- --> [Travel Advisory] Due to Typhoon Ampil, a number of flights to and from Tokyo today and tomorrow have been cancelled or re-timed. Passengers travelling to Tokyo are advised to check with their airlines on the status of their flights. See more See less --> -->

- --> [Travel Advisory] The Changi Airport Connector between T2 and T4 will be closed on 11 Sep 2024 from 11am to 4pm. Public bus services will skip the stop after T2 (Bus stop code 95019) during this period. See more See less --> -->

- ARRIVING PASSENGER FLIGHTS" data-tracking-link-section="navigation: FLIGHTS" class="sub-nvg__menu-item__a" href="/en/flights/arrivals.html">ARRIVING PASSENGER FLIGHTS

- DEPARTING PASSENGER FLIGHTS" data-tracking-link-section="navigation: FLIGHTS" class="sub-nvg__menu-item__a" href="/en/flights/departures.html">DEPARTING PASSENGER FLIGHTS

- ARRIVING FREIGHTER FLIGHTS" data-tracking-link-section="navigation: FLIGHTS" class="sub-nvg__menu-item__a" href="/en/flights/arrival-freighter.html">ARRIVING FREIGHTER FLIGHTS

- DEPARTING FREIGHTER FLIGHTS" data-tracking-link-section="navigation: FLIGHTS" class="sub-nvg__menu-item__a" href="/en/flights/departure-freighter.html">DEPARTING FREIGHTER FLIGHTS

- AIRLINE INFORMATION" data-tracking-link-section="navigation: FLIGHTS" class="sub-nvg__menu-item__a" href="/en/flights/airlines.html">AIRLINE INFORMATION

- JEWEL CHANGI AIRPORT" data-tracking-link-section="navigation: AIRPORT GUIDE" class="sub-nvg__menu-item__a" href="https://www.jewelchangiairport.com/">JEWEL CHANGI AIRPORT

- HUB & SPOKE" data-tracking-link-section="navigation: AIRPORT GUIDE" class="sub-nvg__menu-item__a" href="/en/airport-guide/hub-and-spoke.html">HUB & SPOKE

- TERMINAL 2" data-tracking-link-section="navigation: AIRPORT GUIDE" class="sub-nvg__menu-item__a" href="/en/airport-guide/terminal-2.html">TERMINAL 2

- TERMINAL 4 " data-tracking-link-section="navigation: AIRPORT GUIDE" class="sub-nvg__menu-item__a" href="/en/airport-guide/terminal-4.html">TERMINAL 4

- ARRIVAL GUIDE" data-tracking-link-section="navigation: AIRPORT GUIDE" class="sub-nvg__menu-item__a" href="/en/airport-guide/arriving.html">ARRIVAL GUIDE

- DEPARTURE GUIDE" class="sub-nvg__menu-item__a" href="/en/airport-guide/departing.html">DEPARTURE GUIDE

- TRANSITING GUIDE" class="sub-nvg__menu-item__a" href="/en/airport-guide/transit.html">TRANSITING GUIDE

- FACILITIES AND SERVICES" class="sub-nvg__menu-item__a" href="/en/airport-guide/facilities-and-services.html">FACILITIES AND SERVICES

- SPECIAL ASSISTANCE" class="sub-nvg__menu-item__a" href="/en/airport-guide/special-assistance.html">SPECIAL ASSISTANCE

- TRANSPORT" class="sub-nvg__menu-item__a" href="/en/airport-guide/transport.html">TRANSPORT

- DISCOVER CHANGI" data-tracking-link-section="navigation: DISCOVER" class="sub-nvg__menu-item__a" href="/en/discover/discover-changi.html">DISCOVER CHANGI

- ATTRACTIONS " data-tracking-link-section="navigation: DISCOVER" class="sub-nvg__menu-item__a" href="/en/discover/attractions.html">ATTRACTIONS

- LATEST HAPPENINGS" data-tracking-link-section="navigation: DISCOVER" class="sub-nvg__menu-item__a" href="/en/discover/latest-happenings.html">LATEST HAPPENINGS

- PLAN YOUR EVENTS" data-tracking-link-section="navigation: DISCOVER" class="sub-nvg__menu-item__a" href="/en/discover/plan-your-events.html">PLAN YOUR EVENTS

- TOURS & LEARNING" data-tracking-link-section="navigation: DISCOVER" class="sub-nvg__menu-item__a" href="/en/discover/tours-and-learning.html">TOURS & LEARNING

- CHANGIVERSE" class="sub-nvg__menu-item__a" href="/en/discover/changiverse.html">CHANGIVERSE

- CHANGI LOVE KIDS" class="sub-nvg__menu-item__a" href="/en/discover/changi-love-kids.html">CHANGI LOVE KIDS

- TRAVEL DEALS" class="sub-nvg__menu-item__a" href="/en/discover/travel-deals.html">TRAVEL DEALS

- COME EXPERIENCE THE MAGIC" class="sub-nvg__menu-item__a" href="/en/discover/come-experience-the-magic.html">COME EXPERIENCE THE MAGIC

- SHOPPING DIRECTORY" data-tracking-link-section="navigation: SHOP" class="sub-nvg__menu-item__a" href="/en/shop/shopping-directory.html">SHOPPING DIRECTORY

- GREAT DEALS" data-tracking-link-section="navigation: SHOP" class="sub-nvg__menu-item__a" href="/en/shop/promotions.html">GREAT DEALS

- SHOP ONLINE" data-tracking-link-section="navigation: SHOP" class="sub-nvg__menu-item__a" href="https://www.ishopchangi.com/en/home?utm_source=changiairport.com&utm_medium=site_link&utm_campaign=210419_evergreen&utm_content=ca-shoponline-dropdownmenu&utm_term=generic_awareness">SHOP ONLINE

- CHANGI SHOPPING CONCIERGE" data-tracking-link-section="navigation: SHOP" class="sub-nvg__menu-item__a" href="/en/shop/changi-shopping-concierge.html" target="_blank">CHANGI SHOPPING CONCIERGE

- CHANGI PAY" data-tracking-link-section="navigation: SHOP" class="sub-nvg__menu-item__a" href="/en/shop/changipay.html">CHANGI PAY

- CHANGI 1ST" class="sub-nvg__menu-item__a" href="/en/shop/changi-1st.html">CHANGI 1ST

- BE A CHANGI MILLIONAIRE" class="sub-nvg__menu-item__a" href="/en/shop/be-a-changi-millionaire.html">BE A CHANGI MILLIONAIRE

- DINING DIRECTORY" data-tracking-link-section="navigation: DINE" class="sub-nvg__menu-item__a" href="/en/dine/dining-directory.html">DINING DIRECTORY

- GREAT DEALS" data-tracking-link-section="navigation: DINE" class="sub-nvg__menu-item__a" href="/en/shop/promotions.html">GREAT DEALS

- SIGN UP OR LOGIN" data-tracking-link-section="navigation: CHANGI REWARDS" class="sub-nvg__menu-item__a" href="/en/changirewards/signup.html">SIGN UP OR LOGIN

- BENEFITS AND PRIVILEGES" data-tracking-link-section="navigation: CHANGI REWARDS" class="sub-nvg__menu-item__a" href="/en/changirewards/benefits-and-privileges.html">BENEFITS AND PRIVILEGES

- MONARCH" data-tracking-link-section="navigation: CHANGI REWARDS" class="sub-nvg__menu-item__a" href="/en/changirewards/monarch.html">MONARCH

- REWARDS CATALOGUE" data-tracking-link-section="navigation: CHANGI REWARDS" class="sub-nvg__menu-item__a" href="/en/changirewards/catalogue.html">REWARDS CATALOGUE

- MEMBER'S SPECIALS" data-tracking-link-section="navigation: CHANGI REWARDS" class="sub-nvg__menu-item__a" href="/en/changirewards/promotions.html">MEMBER'S SPECIALS

- EVENTS" class="sub-nvg__menu-item__a" href="/en/changirewards/events.html">EVENTS

- GO MOBILE" class="sub-nvg__menu-item__a" href="/en/changirewards/go-mobile-with-changi-app.html">GO MOBILE

- CHAT" class="sub-nvg__menu-item__a" href="/en/changirewards/chat.html">CHAT

- FEEDBACK" class="sub-nvg__menu-item__a" href="/en/changirewards/feedback.html">FEEDBACK

- THE GREAT CHANGI APPSCAPADE" data-tracking-link-section="navigation: CHANGI APP" class="sub-nvg__menu-item__a" href="/en/changi-app/appscapade.html">THE GREAT CHANGI APPSCAPADE

- TRAVEL WITH CHANGI APP" data-tracking-link-section="navigation: CHANGI APP" class="sub-nvg__menu-item__a" href="/en/changi-app/travel.html">TRAVEL WITH CHANGI APP

- BOOK, REDEEM & PLAY" data-tracking-link-section="navigation: CHANGI APP" class="sub-nvg__menu-item__a" href="/en/changi-app/book-redeem-play.html">BOOK, REDEEM & PLAY

- DINE WITH CHANGI APP" data-tracking-link-section="navigation: CHANGI APP" class="sub-nvg__menu-item__a" href="/en/changi-app/dine.html">DINE WITH CHANGI APP

- DOWNLOAD CHANGI APP" data-tracking-link-section="navigation: CHANGI APP" class="sub-nvg__menu-item__a" href="/en/changi-app/download-qr.html">DOWNLOAD CHANGI APP

- HELP CENTRE" class="sub-nvg__menu-item__a" href="/en/changi-app/help-centre.html">HELP CENTRE

Covid-19 Insurance

Visitors entering Singapore, who wish to purchase travel insurance with Covid-19 coverage can refer to the list of insurance providers below.

