- Attribution Solutions

- Global City & International State Travel

- Global Travel Service

- Air Passenger Forecasts

- Custom Forecasts

- Cruise Forecasts

- Visitor Economy

- Travel Industries

- Marketing Investment

- Events & Projects

- Testimonials

- Budget Analysis

- Policy Analysis

- Marketing Allocation Platform

- Project Feasibility

- In the News

- Client Login

- Oxford Economics

Sports Tourism: State of the Industry 2023

Sports-related travel is a substantial, billion-dollar industry.

Commissioned by the Sports Events and Tourism Association (ETA) and in partnership with Northstar Meetings Group, Tourism Economics assisted in the production of the recently released 2023 State of the Industry Report—a crucial resource that offers a comprehensive analysis of the impact of the sports-related travel industry.

The report is conducted every two years to track trends on key metrics, including industry direct spending, economic impact, tax revenue and job creation. Additional highlights focus on valuable destination profile information, such as budget sizes, event dynamics, staffing and key performance indicators.

Together, these insights serve as a leading tool for advocacy among all industry segments. Learn more about Sports ETA and this biennial report here .

Key highlights from the report conclude that in 2023:

- 63% of cities that responded said sports are the top room-night generator in their communities

- The sports-events industry had a direct economic impact of $52.2 billion , $128 billion in total economic impact and generated $20.1 billion in taxes

- More than 200 million people traveled to youth and adult amateur sports, plus collegiate championships

- Sports-related travel generated more than 73 million room nights

- The industry supported a combined 757,600 full-time and part-time jobs

Learn more about conducting an economic impact study with our team.

Industry Reports

2023 State of the Industry Report

2023 State of the Industry Report (Executive Summary)

Comprehensive Analysis

2021 state of the industry report.

Sports ETA’s State of the Industry Report is a crucial resource that offers a comprehensive analysis of the impact of the sports-related travel industry. It is widely recognized as a leading tool for advocacy among all industry segments.

The report is produced with the valuable support of our partners at Northstar Meetings Group and is conducted every two years to track trends on key metrics, including industry direct spending, economic impact, tax revenue, and job creation.

The report also provides vital destination profile information, such as budget sizes, event dynamics, staffing, and key performance indicators. To ensure the accuracy and reliability of the report, Sports ETA also partners with the leading firm, Tourism Economics, in its development.

2021 Report Key Findings

A catalyst for pandemic recovery.

The COVID-19 pandemic severely impacted the tourism industry; however, sports-related tourism served as a catalyst for pandemic recovery. This is evident in the strong bounce-back seen in several indicators, including traveler volume, spending, and economic impact.

Direct Spending & Economic Figures

In 2021, the direct spending and economic figures for sports-related tourism were nearly 10% less than pre-pandemic numbers ($39.7B vs. $45.1B, respectively). However, it is worth noting that the improvement seen in the sports-related tourism industry is much steeper than that of other tourism segments.

Value of Sports Related Tourism

The economic impact of sports events and tourism in the United States was $91.8B in 2021. This figure is even greater than the combined net worth of the top 17 NFL franchises, highlighting the immense value that sports-related tourism brings to the US economy, according to Forbes 2022.

2019 State of the Industry Report

The 2019 State of the Industry Report is a critical tool for understanding the state of the sports events and tourism industry before the COVID-19 pandemic. The report provides valuable insights into the industry’s growth and performance, offering a benchmark for evaluating the sector’s recovery from the pandemic’s impact. As the pandemic has caused unprecedented disruptions and challenges in the tourism industry, the 2019 report serves as a crucial reference point for understanding the industry’s pre-pandemic baseline, including its trends, challenges, and opportunities.

State-Focused Industry Reports

Use the arrows to scroll through our collection of state-level industry research and resources.

2021 State Association Budget Study

Dive into state association structures, budgets, memberships, and funding parameters.

2019 State Association Research Study

Gain insight into state associations and distribute information to better resource Sports ETA members.

State of the industry podcasts

The sports tourism rebound.

In this podcast, SportsTravel Editor and Publisher Jason Gewirtz, speaks with the president and CEO of Sports ETA, Al Kidd, and Jennifer Stoll, the founder of Stoll Strategies, to talk through, not only the details of the statistics in the report, but how we can all use this information to advocate for the importance of sports-related travel and tell a more global story of why the work we do day in and day out matters.

The $45 Billion Case for Sports-Related Travel

In this podcast, SportsTravel Editor and Publisher Jason Gewirtz, the president and CEO of Sports ETA, Al Kidd, and Jennifer Stoll, the lead researcher on the project, discuss the data in the new survey and how destinations and event organizers can take advantage of the numbers that will serve as a benchmark as the industry continues its recovery.

Sports ETA is grateful to Northstar Meeting Group, our State of the Industry sponsor, for their support in making these industry-wide resources possible.

- WHITE PAPERS

- INDUSTRY REPORTS

© 2024 Sports ETA

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Sports Tourism Market Size, Share, Competitive Landscape and Trend Analysis Report, by Product, Type and Category : Global Opportunity Analysis and Industry Forecast 2021-2030

CG : Travel & Luxury Travel

Report Code: A13076

Tables: 124

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

The global sports tourism market size was valued at $323,420.0 million in 2020, and is projected to reach $1,803,704.0 million by 2030, registering a CAGR of 16.1% from 2021 to 2030.

Sports, travel, and tourism are all interrelated. Sports tourism is now a well-established niche market in the travel industry, whether it is professional athletes or officials attending tournaments and events or fans flying to a country to witness a global sports league.

The tourism industry is rapidly expanding. Tourism is an excellent way to escape the monotony of everyday life. Many people prefer a short or long vacation to break the monotony of life. However, as a generation grows older, the definition of tourism shifts toward exploration. Traditional culture, values, cuisine, monuments, and lifestyles have caught the interest of the X and Y generations, as they provide tourists with a memorable and long-lasting experience. Countries such as the U.S., the UK, Germany, France, Spain, and Australia are popular for sporting events and attract both domestic and international visitors from all over the world. Furthermore, many developing countries, such as India, Sri Lanka, and Brazil, are investing in infrastructure to attract a larger customer base, which is expected to drive the global sports tourism market.

Sports events are cancelled for a variety of reasons, including a lack of financial resources. Sports event planning necessitates a significant investment of both time and money. Sports events are organized by a large number of people, which means they necessitate a significant investment. Organizers of sporting events frequently exhibit excessive commercialism and poor financial management, making poor strategic decisions about ticket prices and sponsors. The Indian Premier League (IPL), Pakistan Super League (PSL), and Big Bash League are all franchise-based sports leagues. A lack of financial support for franchisee teams, on the other hand, can result in event cancellation, which can harm the sports tourism market. As a result, the cancellation of sporting events due to lack of financial resources will restrain the growth of the sports tourism market.

Motorsport segment is expected to grow at highest CAGR of 17.4% during the forecast period.

To broaden the reach and popularity of sports, new tournaments are being held in existing venues to attract more spectators, and new venues for existing tournaments are being established to attract more spectators. As the number of sports tourists has increased, there is a greater demand for more seating capacity at sporting venues around the world. Large seating capacities result in higher ticketing revenue generation because sports event venues can accommodate a larger number of visitors. Increased revenue from tickets and sports packages will drive the growth of the sports tourism market. Many sports clubs and events are working to increase their capacity to accommodate sports tourists. As a result, new tournaments held in existing venues will create lucrative revenue-generating opportunities for the sports tourism market.

The global sports tourism market demand has been negatively affected by the COVID-19 outbreak. However, as things return to normal and vaccination campaigns pick up speed, sports tourism is expected to fully recover by 2022. People are becoming more health-conscious, and it is expected that they will actively participate in sporting activities to fulfil their desire for a healthy and active lifestyle. When the situation improves and travel restrictions are lifted, sports tourism will regain momentum due to the global population's never-ending love and passion for sports.

Domestic segment held the major share of 56.0% in 2020

Travel restrictions across borders may hinder the growth of the sports tourism industry. Major countries such as India, China, and other densely populated Asia-Pacific countries, may take longer to fully vaccinate their populations. This could cause the sports tourism market to recover slowly. As a result, various nations’ government policies imposing travel restrictions can have a direct impact on the sports tourism market and may impede the global sports tourism industry's growth.

