- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex® .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card.

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

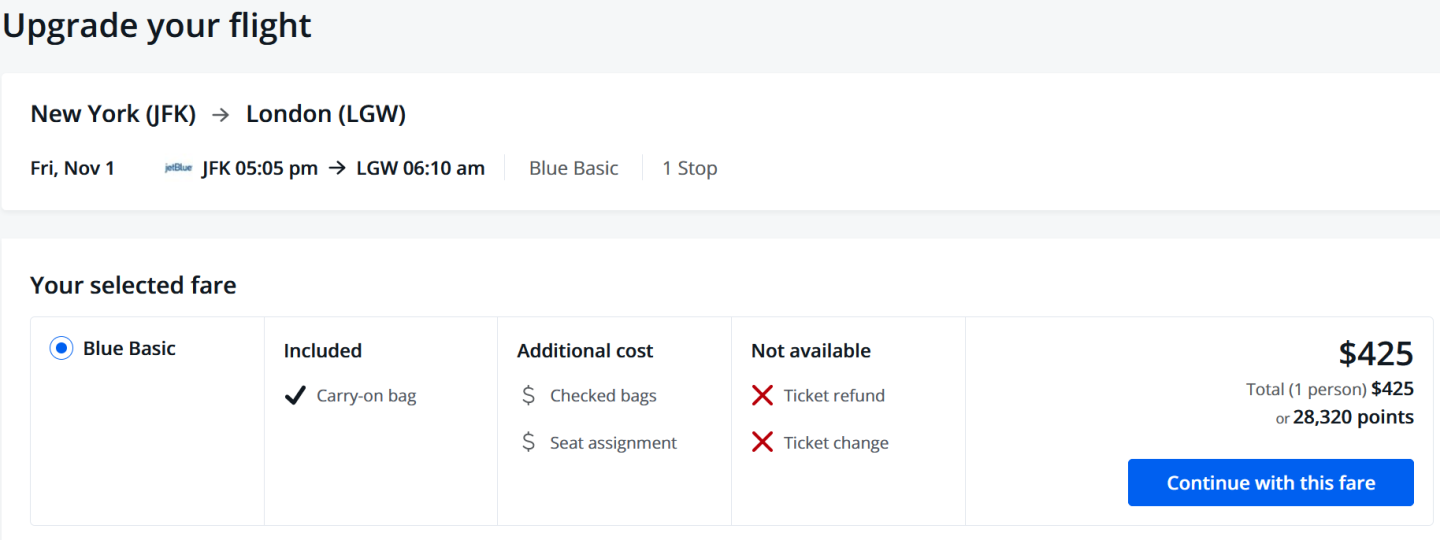

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

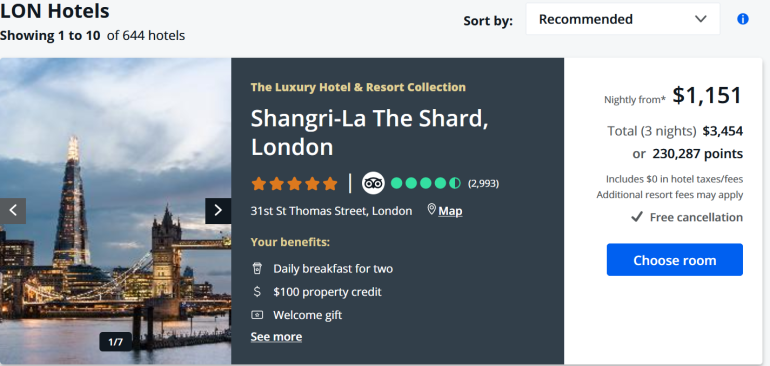

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

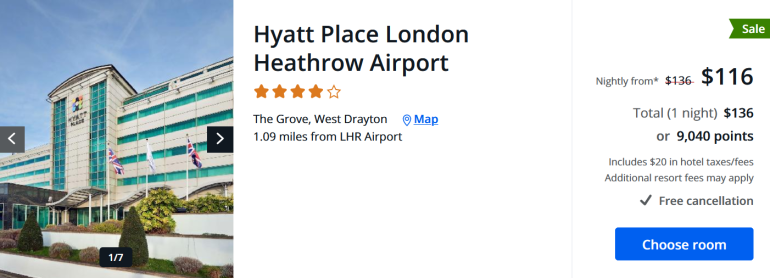

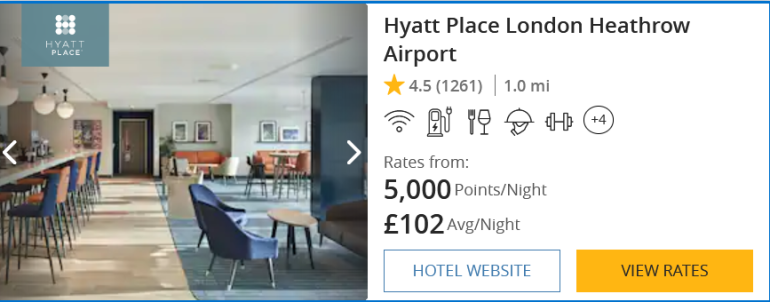

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

How to book activities in Chase's travel portal

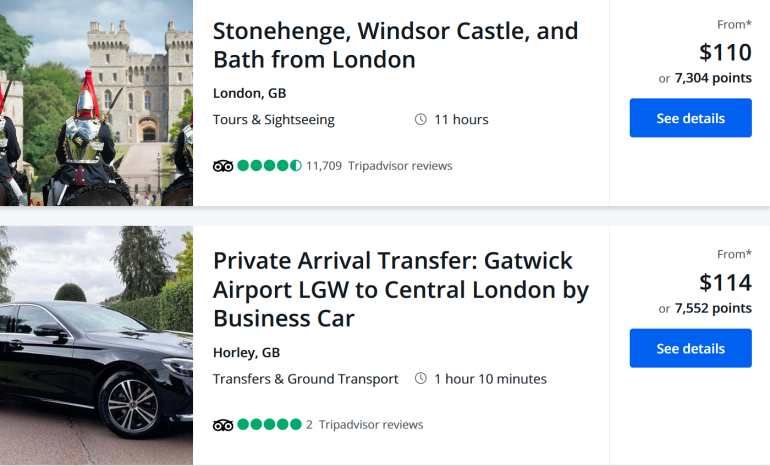

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Chase Travel®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