- Board Of Directors

- Organisation Chart

- Achieving Quality Tourism

- Legislation

- Corporate Governance

- Invest in Tourism

- ASEAN Economic Community

- Media Releases

- Corporate Publications

- Newsletters

- Statistics & Market Insights Overview

- Tourism Statistics

- Industries Overview

- Arts & Entertainment

- Attractions

- Dining & Retail

- Integrated Resorts

- Meetings, Incentives, Conventions & Exhibitions

- Tourist Guides

- Travel Agents

- Assistance and Licensing Overview

- Tourism Sustainability Programme (TSP)

- Singapore Visitor Centre (SVC) Network Partnership

- Grants Overview

- Licensing Overview

- Tax Incentives Overview

- Other Assistance & Resources Overview

- SG Stories Content Fund Season 2

- Marketing Partnership Programme

- SingapoReimagine Marketing Programme

- Singapore On-screen Fund

- Hotel Licensing Regulations

- Data College

- Trade Events and Activities

- Trade Events Overview

- SingapoReimagine Global Conversations

- SingapoRediscovers Vouchers

- Made With Passion

- Joint Promotion Opportunities

- Procurement Opportunities for STB's Overseas Regional Offices

- Product And Industry Updates

- Rental of F1 Pit Building

- Singapore Tourism Accelerator

- Sponsorship Opportunities

- STB Marketing College

- Tourism Innovation Challenge

- Harnessing Technology to Emerge Stronger Post COVID-19

- Tourism Transformation Index (TXI)

- New Tourism Development in Jurong Lake District

- International Trade Events

- Singapore Familiarization Trips

- EVA-Ready Programme

- Tourism Industry Conference

- Expo 2025 Sponsorship and Partnership Opportunities

- Virtual Influencer Open Call for Collaboration

- Students & Fresh Graduates

- Professionals

- Attractions Operator

- Business/Leisure Event Organiser

- Media Professional

- Tourist Guide

- Travel Agent

New insurance coverage for inbound travellers to cover Covid-19 related costs in Singapore

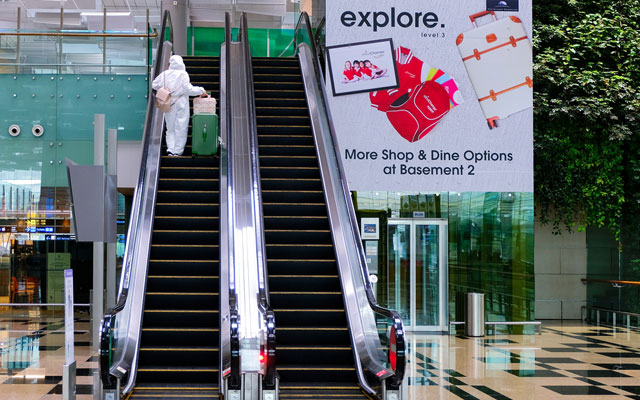

SINGAPORE 18 November 2020 – Changi Airport Group (CAG) and the Singapore Tourism Board (STB), on behalf of the Emerging Stronger Taskforce Alliance for Action (EST-AfA) on Enabling Safe and Innovative Visitor Experiences[1], announced today that foreign visitors will now be able to buy inbound travel insurance coverage for Covid-19 related costs incurred in Singapore.

Inbound insurance coverage has been identified as a key enabler to facilitate the resumption of travel to Singapore. In line with the EST-AfA’s focus on public-private partnerships, CAG, STB and the General Insurance Association of Singapore (GIA) led an Expression of Interest (EOI) exercise to reach out to interested private sector insurers to provide such coverage. In response to the EOI, three insurance companies, AIG Asia Pacific Insurance Pte. Ltd., Chubb Insurance Singapore Limited and HL Assurance Pte. Ltd., have developed travel insurance products which provide at least S$30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs. A minimum of S$30,000 in coverage is recommended by the Ministry of Health based on Covid-19 bill sizes at private hospitals, which is where inbound travellers typically receive care for Covid-19. (Please see Annex for the list of insurers and their insurance plans).

Inbound foreign travellers entering Singapore via the various Safe Travel Lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19, or require medical treatment for Covid-19 while in Singapore. With immediate effect[2], they will be able to purchase a travel insurance plan to help them cover some of these costs.

“We have been actively engaging the insurance community since August this year, through an Expression of Interest (EOI) exercise[3], to develop inbound travel insurance products as Singapore progressively reopens. We noticed such products were not available in the market, and wanted to encourage insurers to develop such products and offer them to travellers at a reasonable price.” said Mr Lee Seow Hiang, Changi Airport Group’s Chief Executive Officer and co-lead of the Alliance.

“With the gradual resumption of travel and the re-opening of borders, having robust travel insurance options in place is integral to ensuring a successful and sustainable revival of inbound travel to Singapore. The general insurance sector is committed to providing travellers visiting Singapore the protection they need to travel here with confidence.” said Mr Ho Kai Weng, General Insurance Association (GIA) of Singapore’s Chief Executive.

Earlier in September, the EST Alliance for Action on Enabling Safe and Innovative Visitor Experiences announced that it will be testing a prototype for safe tradeshows and exhibitions, as well as safe itineraries for event attendees. The new insurance products will complement this earlier work in resuming safe travel.

“As we gradually re-open for safe travel, Covid-19 insurance coverage is a key enabler to rebuild traveller confidence and provide peace of mind. We are heartened that the public and private sectors have come together to provide solutions, and we look forward to more collaborations that will help Singapore lead the way as a safe, trusted and innovative destination.” said Mr Keith Tan, Singapore Tourism Board’s Chief Executive.

Premiums for these inbound travel insurance plans start from S$5.35 (inclusive of GST) and can be purchased directly from the insurers through their respective websites.

[1] The Emerging Stronger Taskforce (EST), formed under the Future Economy Council (FEC) convened the Singapore Together Alliances for Action (“Alliances”), which are industry-led, government-supported coalitions that will act quickly by prototyping ideas on key areas for Singapore. The Alliance for Action on Enabling Safe and Innovative Visitor Experiences is one of them. Co-led by Mr Lee Seow Hiang of Changi Airport Group and Ms Kwee Wei-Lin of Singapore Hotel Association, the Alliance has worked closely with a diverse range of industry stakeholders and government agencies to explore and pioneer new ways to facilitate safe and innovative visitor experiences in a Covid-19 environment.

[2] Refer to Annex for each insurer’s expected sale date.

[3] CAG, on behalf of the Alliance, appointed Willis Towers Watson (WTW) as the consultant of the EOI exercise, where the objective was to invite licensed Singapore insurers to offer coverage to inbound foreign travellers’ Covid-19 related costs in Singapore.

About Changi Airport Group

Changi Airport Group (Singapore) Pte Ltd (CAG) (www.changiairportgroup.com) was formed on 16 June 2009 and the corporatisation of Singapore Changi Airport (IATA: SIN, ICAO: WSSS) followed on 1 July 2009. As the company managing Changi Airport, CAG undertakes key functions focusing on airport operations and management, air hub development, commercial activities and airport emergency services. CAG also manages Seletar Airport (IATA: XSP, ICAO: WSSL) and through its subsidiary Changi Airports International, invests in and manages foreign airports.

About Singapore Tourism Board

The Singapore Tourism Board (STB) is the lead development agency for tourism, one of Singapore’s key economic sectors. Together with industry partners and the community, we shape a dynamic Singapore tourism landscape. We bring the Passion Made Possible brand to life by differentiating Singapore as a vibrant destination that inspires people to share and deepen their passions.