Passive segment held the major share of 59.0% in 2020

The global sports tourism market is segmented on the basis of product, type, category, and region. On the basis of product, the market is categorized as football/soccer, cricket, motorsport, tennis, and others. As per type, it is divided into domestic and international. Based on category, the sports tourism market is bifurcated as active and passive. Region-wise, the sports tourism market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Europe held the higest market share of 36.8% in 2020

As per the sports tourism market forecast, due to the enormous popularity and love for football among the global population, the football/soccer segment was the highest revenue contributor in 2020. Domestic segment accounted for the majority of market share. Government development policies as well as large investments in sports infrastructure such as playing fields, stadiums, and sports clubs, have significantly aided the domestic segment's growth. Due to an increase in sports activities and events across various countries, the passive segment captured the greatest share of the sports tourism market. According to the sports tourism market trends, region-wise, Europe is expected to dominate the market. Due to presence of all the major football playing nations and clubs in Europe made Europe an integral part of the football industry.

The prominent sports tourism industry players include BAC Sports, QuintEvents, Sports Travel & Hospitality Group, MATCH Hospitality, THG Sports, Club Europe Holidays Ltd, Gullivers Sports Travel Limited, Inspiresport, DTB Sports Hospitality, Event Management Ltd, and Great Atlantic Sports Travel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the current trends, estimations, and dynamics of the global sports tourism market from 2021 to 2030 to identify the prevailing market opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry.

- The market player positioning segment facilitates benchmarking while providing a clear understanding of the present position of the key market players.

- The report includes analyses of the regional as well as global market, key players, market segments, application areas, and growth strategies.

Key Market Segments

- Football/Soccer

- International

By Category

- Netherlands

- Rest of Europe

- New Zealand

- Rest of Asia-Pacific

- South Africa

- Rest of LAMEA

Sports Tourism Market Report Highlights

Analyst Review

According to the insights of CXOs of leading companies, sports tourism is one of the fastest growing segments in the tourism industry. Whether sports are the primary goal of the trip or not, more and more tourists are interested in participating in sports activities while on vacation. Sporting events of all sizes and shapes gather tourists as participants or spectators, and destinations attempt to add local flavors to events and provide authentic local experiences. Mega sporting events, such as the Olympics and World Cups, can serve as a platform for tourism development if successfully leveraged in terms of brand equity, infrastructure development, and other socioeconomic benefits.

Sports and tourism are closely connected and mutually beneficial. Sports, whether it is played as professional, hobbyist, or leisure activities necessitate extensive travel to play and compete in various locations and countries. Major sporting events, such as the Olympic Games, football and rugby championships, have evolved into powerful tourism attractions, significantly contributing to the tourism industry.

Sport is a big attraction and thus, a significant economic source, both from the ACTIVE side of those who participate in sports and from the PASSIVE side of those who watch the sport ‘live.’ Active or passive sports involve a flow of millions of people travelling, resulting in a high volume of business. Thus, sports tourism has evolved as a profitable business.

- Travel Destinations

- Luxury Accommodations

- Travel Packages

- Adventure Travel

- Travel Experiences

- Cultural Travel

- Luxury Travel Experiences

- Travel Retail

The global sports tourism market size was valued at $323,420.0 million in 2020, and is projected to reach $1,803,704.0 million by 2030, registering a CAGR of 16.1% from 2021 to 2030. The market growth is attributed to rising popularity of sports, growing participation in sports, growing infrastructure, rising disposable income, and government initiatives to promote sports tourism.

The global sports tourism market is projected to reach $1,803,704.0 million by 2030, registering a CAGR of 16.1% from 2021 to 2030. The rising popularity of sports, growing participation in sports, growing infrastructure, rising disposable income, and government initiatives to promote sports tourism are the factors that are expected to boost the growth of the sports tourism market across the globe.

https://www.alliedmarketresearch.com/request-sample/13441

Product launches, mergers and acquisitions, joint ventures, and geographic expansions are key strategies used by market players. The key players in the global sports tourism market include BAC Sports, QuintEvents, Sports Travel & Hospitality Group, MATCH Hospitality, THG Sports, Club Europe Holidays Ltd., Gullivers Sports Travel Limited, Inspiresport, DTB Sports Hospitality and Event Management Ltd., and Great Atlantic Sports Travel.

The global sports tourism market is segmented on the basis of product, type, category, and region. On the basis of product, the market is categorized as football/soccer, cricket, motorsport, tennis, and others. As per type, it is divided into domestic and international. Based on category, the sports tourism market is bifurcated as active and passive. Region-wise, the sports tourism market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The base year calculated in the report is 2020. The year 2020 was an exceptional year characterized by the outbreak of COVID-19 disease and its rapid spread across the globe. It caused a huge adverse impact on the sports tourism industry due to the lockdown and travel ban strictly imposed by the government in various countries.

The increased number of athletic events around the world and mobile ticketing is expected to fuel the global sports tourism market growth. Moreover, the rising popularity of sports, growing participation in sports, growing infrastructure, rising disposable income, and government initiatives to promote sports tourism are the factors that are expected to boost the growth of the sports tourism market across the globe.

By product, the football/soccer segment was the highest revenue contributor in 2020, due to enormous popularity and love for football among the global population. By type, the domestic segment held the largest market share. Government development policies and large investments in sports infrastructure such as playing fields, stadiums, and sports clubs, have significantly contributed to the growth of the domestic segment.

Government initiatives, geo-political relations between countries, growth of infrastructure favoring sports tourism, rising number of local and national sports events are few of the major factors that have a huge impact on the global sports tourism market.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Sports Tourism Market

Global Opportunity Analysis and Industry Forecast 2021-2030

What is sports tourism and why it is so big?

Sports tourism is BIG business. We all know that sport tourism involves sporting activity, that much is pretty obvious, but there is much more than a game of sport involved in the multi million Dollar global industry. In this article I will explain what sports tourism is, I will tell you about the different types of sports tourism and I will discuss the benefits of sports tourism.

What is sports tourism?

Sports tourism definitions, sports tourism statistics, football world cup, six nations rugby championship, the olympics, the super bowl, calgary olympic park, maracana football stadium, rio de janiero, barcelona olympic park, tough mudder race, london, martial arts holidays, south korea, surfing holidays, portugal, golf tours, florida, yoga retreats, bali, football fans- manchester united spectators, boxing fans- anthony joshua followers, british & irish lions rugby spectators, australian cricket fans, benefits of sport tourism, sports tourism: conclusion, further reading on sports tourism.

Sports tourism is the act of travelling from one locality to another, with the intention of being in some way involved with a sporting activity or event .

Many people believe that sports tourism relates only to watching a sporting event. However, this is not correct. The sports industry is much more than this.

Sports tourism encompasses travelling for your own sporting purposes, such as a yoga teacher training course, a badminton competition or to learn to surf. Sports tourism includes attending sporting events such as a Formula One race or a Premiership football match. Sports tourism includes nostalgic visits to places of historical importance, such as the Olympic stadium in Barcelona or to see memorabilia related to your favourite sporting hero, such as the museum at the Maracana football stadium in Rio de Janeiro.

There are, in fact, four main types of sport tourism. These types are known as:

- Sport Event Tourism

- Active Sport Tourism

- Nostalgia Sport Tourism

Passive sports tourism

While sports tourism has not always been extremely popular, during the recent decade the amount of people attending out of area sporting events has drastically increased. People are now traveling far and wide just to attend their favorite events, and it is no wonder as to what has encouraged the sudden spike in popularity.

Sport tourism is a relatively new concept, although it has been around for a long time.

There are many academic studies which delve into the concept of sports tourism, particularly sports tourism that involves large sporting events, such as the football World Cup or the Olympic Games. Some scholars and sports tourism stakeholders have attempted to define the term sports tourism.

According to Neirotti (2003), sports tourism can be broadly described as;

‘Including travel away from one’s primary residence to participate in sports activity, for recreation or competition purposes, travel to observe sport at grassroots or elite level, and travel to visit a sports attraction such as a sports museum, for instance’.

