- Canara Champ Deposit Scheme

- Canara Junior Saving Account

- Canara Basic Savings Bank Deposit Account

- Canara Small Savings Bank Deposit Account

- Canara NSIGSE Savings Bank Deposit Account

- Savings Account Products Comparison

- UDGAM Portal

- Procedure/Forms for Activation of Dormant/Inoperative Accounts

- Canara Delite Account

- Canara Current Account

- Canara Elite Current Account

- Canara Prarambh

- Current Account Products Comparison

- Canara Green Deposit

- Fixed Deposit

- Kamadhenu Deposit

- Canara Tax Saver Scheme

- Recurring Deposits

- Canara Dhanvarsha

- Nitya Nidhi Deposit Scheme

- Ashraya Deposit Scheme

- Online Account Opening

- Housing Loan

- Housing cum Solar Loan

- Canara Kuteer

- Housing Loan to Agriculturists

- Home loan for NRIs

- Interest Rate Range on Loans

- Approved Housing Projects

- Canara Vehicle

- Canara Green Wheels

- Canara Vehicle to Agriculturists

- Vidya Turant

- IBA skill loan scheme

- IBA Model Education Loan Scheme

- Interest Subsidy Educational Loans

- Education Loan Scheme for pursuing Masters Degree

- Canara My Money

- Canara Ready Cash

- Canara Heal

- Canara Home Loan Plus

- Canara Cash

- Canara Budget

- Canara Pension

- Canara Pension CANARA Bank Ex employees

- Canara Mortgage

- Canara Jeevan

- Canara Rent

- Canara Site Loan

- Rain Water Harvesting

- Swarna Express

- Swarna Overdraft

- Swarna Loan

- Loans against Gold Jewellery for Crop Cultivation

- Overdraft against Gold Jewellery for Crop Cultivation

- Loans against Gold Jewellery for Land Development Activities

- Loans against Gold Jewellery for Allied Activities (monthly instalments)

- Overdraft against Gold Jewellery for Allied Activities

- Swarna Monthly Interest Loan

- MSME Products/Schemes

- MSME Government Sponsored Schemes

- Quick Links

- MSME Digital

- Working Capital Finance

- Export Finance

- Infrastructure Financing

- Kisan Credit Card Scheme

- Krishi Mitra Card Scheme

- Canara Kisan OD

- Farm Machinery Loans

- Dairy Loans

- Estate Purchase Loan (EPL)

- Scheme For Financing Through Self Help Groups (SHGs)

- Fisheries Loan

- Hi tech agriculture

- Scheme For Financing Agriculturists for Purchase Of Vehicles (ALLHV)

- Bee Keeping (Apiculture)

- View All Schemes

- Canara Rooftop Solar CRTS PMSGY upto 3kW

- Canara Rooftop Solar CRTS PMSGY above 3kW to 10kW

- Depository Services

- Merchant Banking

- Online Trading

- Life Insurance

- General Insurance

- Health Insurance

- Investment Secure your Future Apply Now

- Atal Pension Yojana

- National Pension System

- Sukanya Samriddhi Yojana

- Senior Citizen Savings Scheme

- Public Provident Fund

- Sovereign Gold Bond Scheme

- Kisan Vikas Patra

- Floating Rate Savings Bond

- Direct Taxes

- Mahila Samman Savings Certificate

- Customs ICEGATE

- Pradhan Mantri Jeevan Jyoti Bima Yojana

- Pradhan Mantri Suraksha Bima Yojana

- Mutual Funds

- Digital Lending Portal

- Mobile Banking

- Corporate ai1 Mobile App

- WhatsApp Banking

- Net banking

- Credit Cards

- Debit Cards

- Prepaid Cards

- Pre Approved Credit Card Offers

- Apply Debit Card Online

- Canara Bank ITC Self Care Portal

- Canara Rewards

- Hotlisting Debit and Credit Cards

- Standing Instructions on Cards

- Canmedical Insurance Renewal application form

- Credit Card Closure

- Rupay Insurance Program

- FAQs on E mandate for Recurring Transactions

- FAQs on CoFT

- Canara Cancare for Canara Bank Cards

- Lost card Liability Fraudulent Transaction Cover

- Missed Call Banking

- ai1 Merchant Application

- Central Bank Digital Currency

- Canara BMTC Conductor App

- Canara Easy Fees

- Bharat Bill Payment System

- Join 22nd e-AGM

- Investor Calendar

- Investor Presentation

- Disclosure to Stock Exchange

- Shareholder Information

- Financial Result

- Sustainability Report 2023-24

- Annual Reports

- General Meetings

- Investor Feedback

- SEBIs ODR Portal

- Disclosure under Regulation 46 and 62 of SEBI (LODR) Regulations 2015

- Download TDS Certificate for payment of dividend for FY 2022-23

- Unclaimed Interest/Redemption amount of Listed Non Convertible Securities

- NRO Account

- NRE Account

- FCNR B Account

- Resident Foreign Currency Account

- SNRR Account

- Home Loan for NRIs

- Remittance through Western Union and Ria Money

- Rupee Drawing Arrangement

- Remit Money Web based Speed Remittance Facility

- Investment Facilities

- Attorneyship Services

- Nomination facility

- FATCA CRS Self Declaration Form

- Facilities for Returning Indians

- CAIR Remit Money Mobile App

- Branches and Offices Abroad

- NRI News Bulletin

Forex Card Rates

CANARA BANK INTEGRATED TREASURY WING, MUMBAI - 400 051 TREASURY: FOREX-RATEX DATE : 13.09.2024

Note: Rates quoted are in Rupees for one unit of Foreign Currency except for JPY which is quoted for 100 units.

- Rates quoted are subject to change without prior notice.

- Card rates are firm upto US Dollars 5000 or equivalent.