More: www.stb.gov.sg or www.visitsingapore.com

About the Organisation

What industry does your organization fall within, what best describes the key intent of the project that your organisation is seeking funding for, is your organisation a singapore-registered legal entity, is your organisation an association, is the project able to achieve one or more of the following outcome.

- Increase no. of sailings to/from Singapore

- Increase no. of foreign cruise passengers to Singapore through sailings to/from Singapore

- Increase no. of pre/post nights for cruise passengers sailing to/from Singapore

- Increase capability of industry players via cruise-specific industry training programmes

- Strengthen the potential/ attractiveness of cruising in Singapore and/or Southeast Asia

Is the project able to achieve one or more of the following?

- Improve visitor satisfaction (especially foreign visitors)

- Increase footfall

- Increase revenue

- Significant branding and PR value

Is the project able to attract foreign visitors and contribute to foreign visitors' spend?

Who will be the main target audience of your project, is your project innovative and/or a new event in singapore with tourism potential, what best describes your project, does the event have proven track records in singapore or overseas, and/or growth in tourism value such as growing foreign visitorship, and/or enhancement of precinct vibrancy etc, does the project have a clear tourism focus (e.g. tourism-related trainings, tourism companies taking on capability development initiatives or technology companies creating technology products and services for the tourism businesses), what best describes your market feasibility study project.

Based on your selection, the following STB grant/s may be applicable for your project:

Please note that projects that have commenced prior to Singapore Tourism Board's offer may not be eligible for grant support. Examples where projects are deemed as having commenced include:

- Applicant has started work on the project e.g. tender has been called.

- Applicant has made payment(s) to any supplier, vendor or third party.

- Applicant has signed a contractual agreement with any supplier, vendor or third party.

Best Travel Insurance in Singapore with Covid-19 Coverage

Travelling during a pandemic can be stressful. get yourself appropriately covered with the best travel insurance plans before your trip..

by Tan Jia Hui

Make Home Care Personal To Your Loved One

As more countries open up, many Singaporeans are excitedly making holiday plans after close to three years. However, with all the uncertainty regarding outbreaks and government regulations, you may be facing turmoil on whether to book your flight and accommodations, especially if they are non-refundable.

The good news is, travel insurance policies now cover Covid-19-related disruptions. Many also provide compensation if you or your loved ones are diagnosed with Covid-19 before, during, or after the trip, so you can have peace of mind as you book your next vacation.

How to choose the best travel insurance with Covid-19 coverage

With the myriad of options available, how do you choose the best travel insurance with Covid-19 coverage?

Here are 5 key factors you should look out for to help you make an informed decision:

1. Price range

Depending on your destination country, travel duration, and a number of other factors, insurance premiums can range from tens of dollars to several hundreds. It is always best to find a balance between the cost of premium and the coverage you need.

2. Coverage

A typical travel insurance covers the following:

- Overseas medical expenses, including treatment, evacuation and repatriation

- Death and total and permanent disability (TPD)

- Missing or lost baggage

- Flight delays and cancellations

- Trip cancellation

Pay extra attention to the coverage for overseas medical expenses. Most domestic insurance do not cover overseas expenses, which can easily cost upwards of thousands of dollars in the unfortunate event of a medical emergency. The cost of medical expenses may also vary greatly depending on your destination, so be sure to take that into consideration.

Depending on your itinerary and purpose of travel, you may choose to add extra coverage. For example, if you are an adrenaline junkie, consider getting a plan with adventure and sports coverage.

In the current pandemic situation, it is highly recommended to ensure your plan includes Covid-19 coverage. Covid-19 coverage typically includes the following benefits if you or your family members are diagnosed with Covid-19, or if you are affected by a related disruption:

- Medical expenses

- Hospitalisation allowance

- Quarantine allowance

- Trip postponement

- Trip disruption

- Trip curtailment

- Emergency evacuation and repatriation

3. Reliability of provider

Misinformation and fraud is rampant these days, and making sure your insurance provider is reliable is key to avoid being scammed. There are a few steps you can take to ensure the reliability of your insurance provider, such as checking that the agent is authorised by the Monetary Authority of Singapore (MAS), requesting for a receipt, and ensuring the details on the policy document is accurate.

The safest option is to go with a reputable insurance provider that has a great track record so that you can have peace of mind and be confident that your insurance provider has your back should you face any issues overseas.

4. Ease of claims

Often, you may discover travel insurance plans with similar coverage but vastly different costs. While it is tempting to go with the more affordable option, make sure to check the fine print and reviews first. It could be that the company has a tedious and lengthy claim process or highly restrictive rules in the fine print that results in many claims being denied. These days, some insurers also provide a paperless claim process for a more seamless and fuss-free experience.

5. Additional features

Depending on the insurance plan and provider, there may be value-added services and features that you may find useful. For example, some insurance providers provide a 24/7 global medical assistance hotline to connect you with medical treatment and transportation while overseas. Others have an app where you can easily find your policy details, file and track claims, locate nearby medical facilities, police stations, or embassies, and even access medical translation functionalities.

If you find these additional features helpful, keep a look out for them when purchasing your travel insurance plan.

Supporting Your Family and Providing Care from Afar

Planning to take a holiday, but worried of leaving your elderly parents at home alone? Homage can help.

Apart from being able to assist with activities of daily living (ADLs) like changing and cooking to nursing procedures, our Care Pros are also able to provide respite care to accompany your loved ones to their medical appointments or provide primary care in the interim.

Top 8 travel insurance plans with Covid-19 coverage

Depending on the country you are visiting, you may have to meet the mandatory Covid-19 travel insurance requirements to enter. For example, Singapore requires all inbound short-term visitors to have travel insurance with a minimum coverage of $30,000 for Covid-19-related medical expenses.

Here are the estimated premium and Covid-19 coverage of different travel insurance policies for a 7-days trip to most destinations worldwide:

Do note that the numbers above are for the most basic plan offered by each travel insurance provider. Many of them also offer plans with higher coverage, but of course have higher premiums as well.

1. FWD Premium

FWD offers affordable travel insurance plans with Covid-19 coverage. At $51.60 for a week-long trip to most destinations including the USA, FWD Premium has one of the lowest premiums in this list, but its coverage is also limited to only the bare minimum.

The Covid-19 insurance, which you have to purchase as an add-on to the FWD Premium plan, covers:

- Medical expenses : Up to $200,000 while overseas or after returning to Singapore

- Hospitalisation allowance : $50 per day for up to 14 consecutive days while overseas, $100 per day for up to 14 days after returning to Singapore

- Trip cancellation : Up to $5,000 for non-refundable costs, for up to 30 days before the trip

- Trip disruption : Up to $5,000

- Emergency evacuation and repatriation : Up to $200,000

The good thing about the FWD Premium travel insurance policy is that the medical expenses and hospitalisation allowance benefits are applicable for up to 14 days after your return, which not all plans offer.

2. Klook x MSIG Lite Plan

Another affordable travel insurance plan with Covid-19 coverage is the Klook x MSIG Lite Travel Insurance . At only $34.40 for a week-long trip to Thailand and up to $88 for a trip to the United States, its premium is comparable to FWD’s, but their Covid-19 coverage differs.

Covid-19 travel insurance coverage:

- Medical expenses : Up to $100,000 while overseas

- Hospitalisation allowance : $100 per day for up to 14 days while overseas, with maximum limit of $350

- Quarantine allowance : $100 per day for up to 14 days while overseas, with maximum limit of $350

- Trip cancellation : Up to $2,500

- Trip curtailment : Up to $2,500

- Evacuation and repatriation : Unlimited

While MSIG provides an overseas quarantine allowance, its payouts for hospitalisation allowance, medical expenses, as well as trip cancellations or disruptions, are lower compared to FWD.

Importantly, do take note that the Covid-19 cover will cease immediately after your return to Singapore, and the plan covers a trip duration of up to 30 days only, with no extension available.

If you are on a tight budget and don’t mind the basic coverage, consider getting this plan.

3. AIG Travel Guard Basic

For a comprehensive plan that already incoporates Covid-19 coverage, consider the AIG Travel Guard Basic . Under this policy, a week-long trip to Japan would incur a premium of $68.

- Medical expenses, emergency evacuation, and repatriation : Up to $50,000 for those below 70 years old, up to $25,000 for children and those above 70 years old

- Quarantine allowance : $50 per day for up to 14 days while overseas

- Travel cancellation : Up to $2,500

- Travel postponement : Up to $500

While this plan offers decent coverage, it is missing a few elements, namely payouts for hospitalisation allowance, pre-departure changes to your trip, and even if you decide to return to Singapore early.