Weed and Bull (2004), provide a conceptualisation of the sports tourism phenomenon as;

‘A social, economic and cultural phenomenon arising from the unique interaction of activity, people and place’’.

Gammon and Robinson (2003) state that sports and tourism is;

‘Not just about the management and operation of mega events; it also concerns offering consumer-specific sports and tourism-related services and experiences to the sports tourist.’

Read also: Sustainable tourism- everything you need to know

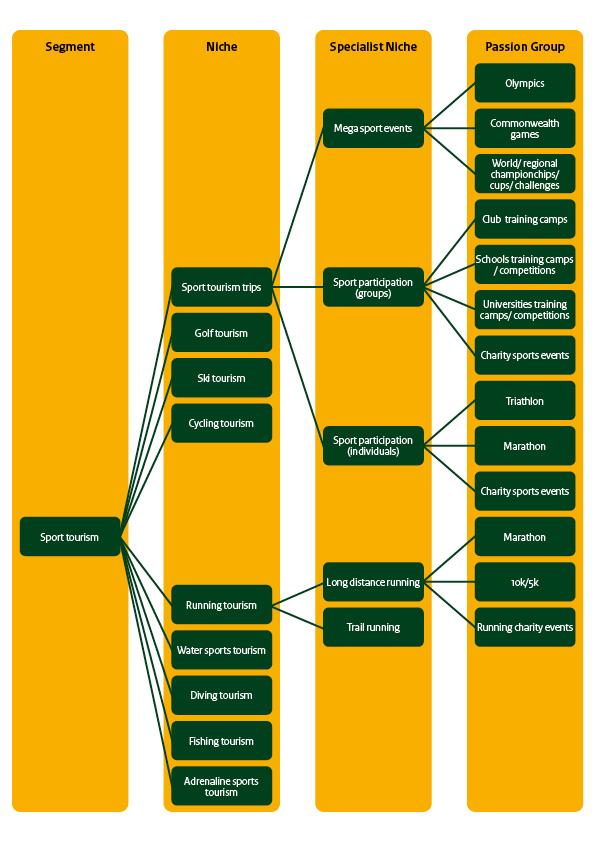

Gammon and Robinson (2003) further argue that the sports tourism industry cannot be defined easily and that there should be different definitions according to the type of sports tourism that is being discussed. They visualise this in the model below.

Today, sport is regarded as the world’s largest social phenomenon. And, tourism is predicted to become the world’s biggest industry early in the next century. So it doesn’t take a genius to work out that sports tourism is pretty big business!

The sports tourism industry has grown considerably in recent years. In 2016 the sports tourism industry was worth $1.41 trillion and this figure is expected to increase to approximately $5.72 trillion by 2021. This is a whopping 41% growth in only four years!

**Studying sports tourism? I recommend- Sports Tourism: Participants, Policy and Providers **

The sports tourism industry makes up a significant part off the overall tourism industry. Some people claim that this figure is as high as 25%, meaning that a quarter of all tourism in the world is sports related!

The importance of sports tourism is further emphasised by the media statements from the World Tourism Organisation (WTO) and the International Olympic Committee (IOC), which in 2004, announced their commitment to reinforce their partnerships on collaboration in the sports and tourism domain. They stated that;

‘Tourism and sport are interrelated and complementary… both are powerful forces for development, stimulating investment in infrastructure projects such as airports, roads, stadiums, sporting complexes and restaurant-projects that can be enjoyed by the local population as well as tourists who come to use them.

This demonstrates that sports tourism has a wider economic and social impact than simply the sporting occasion itself. It provides social and economic opportunities for the local population , as well as visitors to the area.

The different types of sport tourism

Sport tourism can be segregated into four main types: sport event tourism, nostalgia sports tourism, active sports tourism and passive sports tourism. Below I have provided a short explanation of what each type of tourism is, along with some examples.

Sport event tourism

Sports event tourism is tourism which centres around a sporting event. Sporting events can be of any size and importance, however it tends to be the major sporting events which gain the most gravitas.

Hallmark events, such as the Olympics or football World Cup, are important centres for sport event tourism, bringing millions of tourists to the host destination.

Smaller events, such as the Henley Regatta in the United Kingdom or a national tennis competition also clarify as sport event tourism.

An often overlooked example of sport event tourism are amateur sporting events. Events such as regional school competitions, youth sporting leagues and non-profit community based sport events are just a few examples.

Wimbledon, also known as ‘The Championships’ is the oldest tennis tournament in the world. A prestigious sporting event, Wimbledon is often associated with the upper class, where spectators sip sparkling wine and Pimms whilst dressed in their best frocks.

Knowing very little about tennis, I attending Wimbledon a couple of years ago just to experience this famous event, which is an integral part off British heritage!

Dating back to 1877, Wimbledon has been held at the All England Club in Wimbledon, on the outskirts of London, each year. The tennis is played on outdoor grass courts, which is unlike tennis matches played in many other parts of the world.

Wimbledon is one of the four Grand Slam tennis tournaments, the others being the Australian Open, the French Open and the US Open.

The tournament takes place in late June/early July each year.

The football World Cup, known officially as the FIFA World Cup, is an international football tournament held every four years.

The Fédération Internationale de Football Association (FIFA) is the sport’s global governing body. The football consists of mens only teams and boats the most skilled footballers in the world.

Teams must first pass the qualification phase, which takes place over the preceding three years. After this, 32 teams, including the automatically qualifying host nation, compete in the tournament. The World Cup tournament generally lasts about one month.

The Six Nations Championship is an annual international rugby union competition that takes place. It involves what are considered to be the six best nations in terms of rugby in Europe The six nations are:

The Six Nations tournament begins on the first weekend in February each year and finishes with ‘Super Saturday’ on the second or third Saturday in March.

Each team is required to play every other team once (making a total of 15 matches). Each team will play one match at home and one match away from home.

I attended a six nations match once and whilst I’m really not into rugby (surprise!), I really enjoyed the sophisticated and supportive atmosphere at the venue.

Inspired by the ancient Greeks, the modern Olympic Games have been running since 1896. But, in fact, the games have been played in some form or another since long before this date.

The Olympics is perhaps the most famous and the most popular international sporting event. It features both summer and winter sports competitions which take place every four years. Like many other major sporting events, the Olympics are held in a different location each time.

Read also: Slow tourism: Everything you need to know

The Olympics involves thousands of athletes from around the world who compete in a range of different sports, from trampolining to running. Over 200 nations participate in the event.

The Super Bowl is the annual championship of the National Football League (NFL). Based in the Unites States of America, this is the most popular sport tourism event of the year.

Some interesting facts include The Super Bowl being the second-largest day for food consumption in the USA (after Thanksgiving) and the Super Bowl being the most-watched American television broadcast of the year.

Nostalgia sports tourism

Nostalgia sport tourism involves travelling to famous sport-related tourist attractions.

Nostalgia sports tourism may celebrate sports of the past or the present. It may include visiting museums or exhibitions, visiting sporting hall of fames or visiting sporting venues.

The nostalgia sports tourist does not need to be actively participating in sport or to be spectating. They may simply want to learn more or to reminisce.

Here are some examples of popular nostalgia sport tourism attractions.

We visited Calgary Olympic Park on travels through Canada with a baby and loved it!

WinSport’s Canada Olympic Park (COP), (formerly known as Paskapoo Ski Hill) was one of the venues used in the 1988 Winter Olympics. Nowadays, it is open to the general public and iw well known for its ski jumping, bobsleigh and luge.

Whilst we did learn a little bit about the Olympics on our visit here, we actually sent more time on the luge ride than anything else because it was so much fun!

The Maracana is a famous football stadium in Rio de Janeiro, Brazil. The stadium is rich in history and was once the largest stadium in the world.

The stadium was opened in 1950 to host the FIFA World Cup. The venue has seen attendances of 150,000 or more at 26 occasions. Over time terraces were replaced with seating, and after the renovation for the 2014 FIFA World Cup, the Maracana’s original capacity was reduced to 78,838.