- Exchange rates mentioned are indicative & are subject to change depending on market fluctuations

- CUSTOMER EDUCATION

- CORPORATE BANKING

- EX-EMPLOYEE

- E-AUCTION PROPERTIES

- ANNOUNCEMENTS

- FOREX CARD RATES

- VACANT LOCKERS

- PENSIONERS PORTAL

- HOLIDAY LIST

- APR CALCULATOR

- PHOTO GALLERY

- ESG STATEMENT

- SUSTAINABILITY REPORT 2023-24

- GREEN DEPOSIT POLICY & LENDING FRAMEWORK

- GREEN DEPOSIT POLICY & LENDING FRAMEWORK - VERSION 2.0

- ANCILLARY SERVICES

- DOWNLOAD CENTER

- OFFICIAL LANGUAGE

- REGISTER FOR GRIEVANCES

- DOORSTEP BANKING SERVICES

- UNCLAIMED DEPOSIT

- DO NOT CALL REGISTRY

- SUSTAINABILITY

- CANARA BANK COMPUTER SERVICES LTD

- CORPORATE SOCIAL RESPONSIBILITIES INITIATIVES

- SCREEN READER ACCESSIBILITY

- BROWSER COMPATIBILITY

- CONSULTANCY SERVICES

- ENROLL AS A DIRECT SELLING AGENT APPLY ONLINE

- LINKING OF AADHAAR WITH PAN

- BHARAT AADHAAR SEEDING ENABLER (THROUGH NPCI PORTAL)

- ONLINE AADHAAR SEEDING /DE-SEEDING (FOR CANARA BANK CUSTOMERS)

- NOMINATION FACILITY

- BCSBI's CODE

- REGULATIONS

- REGULATORY DISCLOSURES

- RBI KEHTA HAI

- RBI MONETARY MUSEUM

- GENERAL INFORMATION ABOUT THE MUSEUM

- PRADHAN MANTRI JAN DHAN YOJANA

- INTEGRITY PLEDGES

- OTHER LINKS

- E SYNDICATE BANK DP DETAILS

- CKYCRR AWARENESS

- PRIVACY POLICY FOR LOAN RECOVERY APP

- ONLINE ACCOUNT OPENING

- PRE-FILLED APPLICATIONS FOR RETAIL LOAN PRODUCTS

- DOWNLOAD TDS CERTIFICATE FORM 16 A

- GST INVOICE PORTAL

- CANARA E TAX

- NACH E MANDATE

- CCIL FX RETAIL PLATFORM

- ONLINE SERVICE REQUESTS

- ONLINE DISPUTE RESOLUTION PORTAL

- INTERNATIONAL SERVICES

- IRCTC TICKET BOOKING

- ELECTRICITY FOR TNEB ONLINE PAYMENT

- CANBANK FEE COUNTER

- PRESS RELEASE

- MEDIA COVERAGE

Last updated on 15-09-2024 11:27 PM

Visitor Count 419

- Credit Cards

Best Canara Bank Credit Cards 2024

Top Canara Bank Travel Cards

Canara Bank Corporate Card

Canara Bank RuPay Select Credit Card

Canara Bank Global Gold Card

Top canara bank rewards cards.

Canara Bank RuPay Platinum Credit Card

Top canara bank cashback cards, calculators.

- Company Policy

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel / Travel Money Card

Travel Money Card

Lock in exchange rates and load up to 16 currencies on one account to easily access your money while you’re travelling.

Features & benefits

$0 card issue fee.

Order a Travel Money Card for free in branch or online (search 'Travel Money Card' in the CommBank app or log into NetBank ).

Lock in exchange rates

Load up to 16 currencies on one card before your trip, so you know how much you have to spend, no matter how the Australian Dollar moves.

Spend anywhere in the world

Shop online, in-store, or over the phone wherever Visa is accepted, plus get access to Visa ® travel offers .

Easily manage your travel budget

Manage your holiday money and track your spending via the CommBank app or NetBank.

Your purchases, covered

Lost or stolen personal belongings? We may be able to cover the cost to repair or replace them up to 90 days after purchase. 2

Extra card security

Lost, misplaced or stolen card? Lock it and report it in the CommBank app or NetBank.

- Currency converter

Exchange rates

Load up to 16 currencies on one account

Lock in exchange rates and load up to 16 currencies easily on one account – wherever you are in the world – through NetBank or the CommBank app:

- United States Dollars (USD)

- Euros (EUR)

- Great British pounds (GBP)

- Australian Dollars (AUD)

- Japanese Yen (JPY)

- New Zealand Dollars (NZD)

- Hong Kong Dollars (HKD)

- Canadian Dollars (CAD)

- Singapore Dollars (SGD)

- Thai Baht (THB)

- Vietnamese Dong (VND)

- Chinese Renminbi (CNY)

- Emirati Dirham (AED)

- Fijian Dollars (FJD)

- Indonesian Rupiah (IDR)

- Indian Rupees (INR)

No load or reload fees

You can load up to 16 currencies on your Travel Money Card with no load or reload fees. The exchange rate is the CommBank Retail Foreign Exchange Rate at the time of the conversion.

When you’re ready to pay for something, we will always try to complete the transaction for the country you are in. Make sure you have enough of the correct currency for the country you’re in on your card to avoid additional fees. If you don’t have enough of the local currency, we’ll use the next available currency instead, so long as there’s enough of it loaded on your card.

If you load multiple currencies on your Travel Money Card, you can change the order (the next available currency) anytime online.

Rates & fees

See all fees and charges

Who can apply

To get your Travel Money Card, you’ll need to:

- Be at least 14 years old;

- Be registered to use NetBank, or register online New to CommBank? Sign up to NetBank at your nearest branch ;

- Provide a valid email address; and

- Have an Australian residential address

How to apply

Before your trip.

- Order a Travel Money Card in the CommBank app (search 'Travel Money Card'), NetBank , or at your nearest branch .

- Load at least AUD 50 or the foreign currency equivalent to get started

- Once you’ve got your card, activate and set your PIN online in NetBank, or under Cards in the CommBank app

- Lock-in the exchange rate by loading currency on your card in NetBank or the CommBank app

How it works

During your trip.

- The local currency will be automatically applied when you pay for something, as long as it’s loaded on your card and you have sufficient funds

- Reload in real time , fee-free if your balance gets low

- Stick to daily transaction limits

- The maximum value of purchases per day is unlimited, however no more than your available balance

- The maximum amount you can withdraw from ATMs per day is AUD 2,500 or the foreign currency equivalent. Keep in mind most ATM operators have a limit on how much you can withdraw from an ATM per transaction

- The maximum amount for over-the-counter withdrawals per day is AUD 2,500 or the foreign currency equivalent.

When you’re home

- Got leftover currency? Exchange it for another currency or back into your CommBank account from NetBank or the CommBank app

- Top up your Travel Money Card (it’s valid for 4 years) in preparation for your next trip

- Donate your foreign (and local) currency to any CommBank or Bankwest branch and every cent will go to UNICEF

- How to manage your Travel Money Card

You’ve got your new card – here’s how to get the most out of it.

Find detailed info on getting started, loading and reloading currencies, setting a currency order, checking your balance and tracking your spend. Plus, info on Purchase Security Insurance Cover and access to Visa ® travel offers .

Manage your Travel Money Card

Need foreign cash? Have it ready before you travel

If you’re a CommBank customer, you can buy or sell up to 9 foreign currencies at selected CommBank branches in exchange for Australian Dollars.

You can also order foreign cash in over 30 currencies online – even if you’re not a CommBank customer.

Discover Foreign Cash

Planning an overseas trip?