For better overall coverage, you have the option of upgrading to the Standard, Enhanced, or Supreme plans. However, do note that while these plans have higher compensation for the existing benefits, they do not provide additional benefits like hospitalisation allowance.

4. Allianz Single Trip Bronze

Rather than an add-on, Allianz incorporates Covid-19 coverage into its existing travel insurance plans. This means that while its medical expense coverage is significantly higher than the other plans above, it doesn’t provide payouts for travel delays, or allowance for hospitalisation and quarantine due to Covid-19.

You can get the Allianz Single Trip Bronze plan at $49 for a week-long trip to Thailand, or $112 if you are travelling to the USA.

- Emergency medical and dental expenses : Up to $200,000 for those below 70 years old, up to $50,000 for those above 70 years old

- Travel cancellation : Up to $5,000

- Emergency transportation : Unlimited

For those who are looking for a more comprehensive plan, including personal accident and trip interruption coverage, Allianz also provides two other travel insurance plans: Silver and Platinum.

At the time of updating (9 Nov 2022), Allianz is also offering 12% off their travel insurance if you use the promo code “travel12”.

5. AXA SmartTraveller Essential

Since 1 February 2021, the AXA SmartTraveller plans have been updated to better suit Singaporeans’ travel needs. The most basic plan, AXA SmartTraveller Essential , costs $157.02 for a week-long trip to most countries and includes the following Covid-19 travel insurance coverage:

- Medical expenses : Up to $75,000 overseas, and up to $37,500 in Singapore

- Hospitalisation allowance : $100 per day, up to a limit of $1,000

- Quarantine allowance : $50 per day, up to a limit of $350 overseas and $350 in Singapore

- Trip cancellation : Up to $1,000

- Trip postponement : Up to $500

- Trip curtailment or rearrangement : Up to $2,000

While the Covid-19 medical expense coverage for the Essential plan is considered low compared to the other plans on this list, AXA covers medical costs incurred within 90 days of your trip, which is quite generous duration-wise. For a higher coverage, you may want to consider upgrading to the Comprehensive plan, which covers up to $150,000 for Covid-19 medical treatment.

Another perk of the AXA SmartTraveller plan is their flexibility when it comes to claims for trip curtailment, which includes situations where a family member passes on due to Covid-19 or when there is a Covid-19 outbreak at the destination country.

6. NTUC Income Classic

For a week-long trip to most destinations, the NTUC Income Classic plan costs $149. On top of personal accident coverage, the plan includes the following Covid-19 travel insurance coverage:

- Medical expenses : Up to $250,000 while overseas

- Quarantine allowance : $100 per day while overseas, capped at $1,400

- Trip cancellation : Up to $5,000

- Trip curtailment : Up to $5,000

- Trip disruption : Up to $2,000

- Emergency transportation : Up to $150,000

All NTUC Income travel insurance policies bought online now include Covid-19 coverage for the first 90 days of each trip. However, do take note of the exclusions, as they do not cover travel inconveniences caused by border closures and government advisories.

For increased coverage, you have the option to choose NTUC Income’s Deluxe or Preferred travel insurance plans. Alternatively, if you are looking for a travel insurance policy that covers pre-existing conditions, NTUC Income is also one of the few providers that offers it. Their Enhanced PreX Travel Insurance starts from $194 for a week-long trip.

At the time of updating (9 November 2022), there is also an ongoing 40% promotion for all single-trip travel insurance policies bought online.

7. Sompo Essential

The Sompo Essential plan costs $129 for a week-long trip to most countries worldwide, and includes the following Covid-19 travel insurance coverage:

- Overseas medical expenses : Up to $200,000

- Medical expenses in Singapore : Up to $5,000

- Hospitalisation allowance : $100 per day while overseas, capped at $3,000

- Quarantine allowance : $50 per day while overseas, capped at $700

- Trip postponement : Up to $5,000

- Trip disruption : Up to $1,000

- Emergency medical evacuation : Up to $500,000

- Repatriation : Up to $30,000

In terms of breadth of coverage, the Sompo Essential plan has most of the Covid-19 benefits that other plans offer as well. Furthermore, the trip cancellation, postponement, and curtailment benefits apply not only when you contract Covid-19, but also when your travel companion(s) who are also insured by Sompo are infected.

However, do note that Sompo only covers Covid-19-related medical expenses for a period of up to 45 days (or until the maximum limit is reached), starting from your first day of treatment. Any medical expense incurred after 45 days will not be covered.

If you would like a more comprehensive coverage, there is the option to upgrade to the Sompo Superior plan.

At the time of updating (9 November 2022), Sompo is running a promotion for its single-trip Covid-19 insurance plans. Purchase your policies at 25% off till 4 December 2022.

8. Singlife Travel Lite

Singlife offers three plans with different levels of coverage: Travel Lite, Travel Plus, and Travel Prestige. The Singlife Travel Lite plan is the most affordable of the three, at $77.93 for a week-long trip to most destinations worldwide.

- Medical expenses and emergency medical evacuation : Up to $250,000 while overseas

- Medical expenses in Singapore : Up to $10,000

- Trip cancellation : Up to $5,000

- Trip interruption : Up to $1,000

While the Singlife Travel Lite plan—the most basic of the three—has quite a low coverage, the benefits of the other two plans are comparable to the rest on the list and include overseas quarantine allowance of up to $2,000.

Additionally, MINDEF/MHA and POGIS policyholders can enjoy up to 46% off single-trip plans and 30% off multi-trip plans.

While we have provided a brief summary of the pros and cons of various travel insurance plans, remember to also read the fine print before making a decision to make sure the plan is right for you.

What to do if you get Covid-19 during or after your trip?

If you are diagnosed with Covid-19 or are affected by a related disruption during your trip, call your insurance provider immediately as they will be most familiar with the plan you have purchased and will be able to advise you accordingly. There may be steps you need to take within a fixed time frame (e.g. obtain an official quarantine order or a doctor’s letter) for the insurer to approve your claims, so you should call them once you are aware of the diagnosis or disruption. Most insurers should have a hotline that operates 24/7.

You will also have to submit your claim with supporting documents within the deadline (usually 30 days), so make sure that you always keep all receipts in an accessible place so you can submit claims on-the-go and do not have to wait till you are back in Singapore to process the claim.

Have peace of mind for your next getaway

The Covid-19 coverage component in travel insurances is something that is new and unfamiliar to many of us, but we hope that this detailed guide helped you get a better idea of what to look out for your next travel insurance purchase!

Just as insurance provides us with a peace of mind on our travels – if you have elderly parents who you are concerned about leaving at home alone while you are away – Homage is able to provide caregiving services for your loved ones in the interim.

Our trained care professionals are able to provide companionship, nursing care, night caregiving, home therapy and more , to keep your loved ones active and engaged while you are away for your much needed holiday.

Provide the best care to your loved one today! Fill up the form below for a free consultation with our Care Advisory team.

Fill out the form below and our Care Advisors will get back to you with care information you need.

In the event that we will need to contact you, please look out for our outgoing number +65 3129 6885.

This number may be flagged as “potential fraud” but please be assured this is the official Homage number that we use to reach out to our customers.

- First Name *

- Why are you seeking care support? * Post-hospital discharge Maid is unavailable (more than 2 weeks) Maid is unavailable (less than 2 weeks) Family caregiver is unavailable (work, travel) Family caregiver looking for respite Nursing procedures required Therapy required Others

- Personal Care

- Physiotherapy

- Speech Therapy

- Occupational Therapy

- Severe Disability Assessment

- By submitting this form, you agree that Homage may collect and use your personal data, which you have provided in this form, in accordance with Homage’s Data Protection Policy

- Name This field is for validation purposes and should be left unchanged.

Common Scams in Singapore and How to Avoid Falling for Them

Going on Holiday? Here Are 10 Things You Can Prepare for a Worry-Free Trip

Holiday Eating Tips: How To Avoid Indigestion and Bloating During Festive Meals

How To Protect Yourself and Seniors During the Haze

Get started with a free consultation today, and learn why thousands of Singaporeans trust Homage to deliver the best care in their homes.

Get care now with the Homage app

Get your care in as little as 48 hours

Get to know your carers past experience and qualifications

Book, manage and pay for visits all in one place

Scan the QR code to download the app

Available on

4.7 mobile rating

What our customers say

Right from the start from signing up for an account, to making a booking on the app, to the confirmation...

Have been using this for a year to help my grandfather who frequently gets aspiration pneumonia and has difficulty leaving...

Very responsive app, with options to chat with caregiver, review reports and contact support team for assistance.