Nowadays, it is popular to take a tour to visit the Maracana stadium, like I did when I travelled to Buenos Aires with my friend who is football mad!

The Olympic Village, known in Spanish as La Vila Olímpica del Poblenou is an area in the Sant Martí district of Barcelona, Spain.

The Barcelona Olympic Village was built in the late 1980s and early 1990s in preparation for the 1992 Summer Olympic Games, which were held in Barcelona.

Nowadays, visiting the Barcelona Olympic Village is a popular sports tourism activity undertaken by many tourists visiting Barcelona.

Active sports tourism

Active sports tourism is when a person travels to actively participate in their chosen sport, or when they travel for other reasons, but taking part in sport is an important part of their tourism experience.

Active sports tourists can be segregated into three classifications: The amateur sports tourist; the hobbyist sports tourist and the professional sports tourist.

I would say that I would generally come under the first category. I am an amateur (at best!) at every sport I try my hand at. But, I still like to give it a go! I’ve attempted skiing in Argentina, kayaking in Vietnam and surfing in Costa Rica, to name but a few.

Read also: Business tourism: Everything you need to know

My husband, on the other hand, is usually either a hobbyist sports tourist or a professional sports tourist. He plays for badminton and football teams and loves playing a large number of sports in his free time. He is also a former athlete, having competed for Britain as a trampoline gymnast. As part of this role he travelled around the workload for professional sporting competitions. This qualified him as a professional sports tourist.

There are a large number of active sports that a tourist may choose to get involved with around the world. Here are a few that I have experienced on my travels. But there are sooo many other sports that you can get involved in as a sports tourist!

- Diving in the Galapagos

- Swimming at the Great Barrier Reef

- Playing tennis in Morocco

- Learning archery in Spain

- Going running in France

- Cycling in Amsterdam

- Taking yoga classes in Bali

- Learning tai chi in China

- Kayaking in Vietnam

- Sailing in Australia

- Skiing in Argentina

- Surfing in Costa Rica

- Playing baseball in Boston

- Hand gliding in Rio de Janeiro

- Fishing in The Gambia

- Climbing in Thailand

- Horse riding in Equador

- Walking in Jeju

Here are a few active sports tourism examples:

Did I ever tell you that I completed a Tough Mudder Race? This was a BIG achievement!

Tough Mudder is an endurance event. It is a an obstacle course, originally designed for army training. It is a test of the mind and body.

The race is usually between 10-12 miles in length. It includes a number of obstacles, many of which involve mud! The obstacles often play on common human fears, such as fire, water , electricity and heights.

**Buy now: Sport and Tourism – a recommended textbook for sports studies students!**

Common obstacles include:

- Arctic Enema – Participants plunge into a tank filled with ice water, where they must swim under the water and past an obstacle to the other side.

- Electroshock Therapy – This is where participants will run through a pit of mud where electric wires sway in the air. Participants will often get small electric shocks.

- Funky Monkey – Monkey bars over a pit of cold water. The bars are covered with a mixture of butter and mud.

- The birthing canal- A small, confined space that the participant must crawl through. The upper layer is filled with water so it feels like you are being compressed as you crawl through the tunnel.

Of course, you will need to travel to a Tough Mudder venue to be classified a sports tourism, but many people do!

Many people choose to travel to South Korea for martial arts holidays and Taekwondo-themed events. These might be amateur sports tourists, hobbyist sports tourists or professional sports tourists, depending on the level of involvement and activity type.

Portugal is a popular destination for surf holidays. You can go it alone, if you have the skills and ‘know-how’, or you can book a tour. There are a number of tour operator who offer specialised surfing holidays for all levels of sports tourists, ranging from beginner to advanced.

There are several golfing hotspots around the world. One of the most popular places to travel to for a golfing holiday is Florida . With its year-round pleasant weather and large open spaces, Florida welcomes golf tourists from all over the world to play on their first-class golf courses.

There are many parts of Asia that are known for the popularity of yoga. However, done attracts so many tourists as Bali. Bali is famous the world over for offering top quality yoga retreats and yoga teacher training courses.

Lastly, it is important to recognise that whilst sport is inherently active , not all those who participate or who are involved with the sport are themselves active. In fact, passive tourists can actually contribute more to the sport than those who are active!

A passive sports tourist is a person who is not actively participating in the sport. They are spectators or fans. Passive sports tourism involves tourists watching sport being played. This could take place at a major sporting event (qualifying this also as sports event tourism), or they could simply be supporting a family member of friend. Most passive sports tourists are fans.

Football, or soccer, is arguably the most well-known and popular sports in the world.

Manchester United is a particularly famous football club. It is estimated by the BBC that Manchester United has a whopping 659million football fans!

I always find is fascinating when I travel to a country that is so different and so far removed from my own, yet the locals are also quick to ask me about Manchester United!

Many sports tourists will follow Manchester United, or which ever football team is their favourite, around the world to watch their games.

Anthony Joshua is a British professional boxer. He has many millions of followers, both from the UK and abroad.

Anthony is a two-time unified heavyweight champion, having held the WBA (Super), IBF, WBO, and IBO titles since December 2019, and previously between 2016 and June 2019. At regional level, he held the British and Commonwealth heavyweight titles from 2014 to 2016.

Anthony Joshua participates in fights around the world and is often accompanies by his passive sports tourism supporters.

The British & Irish Lions is a rugby union team selected from players eligible for any of the Home Nations – the national teams of England, Scotland, Wales and Ireland.

If rugby is your thing and your from Britain or Ireland, then this is a pretty big deal.

The Lions have many thousands of passive sports tourism supporters who cheat them on each match.

Cricket is pretty big in Australia. So big, in fact, that the Australian cricket team has an estimated 24million supporters! Many of these supporters travel with the team around the world as passive sports tourists.

As with any type of tourism , there are a range of benefits and advantages of sports tourism. Whilst the most obvious is perhaps the economic advantage of tourism , there are also positive social impacts as well as environmental impacts . Below I provide some examples:

- Sports encourages tourists to visit the area

- Sports tourism creates economic growth through tourists booking hotel rooms, eating in restaurants and opening money in local shops

- Sports tourism helps to create exposure and enhances a positive image for the local community

- Many sports tourism infrastructures and facilities can also be used by members of the host community

- The development of sports tourism helps to build a sense of community

- Sports tourism has the potential to attract high-yield visitors and repeat visitors

- It can provide opportunity to develop new infrastructure in the area

- The media can help to promote the destination

- Sports tourism can improve overall tourist numbers

- Money made from sports tourism can be reinvested into the local economy

- Sports tourism creates jobs for local people

- Sports tourism which relies on the natural environment may result in better environmental management and preservation

Whilst there are many positive impacts of sports tourism, however, it is also important that there are a number of negative impacts too. Aspects such as environmental degradation when gold courses, employing foreign rather than local people for major sporting events and locals who feel that their cultural norms are being overlooked (such as not covering your shoulders in the Middle East, for example), are just a few example of negative impacts of sports tourism.

It is clear that sports tourism is big business. Whether its events sports tourism, active sports tourism, nostalgic sports tourism or passive sports tourism, there is a huge market for tourists worldwide. However, as with any type of tourism, sports tourism must be carefully managed to ensure that it is sustainable .

For more information on sports tourism, I recommend the texts below;

- Sports Tourism: Participants, Policy and Providers – explains sports tourism as a social, economic and cultural phenomenon that stems from the unique interaction of activity, people and place.

- Sport Tourism Development – a text book covering the growth and development of sport tourism.

- Sport Tourism Destinations: Issues and Analysis – with contributions from international experts, this book looks at the dramatic effects sports tourism has on the economy and future of tourism destinations.

- Sport and Tourism – This book proposes a groundbreaking theoretical model which explores globalization, mobility and authenticity providing insight into the unique interrelationship that exists in a sport tourism context between activity, people and place.

- Sport + Travel Magazine

What is sports tourism?

According to a market report by Allied Market Research , the global sports tourism industry was pegged at $323.42bn in 2020. However, it is expected to reach $1.8 trillion by 2030, growing at a compound annual growth rate (CAGR) of 16.1% from 2021 to 2030.