377 Published Articles 62 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

169 Published Articles 792 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Table of Contents

Why book travel through the chase travel portal, cards that earn chase ultimate rewards points, what are chase ultimate rewards points worth, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, how to book a hotel through chase travel, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, how do the prices compare to other sites, other ways to use the chase travel portal, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Key Takeaways

- The Chase Ultimate Rewards Travel Portal allows cardholders to book travel using points at a fixed value, typically 1 to 1.5 cents per point, depending on the card.

- The portal offers flights, hotels, cruises, car rentals, and experiences. Users can pay with points, a Chase credit card, or a combination of both.

- You can also use the portal to pay with points at Amazon, Apple, and PayPal, purchase gift cards, and transfer points to Chase airline and hotel partners.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

You Can Earn Frequent Flyer Miles

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

A fantastic travel card with a great welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases through March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%–29.49% Variable

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- No elite travel benefits like airport lounge access

- Earn 90k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

Transfer Your Points Between Credit Cards for Maximum Value

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

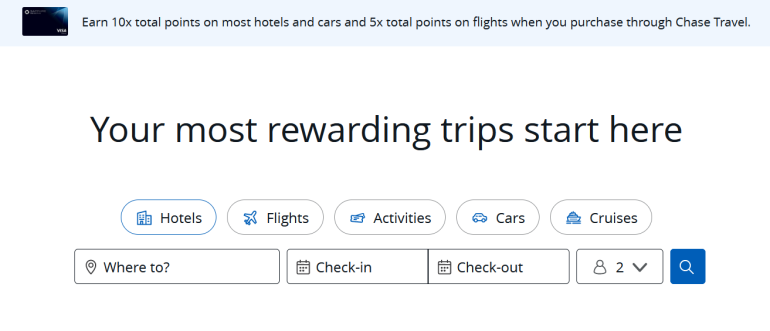

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

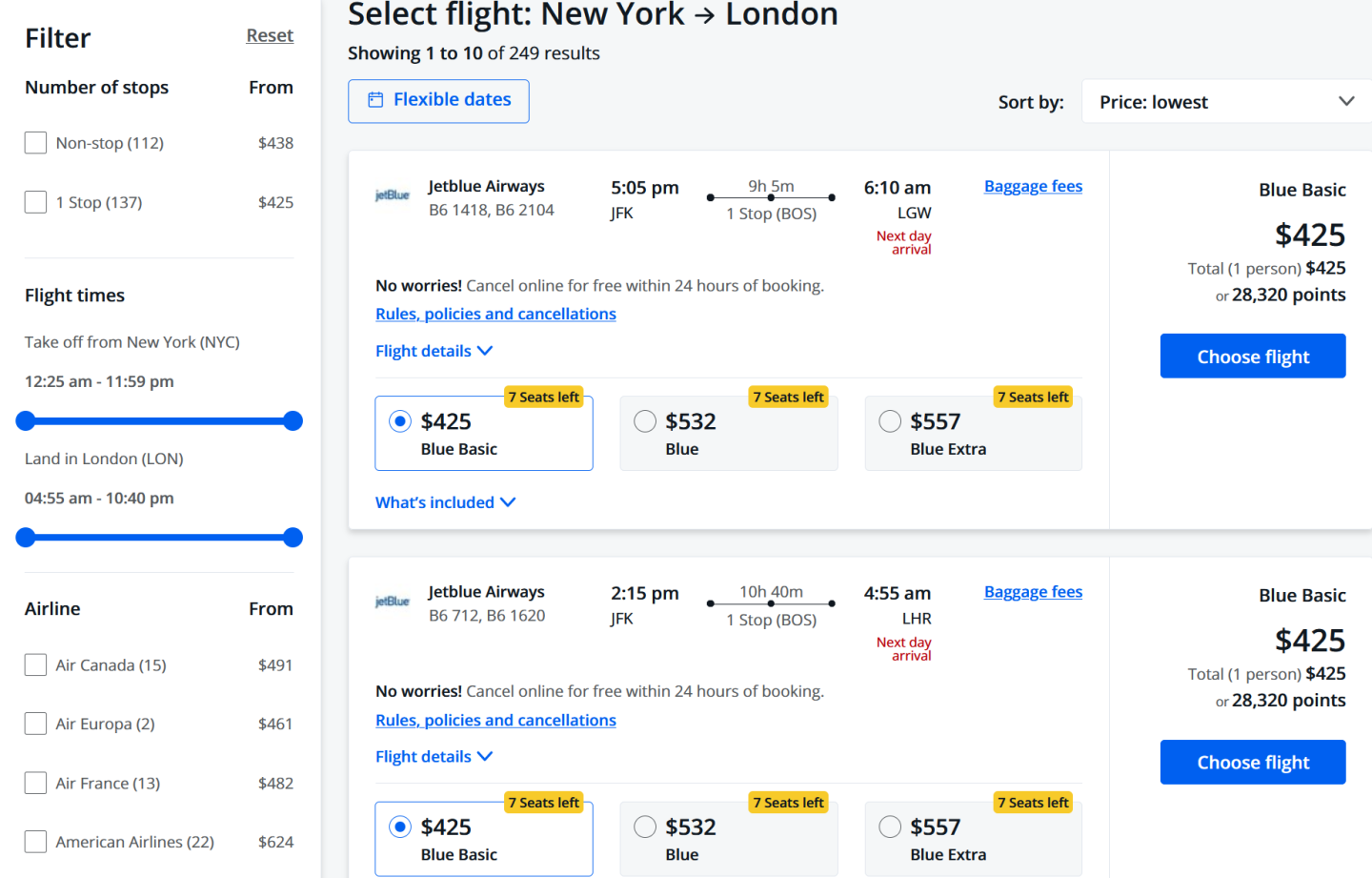

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

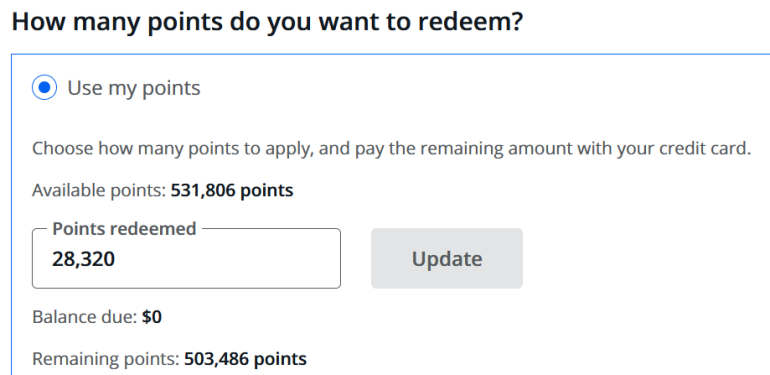

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

The Luxury Hotel and Resort Collection

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.

2. You can then narrow your search with the filtering options on the left-hand side of the page.

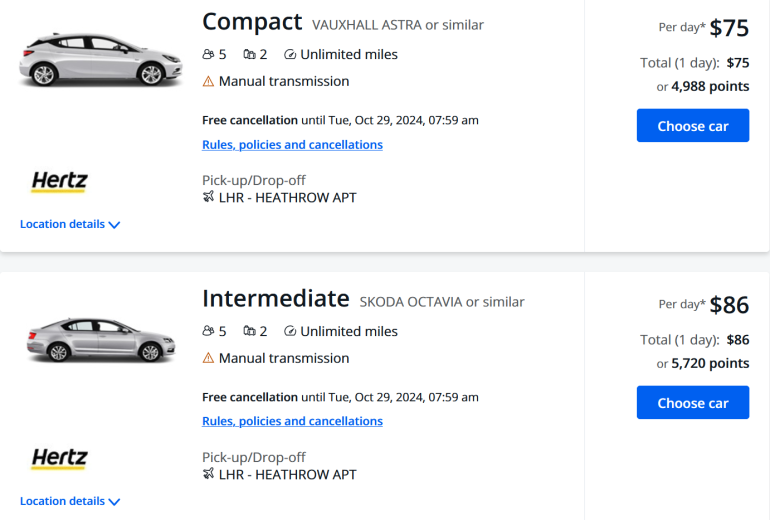

3. For each car option, you will be able to see the car details, rental company, and price in both dollars and Chase Ultimate Rewards points. Once you have selected the car you want to rent, click on Add to Itinerary .

4. You can pay for the entire purchase with points or a Chase credit card or split your payment in any amount. Double-check all of the details before completing your purchase.

Did you know you can also book activities through Chase Travel?