Discover travel tips to help make the most of your European summer holiday.

See travel tips

Emergency support & tools

What to do if you’ve lost your card or it’s stolen.

If you’ve lost your Travel Money Card, or you think it might’ve been stolen, we can have an emergency replacement card sent to you anywhere in the world.

You may also be eligible for an Emergency Cash Advance, giving you access to cash within 24-48 hours (often on the same day).

Call us in an emergency on:

- 1300 660 700 within Australia

- +61 2 9999 3283 from overseas (reverse charges accepted).

When calling from overseas using your mobile, standard roaming charges may apply. To avoid roaming charges, call the international operator in the country you’re in from a landline and give them our reverse charges number +61 2 9999 3283.

Tools & calculators

- Saving calculator

- Budget planner

- Managing multiple currencies on your Travel Money Card

- Travelling overseas: 10-step money checklist

- Beginners guide to exchange rates

- Online banking while overseas

- Planning an overseas holiday

We can help

Your questions answered

Get in touch

Visit your nearest branch

Things you should know

1 The cash withdrawal fee will not apply to cash withdrawals made in Australia.

2 For more information relating to the complimentary Purchase Security Insurance refer to Travel Money Card Complimentary Insurance Information Booklet (PDF) .

As this advice has been prepared without considering your objectives, financial situation or needs, you should before acting on this advice, consider its appropriateness to your circumstances. The Product Disclosure Statement and Conditions of Use (PDF) issued by Commonwealth Bank of Australia ABN 48 123 123 124 for Travel Money Card should be considered before making any decision about this product. View our Financial Services Guide (PDF) .

To raise a dispute related to your Travel Money Card please complete the Travel Money Card Dispute form (PDF) .

Any withdrawal or balance enquiry fee will come from the currency for which you are using your card. If this currency is not loaded on your card, the fee will be taken from the first (or sole) currency loaded on your card. Any SMS balance alert fee will come from the first (or sole) currency loaded on your card.

The target market for this product will be found within the product’s Target Market Determination, available here .

- URL address in the address bar is appropriate.

- Do not enter login or other sensitive information in any pop up window.

Fincash » Credit Cards » Canara Credit Card

Table of Contents

Features of Canara Bank Credit Card

1. canara global gold credit card, 2. canara visa classic/mastercard standard global card, canara bank credit card statement, canara bank credit card customer care number, 1. does canara bank offer multiple credit cards, 2. are there any particular criteria that i must meet to get the canara global gold credit card, 3. is there any time limit for the interest-free credit period with the bank, 4. is there any penalty levied if i miss paying a bill, 5. how will i receive the credit card statement, 6. what is the eligibility criterion for canara visa classic/mastercard standard global card, 7. what is the payment due date for the credit cards, 8. is there an auto-debit facility available with the credit cards, 9. what are the documents required to apply for the card, 10. is there any reward points awarded to credit card holders, best canara bank credit cards 2024- offers & benefits.

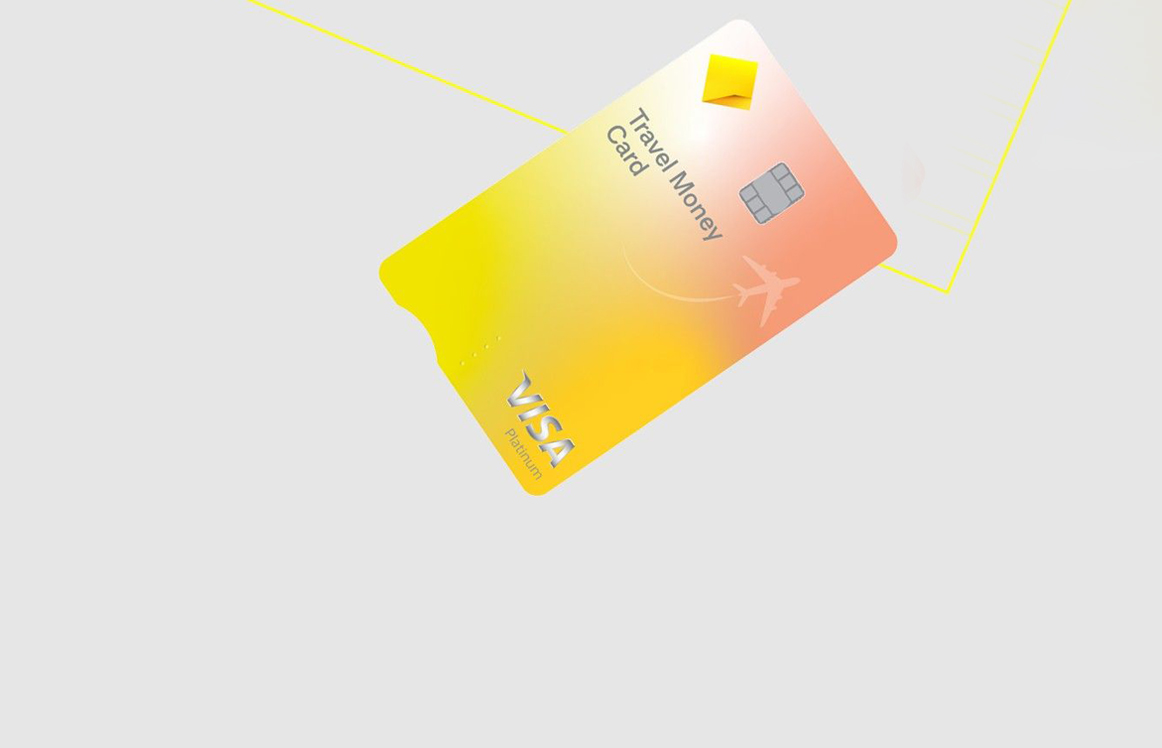

Canara Bank was founded as 'Canara Bank Hindu Permanent Fund' in 1906 and became as 'Canara Bank' in 1969 after nationalization. With a mission to provide quality banking services and create value for all the customers, the bank today has around 6310 branches with more than 8851 ATMs in India and overseas. Amongst all the services the bank offers, this article will particularly highlight about the Canara bank credit cards .

The credit cards Canara bank offers are designed to meet the daily lifestyle and needs of the people. It is also known for its excellent customer services. Let's take a look at different types of credit cards the bank offers.

- The Canara bank has its own rewards program for credit card users. A certain amount of reward points is awarded for using the card to carry out transactions. These rewards are to be collected by the user and redeemed in exchange for gifts, vouchers and discount coupons.

- You will be applicable for a zero cost liability in case you lose your credit card.

- The bank provides free accident insurance to the card user as well as the spouse.

- You’ll receive SMS notifications for all your card transactions.