The report revealed that by region, Europe and North America held the largest share in 2020 – accounting for nearly two-fifths of the market, due to the presence of a large population and high participation in sports activities. However, the global sports tourism market across Asia-Pacific is projected to register the highest CAGR of 17.7% during the forecast period of 2021 to 2030, owing to increase in sports participation and sports event hosting.

Subscribe to our monthly newsletter

Sports tourism: a fast-growing niche

The sport and travel industries go hand-in-hand. Whether it is fans attending a match or an event, or if it is teams and officials travelling to fixtures or competitions, sports tourism is now a major niche in the travel industry.

It’s not just Fifa World Cups, the Olympics or major events that are driving the sector, but also team travel, school sports and smaller competitions.

Did you know that the global sports industry is estimated to be worth between US$480bn and US$620bn, according to research by A.T. Kearney . Globally, travel and tourism’s direct contribution to GDP was approximately US$4.7trillion in 2020, according to a report by Statista .

UN Tourism describes sports tourism as “one of the fastest growing sectors” in the travel industry. It also states that international sports tourism is worth US$800bn and accounts for 10% of the world’s tourism industry.

Here we look at what sports tourism is and an expert’s view on its impact…

The United Nations’s definition

What UN Tourism said about sports tourism:

“ Sports tourism is a fundamental axis, generating around 10% of the world’s expenditure on tourism. It has an estimated growth rate of 17.5% between 2023-2030, moving masses intra and intercontinentally. Sports tourism can promote social, economic and environmental action, it accelerates development and can leave a long-lasting positive legacy.

“ Sports and Tourism are interrelated and complementary. Today, sports tourism is one of the fastest-growing sectors in tourism. More and more tourists are interested in sport activities during their trips whether sports are the main objective of travel or not. Sport events of various kinds and sizes attract tourists as participants or spectators and destinations try to add local flavours to them to distinguish themselves and provide authentic local experiences. Mega sport events such as the Olympics and World Cups can be a catalyst for tourism development if successfully leveraged in terms of destination branding, infrastructure development and other economic and social benefits.”

Impact of sports tourism

Akis Tsolis, CEO of Active Media Group , organisers of the Navarino Challenge and Santorini Experience in Greece, wrote on gtp.gr :

“Aside from the obvious and vast benefits of travel, sports tourism is great for the economy for one simple reason: it generates economic impact through direct spending into a community. Sports tourism is a rapidly growing niche in the travel/tourism industry. In fact, we at ActiveMedia Group share the belief that it is the fastest growing segment within the travel industry today, generating billions of dollars every year. Sports tourism is a trend that’s not going away and is expected to continue growing.”

The ChatGPT answer to this question…

What is the definition of sports tourism, how does it benefit the economy and what can we expect in the future.

Sports tourism refers to the act of traveling to a destination with the purpose of participating in or watching a sporting event. It involves a wide range of activities, including attending professional sports games, participating in amateur sports tournaments, and visiting sports-related attractions such as museums or stadiums.

Sports tourism can benefit the economy in several ways. Firstly, it generates revenue for local businesses such as hotels, restaurants, and retail stores. Secondly, it creates employment opportunities in the tourism and hospitality industries. Thirdly, it attracts investment in sports infrastructure such as stadiums and training facilities, which can benefit the local community beyond the tourism industry. Additionally, sports tourism can help to promote a destination as a sports hub, which can attract further sporting events and opportunities.

In the future, we can expect sports tourism to continue to grow, driven by the increasing popularity of sports and the ease of travel. Technological advancements such as virtual reality may also create new opportunities for sports tourism, allowing fans to experience sporting events remotely. Additionally, as sustainability becomes an increasingly important factor in tourism, sports tourism may shift towards more eco-friendly practices, such as promoting sustainable transportation and reducing waste.

SPORTS EVENTS CALENDAR

Men’s golf: horizon irish open 2024, men’s golf: 2024 bmw pga championship, santorini experience 2024, cricket: icc women’s t20 world cup 2024, uae , navarino challenge 2024, privacy overview.

An Informa Company

Top 10 sports tourism trends for 2024.

From site selection to experience enhancing, we look at the top trends in sports tourism.

The trends in sports tourism for 2024 highlight a diverse and evolving landscape, catering to a wide range of interests and leveraging the latest technological advancements. Here, we take our annual look at the lay of the land.

Emphasis on Experience: Participants travel to play in the games, but any athlete will tell you there is much more to tournaments than what happens inside the lines. Sports planners are seemingly doing a better job at recognizing this fact by building on downtime for teambuilding activities and securing locations that provide enhanced opportunities. “My memories are at the hotels and restaurants, and traveling to the cities and having these awesome experiences that weren't always on the court,” recalls Team Travel Source Chief Experience Office Ainsley Harris, who was a top volleyball player in her youth.

Common itinerary items, particularly among high school students, include stops at universities and Halls of Fame to get a better sense of what awaits them in the future, says Steve Goris, senior vice president of KemperSports Venues. “I don't think the experience has to be tied to more of the you know, traditional vacation amenities like ziplining, etc. I just think it needs to be tied to a diverse set of entertainment opportunities that are different from what they would experience in their hometowns,” he said.

Focus on Families: There's a notable division among sports tourists between those actively participating in sports, those attending events, and recreational athletes seeking to include sports activities during their vacations. Just as the athletes are being more purposely driven to activities before and after games, parents, siblings, and other family members are being treated as more than simply “heads in beds” by savvy destinations, says “We look at tourism as a gateway to the county,” says J.C. Poma, executive director of sports, visitation, and entertainment for Chesterfield County, Va. “Heads in beds is a funding mechanism. It completes the model.”

The end game for CVBs and sports commissions is obvious: Make the case for families to return, regardless if a competition is at the center of a trip.

Sports as Marketing: Many destinations are owning their passion for sports as a way to recruit tournament planners and athletes. Visit Hattiesburg, Miss., says its “Baseburg” campaign–including a World Series advertisement–is a smashing success for the community once best known for its public arts. “Everybody is searching for that authentic experience that helps you be part of something bigger than who you are,” says Visit Hattiesburg CEO Marlo Dorsey. “We have a collective ambition to really position Hattiesburg as something very special.”