1. Click the Activities tab on the Ultimate Rewards travel homepage to get started. Then, input your destination and travel dates and click the Search button to continue.

2. You can narrow your search by selecting 1 or more categories at the left-hand side of the page. Categories can include things like:

- Classes & workshops

- Cruises & sailing

- Food & drink

- Outdoor activities

- Seasonal & special occasions

- Tickets & passes

- Tours & sightseeing

- Transfers & ground transport

- Unique experiences

3. Each activity will show the price in both dollars and points to the right side of the screen. Click on Show Details and Pricing for more information and to book the activity.

6. Double-check all of the details on the final page before completing your purchase. Click the box confirming you understand the travel disclosures, then click Complete Checkout to finish your purchase.

Bottom Line: You can book lots of activities through the Chase Travel portal, including airport transfers!

If you’re a fan of cruises, you’ll be pleased to know you can book them through your Chase Travel portal. To get started, click on the Cruises tab on the Ultimate Rewards travel homepage.

This will bring up a list of available cruises, but there’s also a search box at the top of the screen, so you can input a specific destination or cruise line.

Each listing will display the cruise line, ship, ports of call, sailing dates, and baseline pricing for an interior or oceanview cabin. Unfortunately, if you want any more specific information or if you want to book, you will need to call 855-234-2542 .

You’ll notice that only cash prices are listed for cruises, however, they can be booked using your Chase Ultimate Rewards points, too.

Hot Tip: You can book a cruise through Chase Travel but you’ll have to call to make your reservation as they can’t be booked online.

Are you getting a good deal by booking through Chase? Let’s look at how the prices available through the Chase Travel portal stack up to other OTAs and search engines including Hotwire , Kayak , and Expedia .

We did some flight searches and found there’s no clear-cut pattern on prices between the Chase portal to other websites.

Example #1: Round-trip flight between Philadelphia (PHL) and San Francisco (SFO) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between Alaska Airlines and Delta Air Lines for $526.20. This worked out to be the cheapest price we found, and Priceline had the same low price. Expedia and Hotwire both charge booking fees, making the price a little higher. Each airline’s own website couldn’t split the itinerary between different airlines, so those ended up being much more expensive.