- The Canara bank doesn’t charge an annual fee from its cardholders.

Looking for Credit Card? Get Best Cards Online Disclaimer: By submitting this form I authorize Fincash.com to call/SMS/email me about its products and I accept the terms of Privacy Policy and Terms & Conditions. Processing... Apply Now

Top Credit Cards by Canara Bank

- All the Canara credit card users can enjoy zero annual fees

- Earn 2 reward points for every Rs. 100 you spend

- Get a 2.5% fuel surcharge waiver at all gas stations in India

- Get complimentary accident insurance for the cardholder as well as the spouse

- Travel safe with a baggage insurance of up to Rs. 50, 000

Features of Canara Global Gold Credit Card

Canara Gold Card is designed to meet your high-end lifestyle. No matter if you are in India or abroad, this card offers luxury and comfort at hand.

Here are the few details about the Canara Global Gold Credit Card-

The benefits of Canara VISA Classic/MasterCard Standard Global Card are-

- Collect 2 reward points for every Rs. 100 you spend

- Avail an interest-free period of up to 50 days

- Add an Add-on card for a family member free of cost

Features of Canara VISA Classic/MasterCard Standard Global Card

This card has payment network of both VISA international/ MasterCard, so it is accepted worldwide.

Here are the few details about Canara VISA Classic/MasterCard Standard Global Card-

You will be receiving the credit card statement every month. The statement will contain all the records and transactions of your previous month. You will receive the statement either via courier or through an email based on the option you’ve chosen. The credit card statement needs to be checked thoroughly.

You can Call the customer care representative on the given toll-free number-

- MasterCard - 1800 425 0018

- VISA Credit Cards - 1800 222 884

A: Yes, Canara Bank offers its customers multiple credit cards with different types of facilities. The cards provided by Canara Bank are as follows:

- Canara VISA Classic/MasterCard Standard Global Card

- Canara Global Gold Credit Card

A: Yes, the Canara Global Gold Credit Card is usually applied by individuals who have high flying lifestyles. Hence, you need to fall in the higher income bracket, and also produce an income certificate to prove. Individuals earning at least Rs.2 lakhs per annum can apply for the card.

A: With Canara credit cards, you will get 50 days extra to make payments for your purchases in the given billing month. These 50 days will be interest-free.

A: The bank will charge a penalty of 2% + GST on the billing amount for missing the bill payments (on the given month). Moreover, they will also suspend your card, and you will not be able to make further transactions unless you clear all pending payments.

A: The bank will mail the credit card statement to your postal address, or they will send an e-statement to your email ID. Give instructions to the bank on how you would like to receive it.

A: You will have to produce an income statement showing that you earn a minimum income of Rs. 1 lakh per annum . The card comes with a limit of Rs.10,000. However, it important to know that - with an increase in income, the Credit Limit on your credit card will increase.

A: The Canara Bank Mastercard credit cards are billed on the last working date of every month. The Visa cards are billed on the 20th of every month. You are expected to clear all credit card dues by the 10th of the next month.

A: Yes, you can activate the auto-debit Facility on your card. For this, you will have to instruct the bank first.

A: Some of the documents that you will require to apply for a credit card with Canara Bank are as follows:

- Address proof - Aadhar card, passport, driving license, or other similar documents.

- Copy of your PAN Card

- Passport size photo

- Salary certificate

- Copy of your IT returns.

The bank might ask for other documents as well, depending upon its requirements.

A: Yes, Canara Bank awards reward points to its cardholders based on the transactions made and the type of card. For example, for the Canara VISA Classic/MasterCard Standard Global Card, you will receive two reward points for every Rs.100 that you spend.

You Might Also Like

Axis Bank Credit Card- Know The Best Credit Cards To Buy

Best Yes Bank Credit Cards 2024

Best Union Bank Credit Cards 2024

HDFC Credit Card 2024 - Know Best HDFC Credit Cards To Buy!

Visa Credit Card- Best Visa Credit Cards To Apply 2024 - 2025

Top & Best Indusind Bank Credit Cards 2024

Best Indusind Bank Debit Card 2024 - Benefits & Rewards

Best Citi Bank Debit Cards 2024- Check Benefits & Rewards!

Very informative

Very good working this page provide your sidel

- SavingsPlus

- Explore Funds

- Mutual Fund Basics

- Financial Planning

- Mutual Fund Companies

- Best Performing Mutual Funds

- Best Liquid Funds

- Top 10 SIP Mutual Funds

- Top Balanced Funds

- Best ELSS Funds

- Best Equity Mutual Funds

- Best Large Cap Funds

- Best Ultra Short Term Funds

- Best Index Funds

- Tax Calculator

- Growth of Lumpsum

- Growth of SIP

- Retirement Planning

- Higher Education

- Marriage Expense

- Buy Vehicle

- Any Other Goal

- Building Trust

- Why Fincash

- Our Partners

- Media Center

- Corporate Solution

AMFI Registration No. 112358 | CIN: U74999MH2016PTC282153

- Privacy Policy

- Terms & Conditions

- Disclaimers

© 2024 Shepard Technologies Private Limited. All Rights Reserved

- All Card Categories

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Fintech Cards

- All Card Issuer

- Offers & Rewards

- Lounge Access

- Canara Bank

Canara Bank Visa Classic/MasterCard Standard Credit Card

Canara Bank, being a popular and trusted bank in India, also offers great credit card services to its customers. One of the most basic yet advantageous cards issued by the Canara Bank is the Canara Bank Visa Classic/MasterCard Standard Credit Card. As suggested by its name, it comes in two variants namely Visa Classic and MasterCard Standard, but the features of both the variants are exactly the same. This card comes with a zero annual fee and hence is a choice for thousands of people who want to start their credit journey with a basic lifetime free card.

The card is very similar to the Canara Bank RuPay Select Credit Card , which is also a zero annual fee credit card and offers a similar reward rate. With this card, you can earn 2 Reward Points on every Rs. 100 you spend. Moreover, the Visa Classic/MasterCard Standard Credit Card also provides you with some complimentary insurance covers. For further information regarding this card, its features, and fees & charges, keep reading:

Joining Fee

Renewal fee, best suited for, reward type, welcome benefits, movie & dining, rewards rate.

- 2 Reward Points on every spend of Rs. 100.

Reward Redemption

The earned Reward Points are redeemable against a host of options at a rate of 1 Reward Point = Re. 0.25.

Domestic Lounge Access

International lounge access, insurance benefits.

You get an air accident cover worth Rs. 4 lakhs, baggage insurance cover worth 25,000, and a purchase protection cover worth up to Rs. 25,000.

Spend-Based Waiver

Rewards redemption fee, foreign currency markup.