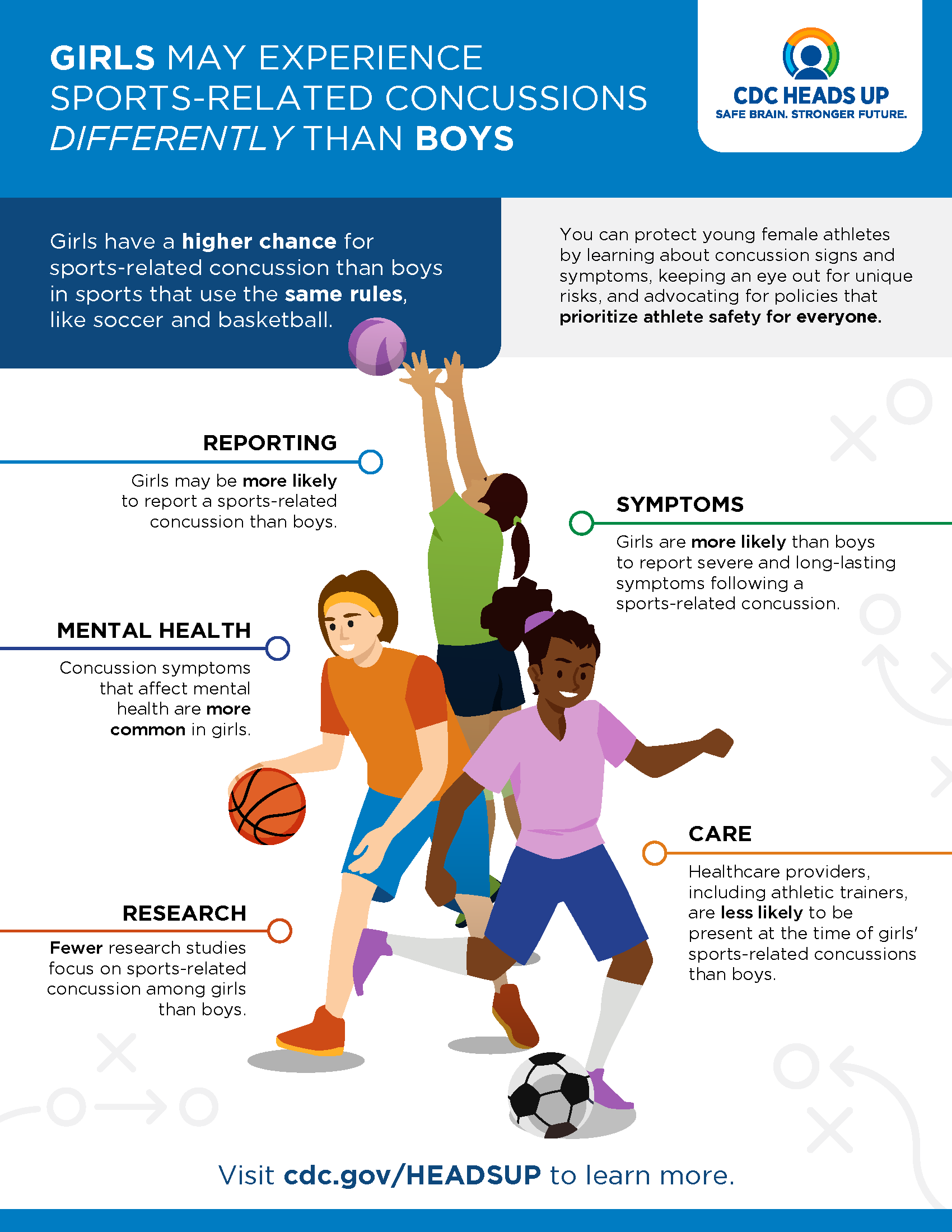

Girls Sports Step Up: The most eye-popping numbers in sports tourism are coming from the women’s side, particularly in volleyball. The University of Nebraska vs. Omaha game in Lincoln drew national headlines when more than 92,000 fans attended. Two weeks after that game, Marquette and Wisconsin set an NCAA regular season indoor attendance record (17,037) during a match at Fiserv Forum in Milwaukee. The trend continued at the women’s Final Four in Tampa, Fl., in December: the national semifinals between Nebraska-Pitt and Wisconsin-Texas at Amalie broke the indoor record at 19,598 and the record then fell again during the national championship with 19,727 in attendance to watch Texas sweep Nebraska. USA Volleyball Director of Events Kristy Cox adds that the NCAA’s decision to move the championship to a Sunday also meant a larger TV audience. Cox adds such big numbers are representative of a larger movement.

“I think that it's a lifetime sport and once girls get exposed to it and boys get exposed to it, they just love it,” says Cox. “ I think that they're getting exposed at a younger age now. Everybody's working really hard on the grassroots movement of getting it out there in the form of clinics so that they can get a taste for it. I also feel like everybody's doing a really, really good job with all our junior clubs.”

Overseas Influx?: There is a growing appetite for more than traditional American favorites. Rugby has an opportunity to find a niche with the buildup to the men’s and women’s World Cups coming to the U.S. in 2031 and 2023, respectively. “This is going to be our springboard for our development as a sport, not only in terms of huge numbers and people watching, but in terms of our competitiveness at the national team level,” predicts Brandy Medran, USA Rugby’s general manager of commercial and events. Another internationally adored game with a chance to make a move in the States is cricket, which won a spot in the 2028 Summer Games in Los Angeles. If the U.S. fields a competitive team, there will be a lot of chirping for more leagues and tournaments.

The Paris Effect: Leap years make NGBs jump for joy as the Summer Games put the spotlight on sports not necessarily in the spotlight otherwise. How will rock climbing and break dancing capitalize the upcoming exposure? This will certainly be a pivotal year to recruit new athletes to sports in an era with so many options.

Data Driven: While sports emphasize statistics, sports tourism is still playing catch up with data-driven decisions. Greater reliance on technology is important across all fields of sports tourism, says Mike Hill, vice president of sales and business development at GroupHousing Travel. “Certain housing companies lack real-time technology, leaving them blind to current housing situations,” he warns. Participants and families need information distributed quickly and accurately or the entire experience could be derailed.

Don’t Call It a Fad: Pickleball is certainly having a moment with the opening of Rhythm & Rally in Macon, Ga., the sport’s largest indoor venue. USA Pickleball is also moving its headquarters to Pure Pickleball, a massive new facility coming to Scottsdale, Az. “We’re busting at the seams,” says Jose Moreno, the NGB’s chief marketing and strategy officer. “We’re growing like crazy.”

The Game’s Afoot: Beyond the huge ratings both the NFL and college football get, flag football is arguably the world’s fastest growing sport. It, too, is headed to the 2028 Summer Games, which will only feed the passion–particularly among women, whether they are Swifties or not.

Eight states, including Arizona, New York, Georgia, and Florida, have already made flag football a varsity high school sport. Hundreds of intramural teams compete at a high level on college campuses, which leads Izell Reese, CEO of RCX Sports and executive director of NFL FLAG, to believe major conferences could jump in within the next year. The Summer Games could end up being a similar catalyst for the women’s game, just as has occurred with women’s college and professional basketball.

To say the least, Reese is high on the sport’s global prospects. “The playbook is already there,” he says. “Now, we’re going to see how we replicate what we’ve done in the U.S.”

World Cup Site Selection: Last but not least, the biggest sports tourism news this year could be when FIFA announces where the 2026 World Cup quarterfinals and beyond will take place. The cities chosen in 2022 are certainly anxious awaiting the decisions, each with different goals. No destinations are shooting higher than Dallas and New York, the favorites to host the championship.

More Latest news

PA Sports Marks Milestone Promoting Keystone State

PA Sports celebrates its 20th anniversary of the statewide effort to draw sports tourism to Pennsylvania.

Play Ball! Overland Park, KS to Welcome New College Baseball Hall of Fame

Patrick Mahomes steps up to the plate for Overland Park to score the College Baseball Hall of Fame.

- Sponsored Content

Let’s Get in the Game in Plano, Texas

Blending historic charm with modern luxury, Plano, Texas, brims with attractions and amenities perfect for traveling sports families.

Hattiesburg, MS., Plays Hardball to Drive Sports Tourism

"Baseburg" World Series campaign highlights Hattiesburg's love for the game.

Sports Management 101 in Today’s Competitive Environment

As KemperSports moves into youth and travel competitions, its senior VP discusses the growth opportunities and challenges facing planners and suppliers.

Up for Bid: 2024 Elite Tournaments Girls Academy Finals

Elite Tournaments is seeking bids to host its 2024 Girls Academy Finals this summer. Find details here.

RESOURCES FOR MEETING PLANNERS

15 Technology Parkway South Suite 250 Norcross, GA 30092

Tel: 678-987-9900

For supplier-related questions, email Derek Rodriguez at [email protected]

For Hosted Buyer-related questions, email Taylor Snow at [email protected] .

For Connect Sports leads and questions, email Matt Swenson at [email protected] .

STAY IN TOUCH

Get the latest industry news - from hotel developments to people appointments to legislation, tips and more to do your job better.

WHY CONNECT?

We develop quality publications, business events, custom programs and services for event professionals and meeting planners to connect them with places and ideas.

- Privacy policy

- Phone: 678-987-9900

© Connect. All rights reserved.

- Hotels, Resorts & Cruise Lines

Sports Tourism Market Analysis Europe, APAC, North America, South America, Middle East and Africa - US, Germany, UK, France, Japan - Size and Forecast 2024-2028

- Published: Jun 2024

- SKU: IRTNTR44823

Enjoy complimentary customisation on priority with our Enterprise License!