If you are in doubt or would like to check prices yourself, Kayak is a great place to start. Kayak will show you prices for a flight on all of the OTAs as well as the airline’s website. It’s a great one-stop shop to compare flight prices.

Example #2: Round-trip flight between New York City (JFK) and Paris, France (CDG) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between American Airlines and British Airways for $689.78. This wasn’t the overall best price we found, though. That award goes to Expedia and Priceline.

Hot Tip: You will earn frequent flyer miles when you book your flight through the Chase Travel portal.

Example #1: Here’s how prices looked for a week-long stay at the JW Marriott Cancun Resort & Spa in Mexico for 2 people including all taxes and fees. The $291.55 resort fee can’t be paid with points.

In this example, the best cash rate by far was through Marriott. However, if you wanted to pay with points, booking with Chase Ultimate Rewards points through the travel portal would be your best bet.

Keep in mind that Marriott doesn’t have an award chart, so different time periods can have different point costs. A 7-night stay at this hotel can dip down to 240,000 points for a 7-night stay. If you’re going to pay for your hotel stay in points, it’s always smart to calculate how many points it would cost to book through Chase versus transferring points . This information can help you make the best and least expensive choice.

Hot Tip: You won’t earn hotel loyalty points when booking a hotel through Chase and any elite status you have may not be recognized.

Example #2: Let’s look at an example of a hotel that doesn’t have a loyalty program. We priced out a 2-night stay at Almond Tree Inn Hotel in Key West, FL for 2 people. The highest prices were direct via the hotel with all other websites surveyed being cheaper.

Here’s how the prices stacked up:

Chase’s low price matched the other online travel websites and was actually lower than the hotel’s own website, so it would be a great option in this case. It also affords the opportunity to use points for a hotel that doesn’t have its own loyalty program.

Car Rentals

In many cases, car rental prices found through the Chase Travel portal were similar to prices found on the rental agency’s own website.

The main difference in booking through Chase vs. directly through a car rental agency is that the car rental agency often has the ability to book the car without paying up front. With the Chase portal, you will be paying at the time of booking and there may be change or cancellation fees if you need to modify your reservation.

In both of these examples, Chase Travel didn’t offer the lowest price, however, that won’t always necessarily be the case. Of course, the advantage of booking through Chase is the ability to use your Chase Ultimate Rewards points. It’s always a good idea to price out your car rental on a few different websites before booking to ensure you’re getting the best price.

Chase actually offered the lowest prices on activities for both examples:

Earn Bonus Ultimate Rewards Points

The Chase Travel portal also helps you earn bonus points. With the Shop through Chase feature, you can earn extra Ultimate Rewards points through your online shopping.

Just click Earn Bonus Points in the top search bar to access the shopping portal. Click on a featured store or search for a specific one. Then simply click through the portal to your website of choice to make your purchase. Your bonus points will be added to your Chase Ultimate Rewards points total within 3 to 5 days in most cases.

Pay With Points

Did you know you can use your Chase Ultimate Rewards points to make purchases at Amazon and PayPal? Click on Pay with Points in the top search bar, then select either Amazon or PayPal to enroll and shop.

Unfortunately, the redemption value you get when shopping through Amazon or PayPal is pretty bad — only 0.8 cents per point. While it’s great to have this as an option, we don’t recommend using points to shop at Amazon or PayPal as your main use of Chase Ultimate Rewards points.

Bottom Line: The value of using your Chase Ultimate Rewards points to shop through Amazon or PayPal isn’t great: you will only get 0.8 cents per point!

Apple Purchases

By clicking on Apple in the main search box in your Ultimate Rewards account, you can use your Chase points to make purchases. Normally, you’ll get 1 cent per point in value when using your points for Apple purchases, but there are occasional bonuses offered to get a better redemption rate.

You can also redeem your Ultimate Rewards points for cash-back. To do this, simply select Cash-back from the main search bar at the top of the screen. You will then be able to see choose how many points you’d like to redeem for cash-back at a value of 1 cent per point .

You can choose to have your cash direct deposited into a checking or savings account or as a statement credit. The deposit or statement credit will be posted within 3 days.

Bottom Line: Your Chase Ultimate Rewards points are worth 1 cent each when redeemed as cash-back. We do not recommend this as a primary redemption option because you can get more value via the Chase Travel portal, and a lot more when transferring to airline and hotel partners.

Experiences

This is a really cool section of the Chase Travel portal. When you click on Experiences in the main search bar, you’ll see a list of exclusive events, preferred seating, and other offers for select Chase cardmembers.

Experiences can be purchased with a credit card or with points. You will get 1 cent per point in value when redeeming points for experiences. Some experiences are only available to cardholders of specific cards so be sure to check all of your cards if you have more than 1 to make sure you don’t miss anything.

If you prefer gift cards, you can purchase them through the Chase Travel portal using points. Just click Gift Cards in the main search bar to get started. From here, you will be able to scroll through all of the available gift cards. You’ll get 1 cent per point in value, with occasional sales offering better redemption rates.

Hot Tip: Points redeemed for gift cards have a 1-cent per point value. However, you might notice some cards offer discounts, so there is the opportunity to get a bit more value!

Pay Yourself Back

Another way to use your Ultimate Rewards points is through the Pay Yourself Back feature. This allows you to redeem your points for a statement credit for purchases in select categories. The current categories include groceries, dining, select charities, credit card annual fee, internet, cable, phone, and shipping and the redemption value varies by card.

Transfer To Travel Partners

Transferring points to travel partners is the best way to get the most value out of your points . By transferring, you can potentially get 2, 3, or more cents per point value.