Speak to our Care Advisors

Inbound visitors to Singapore can now buy travel insurance to cover Covid-19 medical costs

Advertisement.

SINGAPORE — Foreigners travelling to Singapore can now buy travel insurance to cover Covid-19-related medical costs incurred while they are here.

Insurance coverage is a key enabler to rebuild traveller confidence and provide peace of mind, Changi Airport Group’s chief executive officer Lee Seow Hiang said.

Michelle Lee

SINGAPORE — Foreigners travelling to Singapore can now buy travel insurance to cover Covid-19-related medical costs incurred while they are here.

Three companies — AIG Asia Pacific Insurance, Chubb Insurance Singapore and HL Assurance — have developed plans that will provide at least S$30,000 in coverage for medical treatment and hospitalisation costs related to the coronavirus.

The announcement was made in a joint statement by Changi Airport Group (CAG) and the Singapore Tourism Board (STB) on behalf of the Emerging Stronger Taskforce Alliance for Action on Enabling Safe and Innovative Visitor Experiences on Wednesday (Nov 18). The alliance is one of seven industry-led coalitions working with the Government to quickly execute ideas to support and grow the economy.

For now, foreign travellers entering Singapore via the various safe travel lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19 or require medical treatment for the coronavirus here.

A minimum of S$30,000 of coverage is recommended by the Ministry of Health based on Covid-19 bill sizes at private hospitals — where inbound travellers typically receive such care, the statement said.

The plans by AIG and HL Assurance are already available for purchase on their respective websites, while Chubb's will go on sale from Nov 27. Premiums start from S$5.35.

Inbound insurance coverage has been identified as a key enabler to facilitate the resumption of travel to Singapore through rebuilding traveller confidence and providing peace of mind, the statement said.

Mr Lee Seow Hiang, chief executive officer of CAG, said that the group has been “actively engaging” the insurance community since August to develop travel insurance products as Singapore progressively reopens,

“With the gradual resumption of travel and the reopening of borders, having robust travel insurance options in place is integral to ensuring a successful and sustainable revival of inbound travel to Singapore,” he added.

“We are heartened that the public and private sectors have come together to provide solutions, and we look forward to more collaborations that will help Singapore lead the way as a safe, trusted and innovative destination.”

As for outbound travellers, HL Assurance told TODAY that it is working on a product targeted at this group, adding that more details will be released later.

TODAY has reached out to AIG and Chubb for more information on their plans.

Related topics

Read more of the latest in

Stay in the know. Anytime. Anywhere.

Subscribe to our newsletter for the top features, insights and must reads delivered straight to your inbox.

By clicking subscribe, I agree for my personal data to be used to send me TODAY newsletters, promotional offers and for research and analysis.

Recent Searches

This browser is no longer supported.

We know it's a hassle to switch browsers but we want your experience with TODAY to be fast, secure and the best it can possibly be.

To continue, upgrade to a supported browser or, for the finest experience, download the mobile app.

Upgraded but still having issues? Contact us

Get your daily dose of fun

Try our word games, puzzles & quizzes

Play games, quizzes & more

- Chubb in Singapore

- Corporate News

- Singapore News

- Media Resources

- Submit an Enquiry

Travel Protection

When you’re planning your holiday, you don’t plan for all the things that could go wrong. Take out the right cover and you won’t have to.

Overseas Travel Insurance

Chubb Travel Insurance offers customisable cover for individuals and families with worldwide access to medical assistance.

Inbound Travel Insurance

SG Travel Insured is a travel insurance plan specially designed for foreign traveller arriving in Singapore, excluding Singapore Residents.

Staycation Insurance

Travel Local is designed to provide domestic travellers with greater peace of mind when taking a local holiday or staycation.

Coach & Ferry Travel Insurance

Protection against travel inconveniences and medical coverages for coach and ferry commuters.

Make Chubb a part of your travel plan. As a global leader in the provision of travel insurance products and services, covering millions of travellers around the world, Chubb's suite of travel insurance plans provides you and your loved ones with benefits like Covid-19 coverage for overseas medical expenses, journey cancellation and curtailment, emergency medical evacuation, travel inconveniences and more. We offer a wide variety of plan types with different levels of cover and optional add-ons, so you have the flexibility to choose something that's catered to your specific travel needs. Whether you're a leisure or business traveller, you'll have access to a dedicated overseas emergency hotline - Chubb Assistance. Chubb Assistance operates 24 hours a day, 365 days a year. If you need emergency aid or require advice on available medical resources or facilities at your travel destination, you can be comforted in knowing that Chubb Assistance is there for you.

4 Reasons to Get Travel Insurance

If you’re considering traveling for business or leisure, travel insurance can help give you peace of mind in case not everything goes as expected.

Best Practices for International Travel During COVID-19

If you have upcoming trips planned, here are some useful tips to help keep you a little safer as you resume your travels.

8 Ways to Safely Travel Abroad

Travellers often face all kinds of risks and challenges in foreign countries, due to the differences in language, culture, politics, and economics. Here's a quick list of things to think about as you plan your trip.

Let us help.

Find answers to some of our frequently asked questions or drop us an online enquiry.

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

Inbound travellers to Singapore can purchase insurance for Covid-19 related costs

SINGAPORE - Inbound travellers arriving in Singapore can now purchase insurance coverage for Covid-19 related costs incurred during their stay here.

Changi Airport Group (CAG) and the Singapore Tourism Board (STB) said in a joint statement on Wednesday (Nov 18) morning that three insurance companies have developed travel insurance products which provide at least $30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs.

The minimum coverage sum was decided based on recommendations by the Ministry of Health (MOH), which considered bills for Covid-19 treatment at private hospitals.

The three companies providing insurance coverage are AIG Asia Pacific Insurance, Chubb Insurance Singapore Limited and HL Assurance.

While AIG and HL Assurance have started selling their insurance products, Chubb's will be available from Nov 27.

Under present rules, inbound foreign travellers entering Singapore through various safe travel lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19 or require medical treatment for the virus while in Singapore.

As such, the travel insurance plan will help them cover some of these costs, said CAG and STB.

Mr Lee Seow Hiang, CAG's chief executive and co-lead of the Alliance for Action on Enabling Safe and Innovative Visitor Experiences under the Emerging Stronger Taskforce said: "We have been actively engaging the insurance community since August this year, through an Expression of Interest exercise, to develop inbound travel insurance products as Singapore progressively reopens.

"We noticed such products were not available on the market, and wanted to encourage insurers to develop such products and offer them to travellers at a reasonable price."

Mr Ho Kai Weng, chief executive of the General Insurance Association of Singapore said: "With the gradual resumption of travel and the re-opening of borders, having robust travel insurance options in place is integral to ensuring a successful and sustainable revival of inbound travel to Singapore.

"The general insurance sector is committed to providing travellers visiting Singapore the protection they need to travel here with confidence."

Added Mr Keith Tan, STB's chief executive: "As we gradually re-open for safe travel, Covid-19 insurance coverage is a key enabler to rebuild traveller confidence and provide peace of mind.

"We are heartened that the public and private sectors have come together to provide solutions, and we look forward to more collaborations that will help Singapore lead the way as a safe, trusted and innovative destination."

CAG and STB said premiums for these inbound travel insurance plans start from $5.35, with GST, and can be purchased directly from the insurers through their respective websites.

The two organisations added that the new insurance products complement earlier announcements by the Emerging Stronger Taskforce that a pilot for safe tradeshows and exhibition will start from November.

The pilot includes safe itineraries for event attendees which comprise leisure activities that are in line with prevailing safe management guidelines.

Last month (Oct 20), MOH also announced that participants in some mass events will have to take an antigen rapid test for Covid-19 and test negative before admission.

What you need to know about S'pore's new Covid-19 vaccination strategy

Asia stepping up fight against more infectious Covid-19 variants

Hong Kong cements Covid-19 tests with centres just a 15-minute walk

Covid-19 wave looms in Europe amid vaccine fatigue and false sense of security

Long Covid remains a mystery, though theories are emerging

askST: What is excess death and what is Covid-19's true toll on the world?

Biden says pandemic is over; survivors and doctors disagree

No plans to include Covid-19 vaccinations in childhood immunisation schedule: Ong Ye Kung

Human development set back 5 years by Covid-19, other crises: UN report

Covid-19's harmful effects on the brain reverberate years later: Study

Join ST's WhatsApp Channel and get the latest news and must-reads.