Sports Tourism Market Size 2024-2028

The sports tourism market is projected to grow by USD 771.4 billion at a CAGR of 15.2% between 2023 and 2028. This significant growth is driven by several key factors. The sports tourism industry is rapidly growing due to several factors. Global sporting events are attracting larger crowds, increasing demand for hotels and travel services. Sports venues are expanding to accommodate more spectators, creating new business opportunities. Government initiatives to promote sports events and develop infrastructure such as roads, transportation, and hotels are also boosting market growth. Estimated to be worth billions, sports tourism attracts worldwide visitors and significantly boosts local economies with events like the Olympics and FIFA World Cup. This market research report details key drivers, trends, and challenges for the forecasted period.

Get Additional Information on this Report , Request Free Sample in PDF

Market Dynamics

The market is a significant segment in the global tourism industry, with an increasing number of tourists seeking unique and memorable experiences. Destinations like Spain, Portugal, and Australia are known for their sports tourism offerings , including tennis tournaments in Markets like Spain and Portugal, and cricket tours in Australia. These events attract a large number of tourists, contributing to the economic development of these regions. The trend towards experiential travel and the growing popularity of digital platforms have also influenced the sports tourism industry. Events are now being live-streamed and marketed extensively online, making it easier for fans from around the world to engage with their favorite sports and teams. The industry is also seeing a rise in the number of sports-themed tours and packages, offering fans the opportunity to visit iconic sports venues and learn about the history and culture of their favorite sports. The future of sports tourism looks promising, with advancements in technology and a growing emphasis on creating immersive and personalized experiences for tourists. The market is a dynamic sector encompassing a wide range of activities and services.

Key Market Driver

Rising focus on seating capacity expansion is a key driver boosting the market growth. This surge has led to a greater demand for larger seating capacities at these venues globally. Increased seating capacity translates to higher ticket revenue, as more spectators can attend these events, contributing to the expansion of the market. An increase in sporting events and the resulting influx of people. Industry specialists forecast continued growth due to the cultural significance of the Games and the demand from domestic tourists and international visitors.

New stadiums and venues, showcasing Art and Architecture, are being established to accommodate major tournaments and events, expanding the sports travel market and sports destination market. Revenue generation from sporting events tourism is a significant contributor to the tourism industry. Sports Tourism Trends include adventure tourism experiences for athletes and spectators alike, making the world a more interconnected network of sports destinations in various regions. Consequently, sports clubs and events are prioritizing venue expansion to cater to tourists. These initiatives to enhance seating capacity are set to attract more tourists, thereby propelling the global market in the foreseeable future.

Significant Market Trends

The increasing number of fan zones is a major market trend influencing the market. The stakeholders of the industry are focusing on attaining a wider audience to showcase tournaments and expand their reach benefiting the industry. However, the official arenas and stadiums for sporting events have a limited spectator handling capacity and the number of tickets available for the event. This restricts the number of tourists that can witness sports events live in a stadium. To counter the issue, an increasing number of tournaments are focusing on establishing official fan zones. These fan areas can be established in the same region or city hosting the sports event, or in various other cities and regions different from the host.

The fan arenas broadcast the events on large screens. These arenas also carry out numerous supporting and engaging activities. With an increase in the number of events, the number of fan zones is also expected to increase. Various sporting organizations, such as UEFA and BCCI, have established their official fan zones across different regions.

Major Market Challenges

The growing popularity of other tourism industries is a major market challenge hindering the growth of the market. The sports industries encompasses various forms of travel, including cultural, medical, and adventure tourism. Cultural tourism , involving the exploration of a region's art, architecture, religion, and lifestyle, dominates the global tourism sector and is on the rise. This trend will impact the growth of the market. However, the market faces challenges from the growing popularity of health and adventure tourism. Health tourism involves seeking medical treatment and wellness abroad, driven by travelers from countries like Bangladesh, Oman, Nigeria, and Uzbekistan. Adventure sports are also gaining ground, with countries like Australia, New Zealand, and Spain, attracting enthusiasts. The increasing demand for alternative tourism forms will hinder the market's growth.

Market Segmentation

The market is thriving, fueled by the excitement of events like UEFA Champions League, Formula 1, and NASCAR. These events draw enthusiasts to iconic destinations, making them premier travel destination spots. Through partnership initiatives and strategic partnerships , host cities enhance their destination appeal, offering unforgettable visitor experiences. With a focus on sustainable practices and eco-friendly initiatives, the industry is committed to reducing carbon footprints and promoting environmental awareness. This concerted effort ensures overall sustainability, contributing significantly to regional tourism revenues and economic growth by hotels, shops, and food restaurants. As travelers seek predictable conditions for travel and outdoor activities, sports tourism emerges as a dynamic sector, attracting potential tourists and showcasing top-tier athletes in captivating settings . Adventure races, facilitated by travel agencies and tour operators, draw participants seeking adrenaline-fueled experiences. Hospitality chains and event management companies collaborate to create immersive experiences for sports tourists, positioning destinations as premier destinations.

The market growth by the domestic sports tourism segment will be significant during the forecast period. It is the most popular type segment in the market. Tourists travel to various events organized in their respective countries as participants or spectators. The sports travel sector experiences significant economic growth, particularly in the domain of domestic sports tourism, hotel industries, local shops, and food industries. and helps countries in their economical growth. This type of tourism draws a large number of visitors to stadiums for participating in or spectating various sports events within their countries. The industry's economic impact is substantial, with tourists spending on hospitality, merchandise, and adventure experiences related to sports events. Domestic sports leagues are major attractions, with trends indicating an increasing number of fans traveling across venues. Sports teams facilitate transportation, enhancing accessibility. The convenience of intra-region transportation, uniform regional currencies, and familiar cultural backgrounds drives the sector's growth. Domestic sports tourism offers unique experiences, fueling the interest of both participants and spectators. Stadiums serve as economic hubs, generating revenue and creating jobs. This trend underscores the importance of the sports travel sector in the economy. It also includes the expenditure by domestic tourists on hospitality and merchandise products related to that particular sporting event.

Get a glance at the market contribution of various segments Request Free Sample

The domestic sports tourism segment showed a gradual increase in market share from USD 512.00 billion in 2018. Many domestic leagues are held across the globe. These leagues have a higher proportion of domestic tourists due to the easy availability of intra-region transportation, the convenience of using a uniform regional or national currency, and familiarity with the culture and languages. An increasing number of teams are aiding the transportation of their fans across different venues. For instance, in Qatar, the government of Doha provides several transport options to fans when they arrive in the country, which includes free shuttle buses, the Doha Metro, taxis and cab services, and dedicated bus and taxi lanes for fans. The above factors will drive the growth of the market during the forecast period.

Europe is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Samples

Europe stands out as the primary hub, given the multitude of sports events hosted within the region. Sporting teams and events enjoy substantial popularity and active participation, both from athletes and spectators. Various European governments, including the UK, actively promote a healthy lifestyle and engagement in sports. The UK government, for instance, fosters a sports-centric culture among school students through partnerships with major sporting entities like the PREMIER LEAGUE, the Rugby Football Union, and England Hockey. These collaborations offer students avenues for competitive participation, leading to a widespread and deeply ingrained sporting culture among the general public.

Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

- Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- International

- Soccer tourism

- Cricket tourism

- Tennis tourism

- Rest of Europe

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

Market Analyst Overview

The market is a dynamic subset of the broader tourism industry, focusing on the intersection of travel and sporting events, reflecting market growth analysis. Catering to the adventurous traveler, it encompasses the adventure tourism market and sports travel market, offering unique experiences and destinations for enthusiasts, and contributing to market research and growth. Sporting events become key attractions, driving the growth of sports destination markets and attracting visitors from around the globe, emphasizing market growth and forecasting. From marathons to championship games, a wide array of activities and packages cater to diverse interests, highlighting Market forecasting and the growth of Opportunities. These agencies curate unforgettable experiences, tapping into the rising demand for active travel and addressing market Challenges.

The market is witnessing robust growth, driven by the popularity of various sports events such as Motorsport , Triathlons , NBA , Basketball , and Baseball . Events like the Mens FIH Pro League attract sports enthusiasts and travelers alike, contributing to the growth of the industry. With the emergence of strategic partnerships and event-hosting initiatives, destinations are enhancing their appeal as premier travel destinations. Visitors seek unique experiences, leading to sustained growth in leisure travel. Major sporting events like the FIFA World Cup , UEFA Champions League , and Formula 1 further boost tourism, attracting spectators from around the globe. As a result, the market continues to flourish, offering memorable experiences for travelers and sports fans alike.