Chase Airline Transfer Partners

Chase Hotel Transfer Partners

To transfer your Chase Ultimate Rewards points to any of the above airline and hotel partners, log on to your account and click on Transfer To Travel Partners in the top search box. Choose your airline or hotel and then select Transfer Points . You’ll need to fill out your frequent flyer information or hotel loyalty membership number to complete the transfer.

Bottom Line: You can currently transfer your Chase Ultimate Rewards points to 14 different hotel and airline partners.

There are many ways to use your Chase Ultimate Rewards points. While transferring points to one of Chase’s airline and hotel travel partners can get you maximum value, there are a lot of benefits for booking travel directly through the Chase Travel portal .

In addition to hotels and flights, you can book car rentals, activities, and cruises. Or, you can use your points for cash back, shopping, gift cards, or Chase exclusive experiences. With so many ways to use your Chase Ultimate Rewards points, your next trip is only a few clicks away!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Ink Business Plus ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Related Posts

![chase travel voucher How To Earn 100k+ Chase Ultimate Rewards Points [In 90 Days]](https://upgradedpoints.com/wp-content/uploads/2023/01/Chase-bank-branch-new-york.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- What is the Chase Travel Portal?

- Benefits of Using the Chase Travel Portal

- Chase Ultimate Rewards Credit Cards

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex®, Chase Freedom Rise℠. The details for these products have not been reviewed or provided by the issuer.

- The Chase Travel℠ is an online travel agency that lets you pay with Ultimate Rewards points.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

Introduction to the Chase Travel

The Chase Travel℠ is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an online travel agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Overview of the Chase Travel and Ultimate Rewards benefits

The Chase Travel℠ offers one of the most straightforward redemption opportunities for your Chase Ultimate Rewards . Chase boasts one of the most flexible and lucrative credit card rewards programs, and points earned on some travel cards are worth up to 50% more when redeemed through Chase Travel℠.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What is the Chase Travel portal?

The Chase Travel℠ is an online platform that acts as a third-party travel broker similar to Expedia, Booking.com, Travelocity, or Priceline. Through Chase Travel℠, you can book hotels, flights, rental cars, cruises, and vacation packages. You can choose to pay with one of your linked credit cards, or use your Ultimate Rewards balance to defray the cost.

You must be a Chase credit card customer to use Chase Travel℠ to book with cash or points — in fact, you can only access the Chase travel portal when you log into your account management page with Chase.

Benefits of using Chase Travel

One of the primary benefits of using Chase Travel℠ is you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs. Chase Travel℠ allows you to book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two.

There are a few other key benefits to understand as well:

You'll still earn airline miles and work toward elite airline status

You won't earn points or elite night credits when you book a hotel stay with Chase Travel℠ because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights booked through Chase, as long as your frequent flyer number is attached to the reservation. (You can usually add that number, as well as your Known Traveler

Points are worth more on certain Chase credit cards

With a no-annual-fee card like the Chase Freedom Flex® or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

You can combine the points earned on the Chase Freedom Flex® or Chase Freedom Unlimited® with one of these travel cards: Points redeemed through the Chase Sapphire Reserve® are worth 1.5 cents apiece through Chase Travel℠, while points redeemed through the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card are worth 1.25 cents apiece.

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase offers lucrative bonus categories on flights, hotels, and car rentals booked through the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, up to 10x Ultimate Rewards points per dollar.

The Chase Travel is easy to use

If you don't want to deal with many hotel and airline award charts, booking through Chase Travel℠ can help keep your rewards game simple. You'll always be able to use your points for any booking you want without worrying about blackout dates or capacity controls you would normally encounter with loyalty programs.

Chase Ultimate Rewards credit cards

To be eligible to use Chase Travel℠, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase credit cards available to new applicants:

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex® (read our Chase Freedom Flex review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Points earned on these cards are worth 1 cent each when redeemed through Chase Travel℠.

Chase travel rewards credit cards :

- Chase Sapphire Reserve®: Points worth 1.5 cents apiece through Chase Travel℠ (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card: Points worth 1.25 cents apiece through Chase Travel℠ (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card: Points worth 1.25 cents apiece through Chase Travel℠ (read our Chase Ink Business Preferred review )

Points earned on these cards are worth more when redeemed through Chase Travel℠. You can also transfer Ultimate Rewards from these cards to more than a dozen airline and hotel partners, potentially for significantly more value.

Combining Chase points for increased value

You can transfer Chase Ultimate Rewards points between accounts if you hold more than one Chase card. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Chase Sapphire Reserve® account will increase the value of your points when you redeem through Chase Travel℠.

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increment.

Points value in the Chase Travel

Certain Chase credit cards offer a bonus for redeeming points through Chase Travel℠. Here's how much your points are worth with each Chase card:

While these redemption rates are generous, you may get even more value by transferring your points to airline and hotel partners since Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Business Insider's points and miles valuations .

If you want to learn more about how (and when, and why) to transfer your points elsewhere, read our guide to understanding Chase Ultimate Rewards travel transfer partners .

How to use the Chase Travel

Using Chase Travel℠ is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase Travel

Once logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click "Select" a flight option, you'll see a list of what is and isn't included in the fare you selected. You may also see a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.

After you agree to the terms, you'll be taken to a final payment page where you can decide how you want to pay. You can cover your flight entirely in points if you want, but you can also choose to pay with your Chase credit card or a combination of points and your credit card.

During the booking process, add your frequent flyer number to your reservation so you can earn miles on your booking and have your flight count toward elite status requirements. You'll also want to add your Known Traveler Number or Redress number if you have one. However, if you forget this step during booking, you can add your frequent flyer information to your flight through the airline's website.