3% on all foreign transactions

Interest Rates

2.5% per month or 30% per annum.

Fuel Surcharge

2.5% fuel surcharge waiver on all fuel transactions worth Rs. 400 or more. The maximum waiver is capped at Rs. 100 per month.

Cash Advance Charges

3% of the withdrawn amount subject to a minimum of Rs. 30 for every withdrawal of Rs. 1,000 (for Canara Bank ATMs) and different for other banks' ATMs.

- Lifetime free credit card.

- Complimentary air accident insurance cover.

- 2.5% fuel surcharge waiver on all fuel transactions.

- A Lower interest rate of 2.5% per month.

Canara Bank Visa Classic/MasterCard Standard Credit Card Features and Benefits

The Visa Classic/MasterCard Standard Card is a basic card offered by the Canara Bank. It can be listed among the best lifetime free credit cards in India as the card offers a decent reward rate with no annual fee. Other than this, the card has a few more features and benefits which are mentioned below:

Reward Points

With this credit card, you can earn 2 Reward Points on every spend of Rs. 100.

- The Reward Points earned through this credit card can be redeemed against various options available at the Canararewardz portal.

- 1 Reward Point = Re. 0.25.

The following are the insurance benefits that the cardholders get with this credit card:

- Air accident cover worth Rs. 4 lakhs for the cardholder and Rs. 2 lakh for his/her spouse.

- Baggage insurance cover worth Rs. 25,000.

- Purchase protection cover worth up to Rs. 25,000.

Fuel Surcharge Waiver

- With this credit card, you get a fuel surcharge waiver of 2.5% on all fuel transactions worth Rs. 400 or more.

- The maximum surcharge waiver is capped at Rs. 100 per month.

Canara Visa Classic/MasterCard Standard Credit Card Fees and Charges

Some of the important fees and charges associated with this credit card are as follows:

- No joining/annual fee is charged for the Canara Bank Visa Classic/MasterCard Standard Credit Card, i.e, it is lifetime-free.

- The interest rate on this credit card is 2.5% per month or 30% per annum.

- The foreign currency markup fee of the Canara Bank Visa Classic/MasterCard Standard Card is 3% of the transaction amount.

- The cash advance fee for this credit card is 3% of the withdrawn amount subject to a minimum of Rs. 30 for Canara Bank ATMs and it may vary when the cash is withdrawn from other banks’ ATMs.

Canara Visa Classic/MasterCard Standard Card Eligibility Criteria

The eligibility criteria that need to be fulfilled in order to get approved for this credit card are as follows:

- The age of the applicant should be a minimum of 18 years.

- The applicant should have a stable source of income, i.e, the applicant should either be salaried or self-employed.

- The applicant should have a decent credit history.

Documents Required

The documents required to apply for the Canara Bank Visa Classic/MasterCard Standard Credit Card are as follows:

- PAN Card of the applicant.

- Identity Proof: Aadhar Card, Voters’ Id, Passport, or Driving License.

- Address Proof: Aadhar Card, Latest months’ utility bills, Passport, etc.

- Latest bank statements, salary slips, or audited ITR as proof of income.

How To Apply For The Canara Visa Classic/MasterCard Standard Credit Card?

Canara Bank provides its customers with the convenience to apply for a credit card via different methods. You can visit your nearest Canara Bank branch with all the required documents and fill out the physical application form there. You can also download the application form from the Canara Bank’s official website , fill it out at your convenience, and then submit the form along with all the documents at your nearest branch.

Bottom Line

The Visa Classic/MasterCard Standard Card offered by the Canara Bank is one of its most basic yet decent credit cards. The biggest advantage of this card is that it is lifetime free, i.e, the cardholders don’t need to pay any charges to avail of its benefits. Though the card doesn’t offer very exciting benefits over travel, dining, etc, it is still a great option for those who are new to the world of credit cards and want to start their journey with an entry-level card. You can earn a decent number of reward points on all your transactions and these points can later be redeemed via a dedicated portal against a wide range of options available there.

This was our review of the Canara Bank Visa Classic/MasterCard Standard Credit Card. Let us know your views on this in the comment section below!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Add cards to start comparing

- Skip to main content

- Skip to site information

Language selection

Help us to improve our website. Take our survey !

Travelling and money

Take steps that will help you avoid financial problems that may ruin your trip. Make sure you purchase travel insurance , and most importantly make sure you always carry a backup source of funds in case of emergency or an unexpected delay.

On this page

Cards (credit, debit and pre-paid).

- Traveller’s cheques

Travelling with $10,000 or more

Check with the embassy or consulate in Canada of the country you are planning to visit to make sure you are allowed to import or export its currency. If you are permitted to import its currency, bring enough cash to get by for a couple of days and keep it in a money belt or in several different pockets in case your wallet is lost or stolen or your financial institution accidently freezes your cards. When you arrive at your destination, you can withdraw more cash from an ATM.

Exchanging your money

The currency exchange rate tells you how much your Canadian money is worth in the local currency. When you exchange your money, you are actually using it to buy or sell foreign currency at a specific price called the exchange rate. You can find the official exchange rate of the currency in the country you will be visiting by using the Bank of Canada’s online currency converter .

It pays to know your options when dealing with foreign exchange rates. There are a number of ways to manage your finances when you are abroad that will save you a lot of money in exchange fees.

If you want cash on hand before you leave Canada, you can buy foreign currency from your financial institution over the phone or online. It can be delivered to your local branch for pick up. Exchange rates at banks are slightly better than elsewhere. You can also order currency before you leave on your trip from a number of websites that will ship it to your home within a couple of days.

Exchange desks

If you need cash in an emergency, there are foreign exchange desks at airports and hotels that will exchange Canadian money for the local currency. Fees tend to be very high. Even those advertising no commissions may have hidden fees, making these desks the most expensive places to change money.

Black market

The currency black market forms part of the underground economy in a number of countries. In a currency black market, transactions are almost always in cash, since its participants don’t want to leave any evidence.

This illegal or parallel market in foreign exchange operates outside legal banking channels. If you are tempted to take advantage of the currency black market you should be aware that you will be breaking the country’s laws and could be arrested and imprisoned . You are subject to the country’s criminal justice system. Consular officials will not arrange your release from prison.

Be aware of anyone approaching you on the street offering to exchange your money for a much better rate than a bank. Typical money exchange scams include stealing your money in the process of counting and recounting a pile of bills or mixing your money with currency from another country with a much lower exchange rate. It is safer to go through an authorized agency or a bank.

Credit cards

Use a major international credit card for your big purchases, such as your airplane tickets, hotel bills and restaurant tabs. If you reserve your hotel and rental car on your credit card, the reservation should be guaranteed even if you arrive late.