With world-class sports events and live entertainment, the industry projects significant value, leveraging historical data to understand visitor numbers and seasonal fluctuations. However, infrastructure limitations and financial challenges pose pitfalls, necessitating long-term sustainability measures. Despite challenges, training centers and recreational facilities cater to sports enthusiasts, contributing to conservation efforts and promoting tourism practices. Sports tourism continues to captivate adventurers, offering captivating frontiers and unparalleled experiences for travelers worldwide.

Download PDF Sample

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.

Get in touch

1 Executive Summary

- Executive Summary - Chart on Market Overview

- Executive Summary - Data Table on Market Overview

- Executive Summary - Chart on Global Market Characteristics

- Executive Summary - Chart on Market by Geography

- Executive Summary - Chart on Market Segmentation by Type

- Executive Summary - Chart on Market Segmentation by Product

- Executive Summary - Chart on Market Segmentation by Area

- Executive Summary - Chart on Incremental Growth

- Executive Summary - Data Table on Incremental Growth

- Executive Summary - Chart on Company Market Positioning

2 Market Landscape

- Parent Market

- Data Table on - Parent Market

- Market characteristics analysis

- Value Chain Analysis

3 Market Sizing

- Offerings of companies included in the market definition

- Market segments

- 3.3 Market size 2023

- Chart on Global - Market size and forecast 2023-2028 ($ billion)

- Data Table on Global - Market size and forecast 2023-2028 ($ billion)

- Chart on Global Market: Year-over-year growth 2023-2028 (%)

- Data Table on Global Market: Year-over-year growth 2023-2028 (%)

4 Historic Market Size

- Historic Market Size - Data Table on Global Sports Tourism Market 2018 - 2022 ($ billion)

- Historic Market Size - Type Segment 2018 - 2022 ($ billion)

- Historic Market Size - Product Segment 2018 - 2022 ($ billion)

- Historic Market Size - Area Segment 2018 - 2022 ($ billion)

- Historic Market Size - Geography Segment 2018 - 2022 ($ billion)

- Historic Market Size - Country Segment 2018 - 2022 ($ billion)

5 Five Forces Analysis

- Five forces analysis - Comparison between 2023 and 2028

- Bargaining power of buyers - Impact of key factors 2023 and 2028

- Bargaining power of suppliers - Impact of key factors in 2023 and 2028

- Threat of new entrants - Impact of key factors in 2023 and 2028

- Threat of substitutes - Impact of key factors in 2023 and 2028

- Threat of rivalry - Impact of key factors in 2023 and 2028

- Chart on Market condition - Five forces 2023 and 2028

6 Market Segmentation by Type

- Chart on Type - Market share 2023-2028 (%)

- Data Table on Type - Market share 2023-2028 (%)

- Chart on Comparison by Type

- Data Table on Comparison by Type

- Chart on Domestic sports tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on Domestic sports tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on Domestic sports tourism - Year-over-year growth 2023-2028 (%)

- Data Table on Domestic sports tourism - Year-over-year growth 2023-2028 (%)

- Chart on International sports tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on International sports tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on International sports tourism - Year-over-year growth 2023-2028 (%)

- Data Table on International sports tourism - Year-over-year growth 2023-2028 (%)

- Market opportunity by Type ($ billion)

- Data Table on Market opportunity by Type ($ billion)

7 Market Segmentation by Product

- Chart on Product - Market share 2023-2028 (%)

- Data Table on Product - Market share 2023-2028 (%)

- Chart on Comparison by Product

- Data Table on Comparison by Product

- Chart on Soccer tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on Soccer tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on Soccer tourism - Year-over-year growth 2023-2028 (%)

- Data Table on Soccer tourism - Year-over-year growth 2023-2028 (%)

- Chart on Cricket tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on Cricket tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on Cricket tourism - Year-over-year growth 2023-2028 (%)

- Data Table on Cricket tourism - Year-over-year growth 2023-2028 (%)

- Chart on Tennis tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on Tennis tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on Tennis tourism - Year-over-year growth 2023-2028 (%)

- Data Table on Tennis tourism - Year-over-year growth 2023-2028 (%)

- Chart on Others - Market size and forecast 2023-2028 ($ billion)

- Data Table on Others - Market size and forecast 2023-2028 ($ billion)

- Chart on Others - Year-over-year growth 2023-2028 (%)

- Data Table on Others - Year-over-year growth 2023-2028 (%)

- Market opportunity by Product ($ billion)

- Data Table on Market opportunity by Product ($ billion)

8 Market Segmentation by Area

- Chart on Area - Market share 2023-2028 (%)

- Data Table on Area - Market share 2023-2028 (%)

- Chart on Comparison by Area

- Data Table on Comparison by Area

- Chart on Passive sports tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on Passive sports tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on Passive sports tourism - Year-over-year growth 2023-2028 (%)

- Data Table on Passive sports tourism - Year-over-year growth 2023-2028 (%)

- Chart on Active sports tourism - Market size and forecast 2023-2028 ($ billion)

- Data Table on Active sports tourism - Market size and forecast 2023-2028 ($ billion)

- Chart on Active sports tourism - Year-over-year growth 2023-2028 (%)

- Data Table on Active sports tourism - Year-over-year growth 2023-2028 (%)

- Market opportunity by Area ($ billion)

- Data Table on Market opportunity by Area ($ billion)

9 Customer Landscape

- Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

10 Geographic Landscape

- Chart on Market share by geography 2023-2028 (%)

- Data Table on Market share by geography 2023-2028 (%)

- Chart on Geographic comparison

- Data Table on Geographic comparison

- Chart on Europe - Market size and forecast 2023-2028 ($ billion)

- Data Table on Europe - Market size and forecast 2023-2028 ($ billion)

- Chart on Europe - Year-over-year growth 2023-2028 (%)

- Data Table on Europe - Year-over-year growth 2023-2028 (%)

- Chart on APAC - Market size and forecast 2023-2028 ($ billion)

- Data Table on APAC - Market size and forecast 2023-2028 ($ billion)

- Chart on APAC - Year-over-year growth 2023-2028 (%)

- Data Table on APAC - Year-over-year growth 2023-2028 (%)

- Chart on North America - Market size and forecast 2023-2028 ($ billion)

- Data Table on North America - Market size and forecast 2023-2028 ($ billion)

- Chart on North America - Year-over-year growth 2023-2028 (%)

- Data Table on North America - Year-over-year growth 2023-2028 (%)

- Chart on South America - Market size and forecast 2023-2028 ($ billion)

- Data Table on South America - Market size and forecast 2023-2028 ($ billion)

- Chart on South America - Year-over-year growth 2023-2028 (%)

- Data Table on South America - Year-over-year growth 2023-2028 (%)

- Chart on Middle East and Africa - Market size and forecast 2023-2028 ($ billion)

- Data Table on Middle East and Africa - Market size and forecast 2023-2028 ($ billion)

- Chart on Middle East and Africa - Year-over-year growth 2023-2028 (%)

- Data Table on Middle East and Africa - Year-over-year growth 2023-2028 (%)

- Chart on US - Market size and forecast 2023-2028 ($ billion)

- Data Table on US - Market size and forecast 2023-2028 ($ billion)

- Chart on US - Year-over-year growth 2023-2028 (%)

- Data Table on US - Year-over-year growth 2023-2028 (%)

- Chart on Germany - Market size and forecast 2023-2028 ($ billion)

- Data Table on Germany - Market size and forecast 2023-2028 ($ billion)

- Chart on Germany - Year-over-year growth 2023-2028 (%)

- Data Table on Germany - Year-over-year growth 2023-2028 (%)

- Chart on UK - Market size and forecast 2023-2028 ($ billion)

- Data Table on UK - Market size and forecast 2023-2028 ($ billion)

- Chart on UK - Year-over-year growth 2023-2028 (%)

- Data Table on UK - Year-over-year growth 2023-2028 (%)

- Chart on France - Market size and forecast 2023-2028 ($ billion)