How to book a hotel through Chase Travel

Booking a hotel through Chase is similarly easy, and you'll find a lot of different types of lodging options available. For example, you'll find properties from major hotel brands, but you'll also find rental condo options and boutique hotels.

To search for a hotel, enter the destination, dates, and the number of people you want to have in your room. Once you're presented with options, you can filter hotels based on the hotel name you're looking for, the area or neighborhood, price point, guest rating, property type, and more.

Once again, you'll see a price listed in points and a cash price per night.

These prices do not include taxes and fees, however, so your price in points or cash will be higher by the time you get to the final booking page. Also be aware that the price listed is the lowest you can get for the property, but that better or upgraded rooms and suites will cost more in points.

The major downside to booking a hotel through the Chase portal is that you won't earn hotel points or elite night credits for your stay, because it's considered a third-party booking. There's also a risk that the property won't recognize your hotel elite status or give you the perks you'd normally be entitled to, like late checkout or free breakfast . This shouldn't be an issue if you're booking an independent or boutique hotel, but it's something to be aware of if you're looking for hotel points or status.

You'll have the option to select a hotel you want and a room type at the property you're considering. You can also pay with your booking with points, your Chase credit card, or combine both payment methods.

How to book a rental car through Chase Travel

You can also book a rental car through Chase Travel℠ using the same steps. Once you log into your Chase Ultimate Rewards account, click on "Cars" and select the destination and dates.

Once you are presented with your search results, you can select the types of cars you prefer, like an economy car or an SUV. You can also filter results based on a price range, the number of passengers you have, the rental car company, and the type of transmission you prefer (manual or automatic), as well as the total area you want to search in.

Note that, once again, taxes and fees are not included on the initial search page. Instead, they are added to your total cost when you select a rental car. You can also pay for a rental car through Chase with points, your credit card, or a combination of the two.

How to book activities with the Chase Travel

Chase also lets you book various activities through the portal, which they refer to as "Things to Do." Chase activities can include excursions like snorkeling or scuba diving, as well as tours of museums and historic sites. But you can also book more practical options through their activities tab, including airport pickups and other types of transportation.

To search for activities, enter the destination and dates for your trip. You'll be shown a price in points and in cash that does include taxes and fees. You can also filter options based on the type of activity, your interests, and more. Once again, you have the option to pay for activities with your points, your credit card, or a combination of the two.

How to book a cruise through Chase Travel

If you're a cruise enthusiast, you can also book cruises through Chase Travel℠. When you select "Cruises" at the top of the Chase Ultimate Rewards search page, you'll be presented with a list of featured cruises and cruise specials.

You can also search for cruises by destination or cruise line name. Note, however, that only cash prices are listed for each cruise on the portal and that you'll have to call Chase to make a booking.

Either way, you can use your Chase points to pay for all or part of your cruise. Just have your credit card number handy and call their customer service line at 855-234-2542.

How to book a vacation rental through Chase Travel

Chase also offers a selection of vacation rentals including condos, luxury villas, and more. To search, click "Vacation Rentals" at the top of the main page, then enter your destination, dates, and the number of people in your party.

Once you start your search, you'll have the option to filter results based on the local neighborhood you want, star ratings, price range, guest rating, property type, and more. Like hotels through Chase, the price you are shown excludes taxes and fees, but they will be added to your total once you make a selection.

Also be aware that the price shown in your search results is for the lowest-tier option for each property, and that a larger rental or upgraded rental may cost more in points.

When you book vacation rentals through Chase, you can pay with points, your Chase card, or a combination of the two.

Use the Chase Travel to book Luxury Hotel & Resort Collection properties

If you have the Chase Sapphire Reserve®, you can book properties within the Luxury Hotel & Resort Collection. This list of more than 1,000 properties can be reserved ahead of time, and you'll get extra benefits with each stay such as:

- Daily breakfast for two

- A special benefit worth up to $100

- Complimentary internet access

- Room upgrades when available

- Early check-in and late checkout

One detail to note with this program is the fact that you cannot pay with points. Instead, your online booking will reserve your room, and you'll be charged for the stay when you check out from the hotel.

Should you transfer Chase points instead?

While you can book travel directly through the Chase Travel℠, many people prefer transferring points to Chase airline and hotel partners. Doing so could let you get more value for each point you redeem , but you'll have to run the numbers to find out for sure.

Here's a good example of how transferring points to a Chase airline or hotel partner can be a better deal, as well as the math you'll need to do to figure this out on your own. Take this one-way flight on Air France from Chicago to Paris, for example, and assume you have the Chase Sapphire Reserve® card. You're getting 50% more value when you redeem points through the Chase Travel℠ using points on this card.

If you were to book this flight through Chase Travel℠, you would owe 39,607 points with the Chase Sapphire Reserve®, compared with the cash price of $594.10.

However, you could book an award ticket on the exact same flight through Flying Blue (Air France's loyalty program) directly if you transferred your Chase points there first. In this case, the identical flight would set you back 22,000 miles plus $109.44. This means you would transfer 22,000 miles from Chase to your Flying Blue account, and pay the taxes and fees in cash, or by redeeming points for a statement credit to your account.

When you compare, you'll find that booking with miles directly is a better deal. After subtracting the taxes and fees from the cost of booking through Flying Blue, you wind up with a value of around 2.2 cents per mile.

With Chase Travel℠, on the other hand, you're forking over 39,607 points for the same flight, and you're getting a value of 1.5 cents for each point if you have the Chase Sapphire Reserve®.