- Coronavirus

- Travel planning

Read 3 articles and stand to win rewards

Spin the wheel now

- Company News

- Agent Sanctions

Media center

- Annual & Audit Reports

- CAG-STB Joint Press Release - New insurance coverage for inbound travellers to cover Covid-19 related costs in Singapore

New insurance coverage for inbound travellers to cover Covid-19 related costs in Singapore

SINGAPORE, 18 November 2020 – Changi Airport Group (CAG) and the Singapore Tourism Board (STB), on behalf of the Emerging Stronger Taskforce Alliance for Action (EST-AfA) on Enabling Safe and Innovative Visitor Experiences 1 , announced today that foreign visitors will now be able to buy inbound travel insurance coverage for Covid-19 related costs incurred in Singapore.

Inbound insurance coverage has been identified as a key enabler to facilitate the resumption of travel to Singapore. In line with the EST-AfA’s focus on public-private partnerships, CAG, STB and the General Insurance Association of Singapore (GIA) led an Expression of Interest (EOI) exercise to reach out to interested private sector insurers to provide such coverage. In response to the EOI, three insurance companies, AIG Asia Pacific Insurance Pte. Ltd., Chubb Insurance Singapore Limited and HL Assurance Pte. Ltd., have developed travel insurance products which provide at least S$30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs. A minimum of S$30,000 in coverage is recommended by the Ministry of Health based on Covid-19 bill sizes at private hospitals, which is where inbound travellers typically receive care for Covid-19. (Please see Annex for the list of insurers and their insurance plans).

Inbound foreign travellers entering Singapore via the various Safe Travel Lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19, or require medical treatment for Covid-19 while in Singapore. With immediate effect 2 , they will be able to purchase a travel insurance plan to help them cover some of these costs.

“We have been actively engaging the insurance community since August this year, through an Expression of Interest (EOI) exercise 3 , to develop inbound travel insurance products as Singapore progressively reopens. We noticed such products were not available in the market, and wanted to encourage insurers to develop such products and offer them to travellers at a reasonable price.” said Mr Lee Seow Hiang, Changi Airport Group’s Chief Executive Officer and co-lead of the Alliance.

“With the gradual resumption of travel and the re-opening of borders, having robust travel insurance options in place is integral to ensuring a successful and sustainable revival of inbound travel to Singapore. The general insurance sector is committed to providing travellers visiting Singapore the protection they need to travel here with confidence.” said Mr Ho Kai Weng, General Insurance Association (GIA) of Singapore’s Chief Executive.

Earlier in September, the EST Alliance for Action on Enabling Safe and Innovative Visitor Experiences announced that it will be testing a prototype for safe tradeshows and exhibitions, as well as safe itineraries for event attendees. The new insurance products will complement this earlier work in resuming safe travel.

“As we gradually re-open for safe travel, Covid-19 insurance coverage is a key enabler to rebuild traveller confidence and provide peace of mind. We are heartened that the public and private sectors have come together to provide solutions, and we look forward to more collaborations that will help Singapore lead the way as a safe, trusted and innovative destination.” said Mr Keith Tan, Singapore Tourism Board’s Chief Executive.

Premiums for these inbound travel insurance plans start from S$5.35 (inclusive of GST) and can be purchased directly from the insurers through their respective websites.

1.The Emerging Stronger Taskforce (EST), formed under the Future Economy Council (FEC) convened the Singapore Together Alliances for Action (“Alliances”), which are industry-led, government-supported coalitions that will act quickly by prototyping ideas on key areas for Singapore. The Alliance for Action on Enabling Safe and Innovative Visitor Experiences is one of them. Co-led by Mr Lee Seow Hiang of Changi Airport Group and Ms Kwee Wei Lin of Singapore Hotel Association, the Alliance has worked closely with a diverse range of industry stakeholders and government agencies to explore and pioneer new ways to facilitate safe and innovative visitor experiences in a Covid-19 environment.

2. Refer to Annex for each insurer’s expected sale date.

3.CAG, on behalf of the Alliance, appointed Willis Towers Watson (WTW) to launch the EOI, where the objective was to invite licensed Singapore insurers to offer coverage to inbound foreign travellers’ Covid-19 related costs in Singapore.

Popular Topics

What is a no claims discount and how does it work.

A No-Claim Discount (‘NCD’) is an entitlement given to you if no claim has been made und ...

Having the HDB Fire Insurance or policy arranged by my bank is good enough.

If you have an outstanding mortgage loan with HDB or any financial institution, you are required to ...

Insurance Disputes

If you feel you have been treated unfairly by your insurer, you should lodge a complaint directly wi ...

- Philippines

- South Korea

- The Maldives

- Appointments

- Trade Calendar

- News Archive

- Print Edition

Singapore rolls out Covid-19 insurance for inbound travellers

Inbound visitors to Singapore can now buy travel insurance coverage for Covid-19-related costs incurred during their stay here, Changi Airport Group (CAG) and Singapore Tourism Board (STB) said in a joint statement on Wednesday.

The statement was made on behalf of the Emerging Stronger Taskforce Alliance for Action (EST-AfA) on Enabling Safe and Innovative Visitor Experiences.

Under the plan, three insurance companies, namely, AIG Asia Pacific Insurance, Chubb Insurance Singapore and HL Assurance, have developed travel insurance products which provide at least S$30,000 (US$22,326) in coverage for Covid-19-related medical treatment and hospitalisation costs.

The minimum coverage amount is based on recommendations by the Ministry of Health, in view of Covid-19 bill sizes at private hospitals, which is where inbound travellers typically receive care for the virus.

Premiums for these inbound travel insurance plans start from S$5.35, inclusive of GST, and can be purchased directly from the insurers through their respective websites.

The insurance plans available are as below:

Under current regulations, inbound foreign travellers entering Singapore via the various safe travel lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19, or require medical treatment for the virus while in Singapore. Hence, the travel insurance plans have been designed to help them cover some of these costs.

Lee Seow Hiang, Changi Airport Group’s CEO and co-lead of the Alliance, said: “We have been actively engaging the insurance community since August this year, through an Expression of Interest (EOI) exercise, to develop inbound travel insurance products as Singapore progressively reopens. We noticed such products were not available in the market, and wanted to encourage insurers to develop such products and offer them to travellers at a reasonable price.”

Ho Kai Weng, CEO of General Insurance Association of Singapore, which led the EOI exercise alongside CAG and STB, added: “With the gradual resumption of travel and the reopening of borders, having robust travel insurance options in place is integral to ensuring a successful and sustainable revival of inbound travel to Singapore. The general insurance sector is committed to providing travellers visiting Singapore the protection they need to travel here with confidence.”

Earlier in September, the EST-AfA on Enabling Safe and Innovative Visitor Experiences announced that it will be testing a prototype for safe tradeshows and exhibitions, as well as safe itineraries for event attendees. The new insurance products will complement this earlier work in resuming safe travel.

STB CEO Keith Tan said: “As we gradually reopen for safe travel, Covid-19 insurance coverage is a key enabler to rebuild traveller confidence and provide peace of mind. We are heartened that the public and private sectors have come together to provide solutions, and we look forward to more collaborations that will help Singapore lead the way as a safe, trusted and innovative destination.”

Experience Millennium Hotels and Resorts’ sustainable properties in Singapore

Discover serenity and rejuvenation at Korea’s premier wellness destinations

Advertise with us

Is Your Business Listed On TTGmice Planner Online?

Your gateway to Asia with Resorts World Cruises

Digital Travel APAC Summit 2024 returns with a fresh roster of industry professionals for networking and sharing of insights

RELATED ARTICLES

Singapore tourism board, gd world cruises to offer customised cruise routes and packages, singapore positions itself as ideal destination for malaysian families, sunflower blooms at singapore’s changi airport, philippine airlines, singapore tourism board team up for travel campaigns, singapore tourism board calls for tenders for wellness attraction at marina south coastal site, singapore recognises 27 individuals and organisations for their contributions to tourism excellence in 2024 awards, ttg conversations: five questions with wong ming fai, singapore tourism board, agoda, singapore tourism board to showcase destination offerings, glow festival returns for its third edition this july, tried and tested.

SingaPour Drink Tour

Cebu Pacific celebrates 10 years of flying to Australia

What to buy now.

Legoland Malaysia celebrates 12th anniversary with fun-tastic deals

- TTG Travel Awards

- Privacy Policy

- Terms of Use

All Rights Reserved

Scheduled Maintenance: Please note that purchase of Chubb Travel Insurance policies will not be available from 08 September 2024, 2.00am to 6.00am (SGT).

- About Chubb Travel Insurance

- What is covered?

- What is not covered?

- When am I covered?

- Where can I travel?

- Who is covered?