Use the credit card instead of cash wherever possible. Credit card issuers typically charge fees for international transactions and you may get the best exchange rate and fees lower than those associated with exchanging cash. However, you should not use your credit card to withdraw money from an ATM, because the fees and interest charges are usually very high.

Before you leave:

- Know the expiry dates, account balance and amount of credit available to you on all of your credit cards. Make sure you have enough money in your accounts to cover your trip expenses, plus extra in case of emergency.

- Make sure your credit card company and financial institution have your up-to-date contact details, including a cellphone number, and information on where and when you will be travelling so that your account isn’t flagged for unusual activity.

- Check with your financial institution before you leave on your trip. Not all major credit cards are accepted everywhere. Merchants in some destinations prefer to be paid in cash because they must pay a fee to the credit card company. There may be a risk that your credit card will be cloned at some destinations, particularly in restaurants.

Debit cards

Always use bank-affiliated ATMs when you are outside Canada. Check if your financial institution has international branches or partners in your destination country where you can use your debit card fee-free. Using your debit card to withdraw money from ATMs will cost you extra in fees, but you can minimize them by withdrawing larger amounts less often.

You should carry some cash to cover daily expenses. Your debit card may not work in every ATM machine or be accepted at stores or restaurants in your destination country. If you are travelling to a rural area, you may not be able to find an ATM that is part of your financial institution’s network, so withdraw enough cash to manage until you are back in a city.

Due to the potential for fraud and other criminal activity, you should use your credit cards and debit cards with caution. Use ATMs during business hours inside a bank, supermarket, or large commercial building.

Pre-paid cards

Some financial institutions offer pre-paid travel cards in foreign currencies. They may have higher fees than credit and debit cards, so check the terms and conditions and costs before you decide to travel with one. You can usually replace a pre-paid travel card as you would a lost or stolen travellers’ cheque.

Be aware that pre-paid cards may not be accepted at some hotels and car rental companies, and may be difficult to use at the ATM machines of foreign banks.

Dynamic Currency Conversion

Some shops, restaurants and ATMs give the option of using the currency of the country you are in or having the transaction converted into Canadian currency. Always choose to be charged in the currency of the country you are in. You will pay high conversion rates and transaction fees if they convert to Canadian currency.

Save your receipts

As you travel, save all ATM and transaction receipts in an envelope. Bring them home in your carry-on bag. Save your airline boarding pass to prove your return date. If you need to dispute a transaction, sending a copy of your receipt will speed up the resolution process.

After you return home, carefully examine your credit and debit card statements and continue to do so for several months. Identity theft and credit card fraud are not confined to Canada. If you notice any unusual charges on your statement, inform your financial institution immediately and request a copy of the receipt.

Travellers’ cheques

Canadian travellers’ cheques are not widely accepted worldwide, but are an option if you don’t want to use credit or debit cards or carry large amounts of cash.

When possible, order the cheques in the local currency and carry multiple cheques in small denominations. If you can’t order cheques in the currency of your destination country, order them in U.S. funds, which are widely accepted. Sign them as soon as you get them and keep the receipt in a separate location. If they are stolen they can be replaced anywhere in the world, usually within 24 hours.

Keep a record of your travellers’ cheque numbers, credit card account numbers and expiry dates and the telephone numbers for reporting lost or stolen cards in a safe place. If possible, leave a copy of the list with a family member or friend at home who can help you make telephone calls quickly if your cards are lost or stolen.

Any time you enter or leave Canada, you must declare any money or monetary instruments, such as stocks, bond or cheques, you are carrying valued at $10,000 or more.

Canadians who live or work abroad or who travel a lot may still have to pay Canadian and provincial or territorial income taxes.

If you are planning to be outside Canada for an extended period of time, you should inform the Canada Revenue Agency (CRA) before you go to ask for a determination of your residency status. Your residency status depends on whether you are leaving Canada permanently or only temporarily and the residential ties you keep with Canada and establish in another country:

You are leaving Canada permanently

You are leaving Canada temporarily

Visit International and non-resident taxes for information about income tax requirements that may affect you.

Departure tax

In some countries you must pay a departure tax or service fee at the airport or point of departure. Make sure you set aside enough money in local funds to pay it.

- Travel Advice and Advisories

- Financial assistance

- Overseas fraud: An increasing threat to the safety of Canadians

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Canara Bank Card Offers

- Canara Bank Offers

9 Coupons & Offers

3.7 / 5 6 Votes

- Coupons (8)

- Domestic Flights

Grab Up To Rs 400 OFF On All Orders (ICICI, Canara & Bank of India)

- You can grab up to Rs 400 OFF on all purchase

- Offer is valid only once per card during the offer period.

- No two offers will be clubbed together.

Flat Rs 125 OFF by using Canara Bank Mastercard Debit Cards

- Grab Flat Rs 125 off on paying for order using Canara Bank Mastercard Debit Cards

- Minimum order value – Rs 599 (Excluding taxes & delivery charges).

- Valid on cards that have not been used on zomato

Avail Up To 30% OFF On Hotels With Canara Bank Credit Cards

- Valid till 30th Sep, 24

- Canara Bank credit cardholders can avail themselves of an exclusive up to 30% discount on hotel accommodations

- A minimum booking amount is not required for both domestic & international hotels

- The offer is valid once per card per product twice a month

- Valid on every Monday & Thursday

Don't Miss Out on this Flight Offer: ₹1000 OFF on Bookings

- Grab Up to 6% OFF on flights.

- The maximum discount that you can avail is Rs 1000.

- Offer is applicable for both one-way and return flight ticket booking.

- The coupon cannot be used when you are using MMT Gift Cards or My Wallet.

- Lock prices of your domestic flight with PRICE LOCK to avoid increasing flight fares, by paying an amount as small as Rs 99, and convert it to final booking later.

- Get instant Rs 500 discount on minimum transaction of Rs 5000

- Use code MMTMBK on the payment page to avail the offer

- Can be redeemed once during the offer period

Canara Bank Flight Offers

Up To Rs 1500 OFF on Select Domestic Flight Routes

- Make My Trip is now offering an deal on flight bookings using canara bank cards

- Grab up to Rs 1500 discount on flight fares

- This promo can be availed only once per customer and on select routes and airlines

- Offer valid on Wednesday & Thursday only

Get Huge Discounts On Flight, Hotel & Bus Bookings By Using Canara Bank Mastercard Debit Cards

- Domestic Flights - Flat 12% OFF up to Rs 1800 on booking value Rs 3000 & above

- International Flights - Flat 10% OFF up to Rs 5000 on booking value Rs 10000 & above

- Domestic Hotel - Flat 20% OFF up to Rs 4000 on booking value Rs 1000

- International Hotel - Flat 15% OFF up to Rs 5000 on booking value Rs 2000 & above

- Buses - Flat 15% OFF up to Rs 500 on booking value Rs 500 & above

- The offer can be availed by all Canara Bank Mastercard debit cardholders.