Chase Travel portal frequently asked questions

Accessing Chase Travel℠ is simple. If you're a Chase credit cardholder with Chase Ultimate Rewards points, you can log in to your Chase online account. Once logged in, navigate to the 'Travel" or "Rewards" section, where you'll find the Chase travel portal. From there, you can search and book flights, hotels, and other travel services using your earned points or card benefits. It's a convenient way to plan and manage your travel adventures.

Chase Travel℠ refers to the travel booking and rewards platform offered by Chase Bank. It's part of the Chase Ultimate Rewards program, allowing cardholders to use their earned points to book flights, hotels, car rentals, and other travel-related expenses. Chase Travel℠ provides a convenient way to plan and book your trips while taking advantage of the rewards and benefits associated with Chase credit cards.

To earn 5% on Chase Travel℠, consider using a Chase credit card that offers bonus rewards on travel purchases. Cards like the Chase Sapphire Preferred or Chase Sapphire Reserve often offer 5 points per dollar spent on travel booked through the Chase travel portal. Additionally, taking advantage of limited-time promotions and special offers can also help you maximize your rewards when booking travel with Chase.

Maximizing rewards through Chase Travel

The Chase travel portal offers another way to maximize rewards earned with a Chase credit card. Before you pull the trigger, consider all your options and the value you're getting for your points.

Remember that, no matter which Chase credit card you have, you can use your rewards points in other ways. You can redeem Chase points for statement credits or cash back, or cash them in for gift cards or merchandise. And if you have a premier Chase travel credit card, you can transfer your points to Chase airline and hotel partners at a 1:1 ratio.

However, booking travel through Chase can make your life considerably easier — especially if you don't like dealing with complicated hotel and airline programs. You may not get as much value from your points as you would if you booked a premium flight with airline miles, but the Chase travel portal does offer the flexibility to book the flight you want without any blackout dates or hoops to jump through.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Miles and points are my favorite currency

How To Book Delta Flights With Chase Ultimate Rewards Points

Advertiser disclosure : The Miles Genie has partnered with CardRatings for our coverage of credit card products. The Miles Genie and CardRatings may receive a commission from card issuers. Editorial disclosure : Opinions, reviews, analyses, and recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

If you have ever looked at the Chase Ultimate Rewards airline transfer partners, you may have noticed that Delta Skymiles is not a direct transfer partner. You may or may not be surprised to learn that you do not need Delta Skymiles to book a flight operated by Delta. If you have transferable Chase Ultimate Rewards points, there are 3 other ways to book Delta flights.

Transferable bank points such as Chase Ultimate Rewards points are my favorite type of credit card rewards. Chase Ultimate Rewards points are easy to earn and easy to redeem. There are several redemption options thanks to Chase’s airline and hotel transfer partners.

When you use an airline co-branded card, you only earn miles for that airline program. For example, if you only have a Delta co-branded card, you only earn Delta Skymiles. Airline miles generally to not transfer to other airlines; you cannot transfer Delta Skymiles to other airlines. Airline co-branded cards are great for welcome bonuses and for benefits such as free checked bags. For everyday spending, it usually makes more sense to accumulate transferable points such as Chase Ultimate Rewards or American Express Membership rewards points.

The most common argument is “but I fly [insert airline] so I need [insert airline] miles”. This seems like a reasonable argument, but most people overlook the fact that transferable points such as Chase Ultimate Rewards and American Express Membership Rewards have airline partners.

American Express Membership Rewards points transfer to Delta Skymiles. So it’s pretty easy to argue that Amex Membership Rewards are better than Delta Skymiles because I can transfer American Express Membership Rewards points to 17 different airlines including Delta.

Delta Skymiles is not one of the 11 airline transfer partners of Chase Ultimate Rewards, so I can’t really make that argument.

You cannot transfer Chase Ultimate Rewards to Delta, but I’ll explain why you don’t need Delta Skymiles to book Delta flights. There are 3 ways to book Delta flights with Chase Ultimate Rewards points. No Skymiles necessary.

You do not need Delta Skymiles to book Delta award flights

There are three ways to redeem Chase Ultimate Rewards points for Delta flights

- Redeem Chase Ultimate Rewards points for Delta flights by booking via the Ultimate Rewards redemption portal.

- You can transfer Chase Ultimate Rewards points to Virgin Atlantic to book Delta flights.

- You can also transfer to KLM/France to book Delta flights

With Chase Ultimate Rewards partner, you can book some Delta flights for significantly less than the amount of Delta Skymiles required

The way Delta Skymiles prices award tickets often makes Skymiles have a pretty low value. The amount of miles required for some tickets gets pretty insane. There are some great deals occasionally, but without Delta publishing any type of award pricing information, it’s hard to predict. As you’ll see in an example below of a roundtrip Delta flight from the US to Paris, you would not want to use Delta Skymiles even if that is an option. This particular flight would be 98,000 Delta Skymiles. But Chase has 2 partners that can book the exact same Delta flight for 60,000 miles or less.

How to earn transferable Chase Ultimate Rewards points

These 3 cards earn Chase Ultimate Rewards points that can be transferred to Chase’s airline partner programs:

- Chase Sapphire Preferred ®

- Chase Sapphire Reserve®

- Chase Ink Business Preferred®

Tip: If you have one of those 3 cards, you can also earn bonus points by making purchases online in the Ultimate Rewards shopping portal.

Earn your first 60,000 Ultimate Rewards points

No matter what your travel goals are, the Chase Sapphire Preferred is the first card I suggest for almost anyone. The welcome bonus of 60,000 is worth at least $750. But you can potentially get even more value out of those points by using transfer partners as I’ll discuss in this post.

Bonus categories and benefits have recently been added and/or improved!