- COVID-19 Cover

- Preparing to Travel

- At Your Destination

- When the Unexpected Happens

- Planning Your Travel

- Chubb Assistance

- Relating to COVID-19 Cover

- Types Of Plan & Eligibility

- Medical Cover

- Baggage Cover

- Sports And Sporting Equipment

- Trip Cancellation

Chubb Travel Insurance has got you covered. Get up to S$150 worth of e-Vouchers for Annual Plans and up to S$50 worth of e-Vouchers for Single Trip Plans*!

Choose your vouchers from merchants such as grab, capitaland, fairprice and more. *valid from 31 august to 11 september 2024. click here for the terms and conditions., chubb travel insurance has got you covered. save up to 20% + get up to s$50 worth of e-vouchers for annual plans and up to s$20 worth of e-vouchers for single trip plans*, choose your e-vouchers from merchants such as grab, capitaland, fairprice and more. *valid from 12 september to 19 october 2024. click here for the terms and conditions..

Personalise your travel insurance coverage

Chubb travel insurance has got you covered. save up to 20% + get up to us$30 worth of airalo airmoney now, *valid from 26 july to 30 august 2024. click here for the terms and conditions., special promo for m1 customers enjoy 10% off + get up to s$150 worth of e-vouchers when you purchase chubb travel insurance*, choose your vouchers from merchants such as grab, capitaland, fairprice and more. *valid from 31 august to 30 september 2024. terms and conditions apply ., chubb travel insurance has got you covered, 4 plan types with customisable benefits catered to every traveller, destination and budget.

Our most affordable plan with basic coverage, especially tailored for travellers heading to Batam, Bintan, and Malaysia.

A starter plan for worldwide travels (excluding Cuba) with higher coverage limits than our Saver Plan.

The most popular option for both leisure and business travellers as it offers comprehensive benefits and cover limits.

Our most comprehensive plan with extensive range of cover and the highest coverage limits.

Why choose Chubb?

Quality travel cover at an affordable price.

With more than 50 years of insurance experience and many millions of travellers served, Chubb Travel Insurance offers high-quality insurance to travellers. We have plan option for all types of travellers, from frequent flyers and families to holidaymakers on a budget, adventure seekers and sports enthusiasts.

Fast, fair and efficient handling of claims

Experience has taught us the importance of being proactive when managing claims. Chubb understands that a fast, fair and efficient approach to claims handling will bring about an expedited outcome, and can help to deliver an improved result.

Access to a global team of travel experts

Purchasing travel insurance from Chubb means access to a truly global network. In addition to our wealth of local expertise, Chubb's operation in Singapore is backed by our extensive global travel network and breadth of resources to serve your every need.

24-hour overseas emergency assistance

When you purchase Chubb Travel Insurance, you are instantly covered by Chubb Assistance, our 24-hour overseas emergency hotline that provides the support that you expect in your time of need, anywhere, anytime.

Travel Smarter with Chubb Travel Insurance. Get an instant quote now!

You may contact us via the following:.

Chubb Insurance Singapore Limited

138 Market Street

Level 11-01 CapitaGreen

Singapore 048946

Chubb Travel Insurance Customer Service

For general enquiries and claims, call (65) 6398 8776 (Mondays to Fridays, 9.00am-5.00pm,excluding Public Holidays)

For 24-hour overseas emergency assistance,call (65) 6836 2922

Chubb Worldwide Offices

For the mailing address, telephone

number and email address of any Chubb

office in our global network, use our

office locator.

Chubb. Insured.™

- About Chubb

- Chubb Insurance

© Chubb Insurance Singapore Limited. This policy is underwritten by Chubb Insurance Singapore Limited. Co. Regn. No. 199702449H. Full details of the terms, conditions and exclusions of this insurance are provided for in the policy documentation. Please read our Terms of Use , Licensing Information and Privacy Policy .

PSLE results out on 25 Nov, students to collect in separate classrooms

Jail for employer of maid who climbed down 15 floors to escape cruel abuse

Singapore's hawker culture recommended by experts to be inscribed on UNESCO list

Latest stories

Trump gave harris a shocking two-word compliment after the debate.

Presidential candidates both attended a memorial ceremony at Ground Zero hours after the debate

17 People Who Were Undecided Before The Presidential Debate Are Sharing Where They Stand Now, And It's Not What I Expected

"I was leaning toward Harris before the debate, but now I'm voting for Trump. Harris never really explained her flip-flops."

Daughter of British millionaire who left fortune to widow wins legal battle over his will

The daughter of a British millionaire whose Chinese widow “dumped him in the cheapest possible grave” after being left his fortune has won a legal battle over his will.

Sharon Stone Shows Off Her Bikini Body at 66 After Pool Workout

The actress detailed her "last workout" before she films her latest movie role

Trump Reveals Who He Will Blame If He Loses Election

Is Donald Trump gearing up to blame old folks if he loses the presidential election to Kamala Harris in November? It sure sounded that way Thursday at a rally held by the former president in Tucson, Arizona, where he took note of the changing demographic of his supporters and wondered aloud if they will be to blame if he’s defeated on Election Day.“We have a lot of young people here,” Trump said. “My audiences, they’ve gotten younger and younger, do you notice that?”Read more at The Daily Beast.

Florence Pugh Wore a Black Naked Dress Over Nothing But an Itty-Bitty Bra

The queen of sheer dressing strikes again.

Former model and Miss Switzerland finalist Kristina Joksimovic 'pureed' in blender by husband - reports

A former model who was a finalist in the Miss Switzerland contest was allegedly murdered and "pureed" in a blender by her husband, officials in Switzerland are reported to have said. Kristina Joksimovic, 38, was found dead in her home in Binningen, near Basel, Switzerland, in February this year. According to local news outlet BZ Basel, a man named Thomas, 41, had an appeal for release from custody denied by the Federal Court in Lausanne on Wednesday after he reportedly confessed to killing his wife, with whom he had two children.

Elon Musk Has Been Making Sad Attempts to Woo Taylor Swift for Years, and She’s Never Responded a Single Time

Elon Musk has apparently had a longstanding crush of sorts on Taylor Swift, making his vile tweet suggesting he could impregnate her just the latest in a long string of embarrassing failed attempts to get her attention. As X-formerly-Twitter user @esjesjes flagged, Musk has repeatedly replied to the 34-year-old pop star on the site he […]

Rita Ora just blessed our timelines with a new nude selfie

There simply aren't enough fire emojis, for Rita Ora's latest Instagram Story upload which sees her completely nude.

Man City 115 charges punishment: Expulsion to non-league an option but titles and trophies likely to remain

A hearing for the case is due to start on September 16

Otter attack in Malaysia leaves woman bloodied and unable to stand

Mariasella Harun was ambushed while jogging in Perdana Park

The Navy SEAL unit that killed Osama bin Laden is busy preparing for a possible Chinese invasion of Taiwan, report says

Navy SEAL Team 6 has been planning and training for a Chinese invasion of Taiwan for the past year, the Financial Times said.

Tottenham: The 12 games Rodrigo Bentancur could miss after FA charge over Heung-min Son remarks

The Uruguayan midfielder may miss up to 12 games if found guilty

'Not easy': Pope Francis leaves for Rome after 12-day Asia trip

Pope Francis left Singapore for Rome on Friday, after a demanding trip across Southeast Asia and Oceania in which he urged action on climate change, pressed for interfaith dialogue, and reinforced the Catholic Church's presence in a region where it is a small minority. The Singapore Airlines flight carrying the Catholic pontiff and his entourage took off around 12:25 p.m. (0425 GMT) in Singapore and is due to arrive in Rome on Friday evening, after a 12-hour flight through six time zones. Francis visited Indonesia, Papua New Guinea, East Timor and Singapore over a span of 12 days.

Pope marvels at Singapore's skyscrapers and asks that the lowest migrant workers not be forgotten

Pope Francis on Thursday praised Singapore’s economic strength as a testament to human ingenuity but urged the city-state to look after the weakest, too, especially foreign workers, as he opened the final leg of his tour through some of Asia’s poorest countries in one of the world’s richest. Francis marveled at Singapore's modern skyscrapers “that seem to rise from the sea” in both his opening speech to the city-state's leaders and again in the afternoon, when he celebrated Mass before an estimated 50,000 people at Singapore's national stadium. Singapore celebrated Francis' arrival by unveiling a new hybrid orchid named for him, the "Dendrobium His Holiness Pope Francis."

Jin Ji Teochew Braised Duck & Kway Chap: 2nd-gen hawker modernises 40-year-old stall with jumbo bento sets & duck ramen

The post Jin Ji Teochew Braised Duck & Kway Chap: 2nd-gen hawker modernises 40-year-old stall with jumbo bento sets & duck ramen appeared first on SETHLUI.com.