- This offer can be availed by all customers

Details on Canara Bank Card

Latest Canara Bank Card Coupons & Discounts For Sep 2024

Canara bank: india's most customer-centric nationalized bank.

One of the most customer-centric banks, Canara Bank was founded in 1906. The bank was nationalized in 1969. It has seen tremendous growth since then and has been widely considered as one of the most approachable banks in the country. In 2006, the bank completed a century of operation in the Indian banking sector. Today, Canara Bank occupies one of the top positions amongst the Indian banks.

Canara Bank offers one of the best interest rates. They also have a lot of offers when you purchase something through their debit and credit cards. You can also avail their net banking, which also gives away a bunch of offers. If you have an account with Canara Bank, you can avail a bunch of offers through them. Most of the popular websites like Amazon and Flipkart offer multiple discounts through Canara Bank Visa and Mastercard. Whenever you purchase something, make sure you check for all the offers that they have when you finalize your order.

Get The Best Offers@ GrabOn

If you are looking for amazing discounts and want to save much more on the products you buy, you are on the right page. Since GrabOn helps you save on everything, we have everything you will ever need. If you are looking for the best coupon code and offers, your search ends right here. Get fantastic promo codes and coupons every day, courtesy GrabOn. Find the best offers and deals like- Get Rs 100 OFF On First Food Order @ Zomato [Visa Card Offer], Get Extra Flat 10% OFF On All Prescription Medicines (VISA Card Offer), BHIM UPI Special Offer: Flat 30% OFF On OYO Rooms and other exciting offers. Since this page is updated every day with the best Canara Bank Net Banking coupon codes, visit it regularly and make the most of the discounts. So hurry up, what are you still waiting for!

- Shoppers Stop

Banks/Wallets

More About Canara Bank Card

Offers from similar banks/wallets.

We Value Your Savings As Much As You Do. Subscribe now And Keep Saving On Everything With The Latest Coupons and Offers!

Thank you for your valuable feedback

Rate Canara Bank Card

Rated 3.7/5, Out of 6 Votes

Thank You For Rating.

Manage Booking

Access your bookings, easy cancellation, date change and much more

Grab Flat 12% OFF*

Exclusive offer* on canara bank credit cards only.

- Customers will get instant discount as mentioned in the table above on Canara Bank Credit Cards.

- To avail the offer, customer must enter E-Coupon as per aforementioned table in the E-Coupon field.

- The Offer is valid every Tuesday & Friday starting from 2nd July – 28th Sept’24 (between 0000 hrs to 2359 hrs).

- The offer is valid for bookings made on GoIbibo website, Mobile site, Android & iOS App.

- The offer is valid on Canara Bank Credit cards.

- The offer is valid for 1 booking per card per category per Month throughout the offer period.

- For flights, discount will be calculated on the booking amount (excluding convenience fee and any ancillaries purchased e.g.: meals, insurance).

- The offer is not valid on "Multi-City Flights" made through the "Multi-City" tab on GOIBIBO website.

- Offer is not applicable on payments made through My Wallet (GOIBIBO Wallet - bonus amount), 3rd party wallets, COD, Pay Pal, Gift card and net banking payments.

- Offer is not applicable on payments made through Canara Bank NetBanking or App

- In case of partial/full cancellation the offer stands void and customer will not be eligible for the discount.

- If the Customer cancels the travel service purchase after the discount amount is availed, GOIBIBO will deduct the discount amount from the refund and cancellation charges shall apply.

- If there is any rescheduling or cancellation, customer has to bear the fare difference (regardless of whether the component is in the base fare or in tax + surcharge) and other rescheduling/cancellation fees.

- If the customer doesn't receive the discount, he/she must raise the claim at https://support.GOIBIBO.com/MyAccount/MyIncidents/NewComplaint within 3 months from the booking date. In the event the cardholder fails to do so, he/she will not be eligible for the discount amount.

- This offer is NOT applicable on Canara Bank commercial cards.

- Add-on cards will be treated as separate cards.

- This offer cannot be clubbed with any other offer of GOIBIBO.

- Offer is only valid on the eligible BINs shared by Canara Bank. If the BIN series of the card does not match with the one provided by Canara Bank to GOIBIBO, then the cardholder will need to approach Canara Bank and GOIBIBO shall be entitled to withhold or deny the offer to the customer.

- GOIBIBO & Canara Bank reserves the right, at any time, without prior notice and liability and without assigning any reason whatsoever, to add/alter/modify/change or vary all of these terms and conditions or to replace, wholly or in part, this offer by another offer, whether similar to this offer or not, or to extend or withdraw it altogether.

- For any card related claims, the customer will need to approach the Bank. GOIBIBO shall not entertain any such claims.

- GOIBIBO shall not be liable for any loss or damage arising due to force majeure event.

- In the event of any misuse or abuse of the offer by the customer or travel agent, GOIBIBO reserves the right to deny the offer or cancel the booking.

- In no event will the entire liability of GOIBIBO under this offer exceed the amount of promotional discount under this offer.

- GOIBIBO shall not be liable to for any indirect, punitive, special, incidental or consequential damages arising out of or in connection with the offer.

- Disputes, if any, arising out of or in connection with this offer shall be subject to the exclusive jurisdiction of the competent courts in Delhi.

- User Agreement and Privacy Policy of the GOIBIBO website will apply.

- Customers who are travel agents by occupation are barred from making bookings for their customers and GOIBIBO reserves the right to deny the offer against such bookings or to cancel such bookings. For such cases, GOIBIBO shall not refund the booking amount.

- Any queries, escalations, dispute related to the services made available on the GOIBIBO needs to be directly addressed by GOIBIBO. Canara Bank will not be responsible for the same in any manner

- Canara Bank shall not be liable in any manner whatsoever for any loss/ damage/ claim that may arise out of use or otherwise of any services availed by the customer under the Offer.

- Canara Bank and GOIBIBO reserves the right to disqualify/ exclude any Cardholder from the offer, if any fraudulent activity is identified as being carried out for the purpose of availing the benefits under the offer or otherwise by use of the Card.