- Earn 5 points per dollar on travel purchased via Chase Ultimate Rewards

- Earn 2 points per dollar on other travel purchases

- Instead of the old earn rate of 2, you can now earn 3 points per dollar on dining (including eligible delivery services and takeout)

- 3 points per dollar on online grocery purchases (this excludes Target, Walmart and wholesale clubs)

- 3 points per dollar on select streaming services

- Earn 1 point per dollar on all other purchases

Also, receive credit of up to $50 annually on hotel stays purchased through Ultimate Rewards. New cardmembers will receive this credit immediately and existing cardmembers will start earning after the next anniversary.

Each anniversary, you’ll receive bonus points equal to 10% of total purchases made the previous year. This excludes any sign up bonus points, so it’s only on points earned from spending.

The annual fee is $95, but the welcome offer alone is worth a lot more than that.

Transfer partners are generally the most valuable way to redeem Chase Ultimate Rewards points. But first, I’ll explain the Ultimate Rewards booking portal option.

Redeem Chase Ultimate Rewards points for Delta flights using the Ultimate Rewards redemption portal

You can use your Ultimate Rewards points to ‘pay’ for all or part of your airfare by booking through the Ultimate Rewards redemption portal . Note that you can also use Ultimate Rewards to book hotels and cars through the redemption portal. This portal is powered by Expedia, so they should have the same options for flights, hotels, rental cars, and tours as what Expedia.com offers.

The advantage to this (as opposed to transferring to airline partners) is that you have lots of options in terms of airlines and routing. You do not have to worry about award seat availability since the ticket is issued as a paid ticket, not an award ticket. This also means that you will actually earn miles for the flight the same way you would on a paid ticket.

The disadvantage is that you will be redeeming the points at a fixed rate. Sure, there are no blackout dates to worry about. You also don’t have to worry about award seat availability. The problem is, a more expensive plane ticket is going to require more miles/points. This can be a problem if you’re trying to book travel on peak dates such as holidays.

How much are Chase Ultimate Rewards points worth if I redeem via the redemption portal?

Ultimate Rewards points are worth 1.25 cents per point or 1.50 cents per point, depending on which card you hold:

- Chase Sapphire Preferred: 1.25

- Chase Ink Business Preferred: 1.25

- Chase Sapphire Reserve: 1.50

Redeeming Chase Ultimate Rewards points for travel via the Ultimate Rewards redemption portal is a good option when paid fares are low, but tickets with higher fares may require more Ultimate Rewards than you care to redeem.

Tip: There are other Chase cards, such as the Chase Freedom Unlimited, that earn Ultimate Rewards points but those points cannot be transferred. The no annual fee Chase Freedom Unlimited is basically a cash-back card on its own, but pairing it with a CSP, CSR, or CIBP is a great way to boost your earning potential.

If you also have one of the three Chase cards that earn transferable Ultimate Rewards points (CSP, CSR, or CIBP), then any points earned from the Chase Freedom Unlimited can be redeemed the exact same way you would redeem your transferable Chase Ultimate Rewards points.

Pairing one of the transferable Chase Ultimate Rewards earning cards with the CFU gives you the potential to earn a higher return on your spending when you redeem through the redemption portal than what the Chase Sapphire cards alone would give you. Click here for more information .

How to book via the redemption portal

I’m using a nonstop Delta itinerary between the US and Europe for this and other examples throughout the post. You will be able to see that each of the three ways to redeem Chase Ultimate Rewards for Delta flights will result in a different redemption price. The best way to book depends on routing, paid fares, and availability.

Log in to Ultimaterewards.com using your Chase username and password. On the main menu, select travel.

Type in your dates and destination. All available flights will populate. You can filter by airline, nonstop, etc. The cheapest nonstop route is $1285.

A nonstop Delta flight from Atlanta to Paris is just over $1,285 on these dates. That would require 85,238 points if you have the Chase Sapphire Reserve (points are worth 1.5 cents each). If you have the Chase Sapphire Preferred or Chase Ink Business Preferred, the price would be 102,789 points as pictured above (points are worth 1.25 cents each).

Depending on which Chase Sapphire credit card you have, this itinerary is 102,789 points or 85,238 points

Using points to book in the redemption portal is a good option when fares are low. Even if you feel like the fare and thus the redemption price is low, it’s always a good idea to check transfer partners for award ticket availability as well. This is how you can get more than 1.25 or 1.50 cents value out of your Ultimate Rewards points. To put it another way, this is how you can potentially book the same flights for significantly less points.

This exact ATL-Paris Delta itinerary that requires 85,238 points or 102,789 in the Chase redemption portal can be booked for just 58,000 Chase Ultimate Rewards points if you use one of Chase’s airline transfer partners to book.

Transfer Chase Ultimate Rewards points to airline partners

The second way to redeem Chase Ultimate Rewards for flights is to transfer them to airline partners. Transferring Chase Ultimate Rewards to airline partners is how you can potentially get more value out of your points. Once transferred, your Ultimate Rewards become miles for the program to which you transfer. You can redeem the miles according to the policies of the airline program.

You can transfer Chase Ultimate Rewards points to these 11 programs at a 1:1 ratio.

Chase Ultimate Rewards has 11 airline partners, but Delta Skymiles is not one

Delta Skymiles is not a transfer partner of Chase. You cannot convert Chase Ultimate Rewards points to Delta Skymiles. But you can still book a flight operated by Delta.

This is possible because Virgin Atlantic Flying Club and AirFrance/KLM Flying Blue are transfer partners of Ultimate Rewards. Both of these airline programs have a partnership with Delta. As a result, you can transfer Chase Ultimate Rewards to Virgin Atlantic Flying Club and AirFrance/KLM Flying Blue. Then you can use miles of either program to book a flight operated by Delta.

The best part is, using these programs sometimes results in a better redemption price than if you were to use Delta Skymiles.