Prince William reveals Prince Louis' hilarious fixation with Princess Charlotte's jewellery

Prince William made a candid confession about his youngest son Prince Louis whilst on his solo outing in Wales on Tuesday. See details.

'I hope they won't reach us' - Russian fears grow over long-range missile strikes

The last time war came to Oryol was 1941. It came under Nazi occupation, before becoming one of the first major cities to be liberated by the Soviet Red Army. Ukraine's incursion into the neighbouring Kursk region is little more than 100 miles south, and if the West does allow Kyiv to strike deeper inside Russia, Oryol would be in range.

China's carrot-and-stick with EU trading partners start to pay off

BEIJING (Reuters) -Beijing, as a vote on EU duties on China-made electric vehicles looms, employed a carrot-and-stick approach to deal with the 27-strong bloc, threatening trade retaliation while cajoling key EU states into one-on-one talks on deals and investments. European Union members such as Germany, Finland and Sweden that have not pushed for the tariffs would feel less impact, with little exposure to the export items singled out by China. China's tactics appear to be working.

Israeli special forces 'raid missile site in Syria'

US media say the operation included special forces who rappelled down from helicopters.

- Ministry of Health

News Highlights

16th Jan 2021

The Multi-Ministry Taskforce regularly reviews Singapore’s border measures to manage the risk of importation and onward local transmission from travellers. Given the resurgence of COVID-19 cases around the world, we will be putting in place more stringent measures for travellers to manage the risk of importation. On-arrival Testing for Travellers 2. We currently require travellers who are not Singapore Citizens (SCs) or Permanent Residents (PRs), and who have recent travel history to high-risk countries/ regions, to take a COVID-19 Polymerase Chain Reaction (PCR) test within 72 hours before departure. These travellers are then required to serve their Stay-Home Notice (SHN) upon arrival in Singapore, and they are tested at the end of their SHN. 3. Given the emergence of new virus variants and the worsening COVID-19 situation around the world, we will put in place additional border control measures for all travellers. In particular, from 24 January 2021, 2359 hours, all travellers (including SCs and PRs) will need to take a COVID-19 PCR test upon arrival in Singapore 1 . The prevailing SHN requirements, including the PCR test at the end of the SHN, will continue. Further Precautions for Travellers from the United Kingdom and South Africa 4. We had earlier restricted entry and transit for all long-term pass holders and short-term visitors with recent travel history to the UK and South Africa. This arose from concerns of a more contagious variant of the COVID-19 virus circulating in these countries. 5. As a further precaution, from 18 January 2021, 2359 hours, until further notice, all returning SCs and PRs from the UK and South Africa will be subject to an additional 7-day self-isolation at their place of residence, following their 14-day SHN at dedicated SHN facilities. The returnees from the UK and South Africa will be tested at the end of their SHN (as per the current requirement), and again after they have completed their 7-day self-isolation period. These further precautions will apply to travellers who are currently serving their SHN. Insurance Coverage 6. Currently, short-term visitors entering Singapore under the Air Travel Pass (ATP) and Reciprocal Green Lanes (RGLs) are required to bear the full costs of medical treatment, should they be suspected of being infected with COVID-19 or require medical treatment for COVID-19 while in Singapore. 7. With effect from 31 January 2021, 2359 hours, visitors applying to enter Singapore under the ATP and RGLs will need to have travel insurance for their COVID-19-related medical treatment and hospitalisation costs in Singapore, with a minimum coverage of S$30,000. The travel insurance will help them pay for the costs of their medical treatment in Singapore. The visitors can purchase the travel insurance from Singapore-based or overseas insurers. A list of available insurance products can be found at the SafeTravel website . Looking Ahead to Further Reopening 8. As the global situation evolves, we will continue to adjust our border measures to manage the risk of importation and transmission to the community. The Ministry of Health will also continue to review the data and evidence on any new viral strains and update the measures accordingly. 9. Any changes to border measures will be updated on the SafeTravel website . Travellers are advised to visit the website to check for the most updated border measures before entering Singapore and be prepared to be subjected to the prevailing border measures upon entry, including payment for their stay at dedicated SHN facilities, tests and treatment. 10. We seek the continued cooperation of all Singaporeans to remain united and disciplined in our fight against COVID-19. MINISTRY OF HEALTH 16 JANUARY 2021 1 To expedite the COVID-19 PCR test at the airport, travellers are strongly encouraged to register and pre-pay for their on-arrival COVID-19 PCR test prior to departing for Singapore at https://safetravel.changiairport.com .

Category: Highlights Press Releases

- Single Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Family Travel Insurance

- Schengen Travel Insurance

- International Health For Individuals

- International Health for SME

- Travel Insurance Promotion

- COVID-19 Alerts

Travel Insurance

Travel Insurance Singapore

With Allianz 24/7 Global Assistance and Support , you'll get the help you need while overseas. From Covid-19 and other epidemics or pandemics, to injury, illness, flight cancellations and baggage delays, we will be with you.

50% off Travel Insurance Plan

Save 50% on the normal cost of single trip, annual multi trip, or family travel insurance from Allianz Travel.

Refund within 14 days - Get your money back if you change your mind after purchasing of policy*

Travel Insurance with Selected Covid-19 Coverage*

- Our Travel Insurance will cover you against medical costs, cancellations and curtailments due to COVID-19*

- Discover scenarios where Covid-19 has impacted the travel plans of people covered by Allianz Travel insurance policies here

Travel Insurance Catered to Different Needs

- For Frequent Travellers: Get covered for an unlimited number of trips (up to 90 days’ duration each trip). Discover our Annual Plan Travel Insurance here

- For One-off Trips: Single trip plan is suitable for an occasional traveller or those who are looking for a short getaway. Discover our Single Trip Travel Insurance here

- For Family: Family plan provides cover for you and the members of your family who travel with you on your journey (maximum of 2 adults) . Discover our Family Travel Insurance here

24/7 Assistance And Support - For Your Safety, Health And Security

- Our team will help organise emergency medical assistance around the clock.

Identify closest hospitals & arrange and pay for transport*

Advance payment for in-patient services, where accepted*

Provision of medical escort if needed, subject to availability*

Arrange payment to return home*

Allianz Partners Group prides itself on providing individuals and their families with assistance and travel insurance solutions specific to their needs. This travel insurance is underwritten by Tokio Marine Insurance Singapore Ltd, with services provided by Allianz Travel, trading as AWP Services Singapore Pte Ltd.

*Subject to the terms, conditions, exclusions and benefits limits of the policy wording. For more information please click on the Policy Wording to read the Allianz Travel Policy Wording.

^Terms & Conditions.

50% Off All Plans (Single Trip, Family and Annual Plans)

The promotional code 'flash50'

1. is valid until 30 September 2024

2. ‘flash50’ code is applicable to Allianz Travel insurance

3. is applicable only on the website of Allianz Assistance Singapore - https://www.allianz-assistance.com.sg/

4. All benefits, limits, terms and conditions of the travel insurance plan purchased under this promotion are subject to the terms and conditions of the Policy Wording. By purchasing our travel insurance with the discount codes above, you are deemed to have read the Policy Wording and agreed to all terms and conditions and policy exclusions

5. Allianz Travel reserves the right to end such promotion at any time as it deems fit

Allianz Assistance Singapore

"i got my luggage delayed during my trip in thailand in 2018, allianz travel insurance have been helpful when i inquiry before buying the insurance, during the luggage delayed happen, and afterwards to claim. response have been very fast and accurate. claim is also very fast. i would give 5 stars plus plus plus if possible", benefits highlights.

Swipe to view more

Designed for essential travel and medical coverages only

From S$ 17.50

Well-balanced coverages for most type of travels

Inclusive of an extensive scope of travel protection

Core Benefits

- Selected COVID-19 Cover*

- Overseas medical expenses

- Trip Cancellation, Baggage delay and emergency transportation benefits

- Travel inconveniences including trip curtailment and travel delay, medical expenses, and emergency transportation benefits

- Travel personal accident, rental car excess, and lost travel documents benefits

- Personal liability and sports benefits

You have to pay for emergency medical or dental treatment while on your trip.

With Selected Covid-19 Coverage*

You have to pay for emergency medical care (including Covid-19-related) or dental treatment while on your trip.

Any medical expenses incurred in Singapore will not be payable under this plan.

Up to S$ 200,000

Dental care maximum sublimit: S$ 250

Traditional Chinese Medicine sublimit: S$ 200

Up to S$ 500,000

Hospical cash: Up to S$ 1,000

Traditional Chinese Medicine sublimit: S$ 250