- Canara Bank shall not be held liable for any delay or loss that may be caused in delivery of services

- OUR PRODUCTS

- Domestic Hotels

- International Hotels

- Domestic Flights

- International Flights

- Multi-City Flights

- Bus Booking

- Cab Booking

- Airport Cabs Booking

- Outstation Cabs Booking

- Train Booking

- Terms of Services

- User Agreement

- YouTube Channel

- Technology@Goibibo

- Customer Support

- Facebook Page

- Twitter Handle

- TRAVEL ESSENTIALS

- Airline Routes

- Train Running Status

- Cheap Flights

- Cancellation

Book Tickets faster. Download our mobile Apps

Popular With Goibibo

Popular hotels in india to stay, popular luxury hotels in india, best hotels in india for family, top hotels cities, top hourly hotels cities.

IMAGES

VIDEO

COMMENTS

Canara Bank International Travel Prepaid Card is designed exclusively for customers who travel extensively across the globe. It is a unique product with multiple currencies loaded on the same card, thus eliminating the need to carry multiple cards for different destinations. The card, which is available on the MasterCard platform. Features.

23.1678. 22.3900. Rates quoted are subject to change without prior notice. Card rates are firm upto US Dollars 5000 or equivalent. Exchange rates mentioned are indicative & are subject to change depending on market fluctuations. Access Canara Bank real-time Forex Card Rates for accurate currency exchange information.

Debit Card: Apply for Debit online at Canara Bank and make your life easy. Withdraw cash anytime, anywhere in India, shop online / offline using a debit card and get cash bash, reward points, offer, and much more.

Canara Corporate Credit Card. Canara Bank launched Canara Corporate Credit Card to meet the requirements of the corporates providing a high cash withdrawal limit. The primary features of Canara Bank Corporate Credit card are; There is no joining and annual fee. You earn 2 reward points per Rs. 100 spent on this card.

Canara Bank Forex Rates on Prepaid Travel Cards. International students travelling abroad should consider carrying international travel cards for easy money management. Canara Bank Prepaid Card might be the perfect solution for you for a secure and convenient way of handling cash. These cards offer a variety of benefits for travellers ...

Canara Bank provides credit cards with a variety of advantages and features backed with rewards, cashback, lifestyle, entertainment, travel, and so on. Canara Bank credit cards have fees and charges, including an interest rate. Your card's interest rate is added to your transactions and shown on your credit card statement as the 'Total Amount Due.'

Canara Bank RuPay Platinum Credit Card. Rating. 3.6/5. Joining Fees. ₹0. <p>Find out all the top Canara Bank Cards and get amazing offers and rewards. Choose from Canara Bank travel cards, fuel cards, cashback cards and business cards to match your needs </p>.

Before your trip. Order a Travel Money Card in the CommBank app (search 'Travel Money Card'), NetBank, or at your nearest branch. Load at least AUD 50 or the foreign currency equivalent to get started. Once you've got your card, activate and set your PIN online in NetBank, or under Cards in the CommBank app. Lock-in the exchange rate by ...

URL address in the address bar is appropriate. Do not enter login or other sensitive information in any pop up window. User ID : Password : Use virtual keyboard. (Recommended) Forgot Password. Virtual Keyboard (for entering password only)

Best Canara Bank Credit Cards 2024- Offers & Benefits! Updated on September 9, 2024 , 64722 views. ... Travel safe with a baggage insurance of up to Rs. 50,000; Features of Canara Global Gold Credit Card. Canara Gold Card is designed to meet your high-end lifestyle. No matter if you are in India or abroad, this card offers luxury and comfort at ...

The interest rate on this credit card is 2.5% per month or 30% per annum. The foreign currency markup fee of the Canara Bank Visa Classic/MasterCard Standard Card is 3% of the transaction amount. The cash advance fee for this credit card is 3% of the withdrawn amount subject to a minimum of Rs. 30 for Canara Bank ATMs and it may vary when the ...

As a Canara Bank Platinum Debit Cardholder, you will be entitled to receive the following insurance benefits: Baggage insurance upto Rs.25,000. Purchase Protection upto Rs.25,000. Misuse of card while purchasing air tickets online upto Rs.25,000. Accident Insurance.

For example, you hold a Canara Bank savings account at Mumbai Grant Road branch. Let's say, your account number is 4251. Then, 13 digit Canara Bank account number will be 0135-101-004251. 0135 is the DP code for Canara Bank Mumbai Grant Road branch; 101 is the account type code for the ordinary savings account; 4251 is the actual account number.

Domestic & International Acceptance. Available. Maximum Credit Limit Per Month. ₹ 25,00,000. Cash-Withdrawal Limit. 50% of Credit Limit or ₹50,000/- , whichever is lower. Cash-Withdrawal Charges. 3% of the transaction amount subject to a minimum of ₹30/- Per ₹1000/- withdrawn or part thereof. Interest Free Credit Period.

Use ATMs during business hours inside a bank, supermarket, or large commercial building. Pre-paid cards. Some financial institutions offer pre-paid travel cards in foreign currencies. They may have higher fees than credit and debit cards, so check the terms and conditions and costs before you decide to travel with one.

Canara Bank Card Promo Codes & Offers: MakeMyTrip: Flat Rs 1000 OFF: Northmist: Flat 25% OFF: Zomato: Flat Rs 125 OFF: Shopper Stop: Up To Rs 400 OFF: Zomato: Rs 50 OFF: Canara Bank: India's Most Customer-Centric Nationalized Bank. One of the most customer-centric banks, Canara Bank was founded in 1906. The bank was nationalized in 1969.

Customers will get instant discount as mentioned in the table above on Canara Bank Credit Cards. How do you get it? To avail the offer, customer must enter E-Coupon as per aforementioned table in the E-Coupon field. The Offer is valid every Tuesday & Friday starting from 2nd July - 28th Sept'24 (between 0000 hrs to 2359 hrs).

Welcome to Canara Bank, an Ideal destination for Personal Banking needs! We offer a wide range of consumer banking services like a savings account, fixed deposit, debit card, loan, Mutual funds, and many more that helps you meet personal financial needs.

Last updated on 11-09-2024 02:39 AM. Visitor Count 207. Explore Canara Bank's exclusive offer for special deals and benefits.

Here are the steps you need to follow to install and set up the Canara Bank passbook: Open the Google Play Store and Search for Canara e-Infobook. Select on the Canara e-Infobook app from the list and click on the Install. The app will ask for the necessary permissions. Click on "Accept".

Rupay Platinum Credit Card. Upto 50 days of interest free credit. Easy EMI Conversion through Canara ai1 app. ATM Cash Withdrawal & other non financial services. Complimentary Airport lounge access. Know More. Mastercard Gold Credit Card. Upto 50 days of interest free credit.

Profile. Profile. Widely known for customer centricity, Canara Bank was founded by Shri Ammembal Subba Rao Pai, a great visionary and philanthropist, in July 1906, at Mangalore, then a small port town in Karnataka. The Bank has gone through the various phases of its growth trajectory over hundred years of its existence.