- Customer Service

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

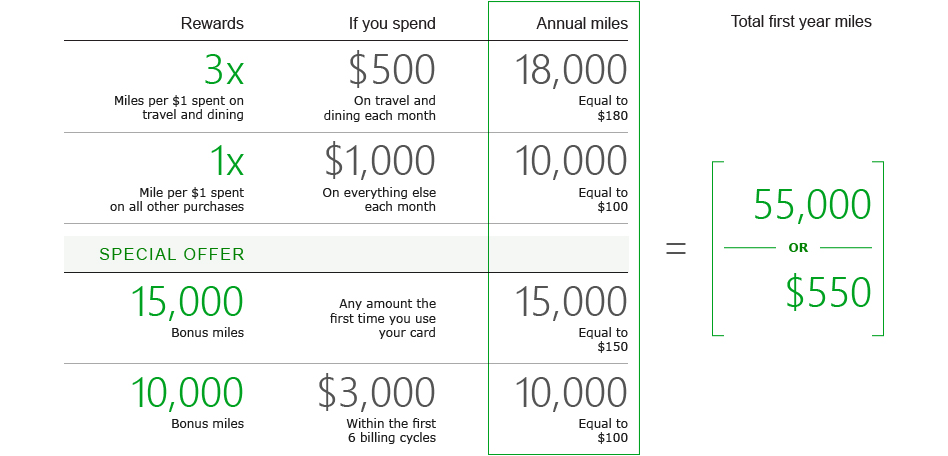

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- Customer Service

- En Español

Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N.A. or any of its affiliates; and, may be subject to investment risk, including possible loss of value.

SECURITIES AND OTHER INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT; NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY TD BANK, N.A. OR ANY OF ITS AFFILIATES; AND, MAY BE SUBJECT TO INVESTMENT RISK, INCLUDING POSSIBLE LOSS OF VALUE.

Based on average store hour data pulled in January 2024 of Top Banks (as defined below) in metropolitan statistical areas in which TD Bank operates ("TD MSAs"), excluding drive-thru hours and hours of locations in retail stores (such as grocery stores). Top banks are the top 20 banks by total deposits across TD MSAs, the top five banks by store share (or by total deposits, if store share is equal) in each TD MSA, and any bank with greater or equal store share compared to TD Bank in each TD MSA ("Top Banks").

©2022 TD Bank, N.A. All Rights Reserved.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Mortgage Renewal

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does a Mortgage Work in Canada?

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- How to Save Money on Your Next Renewal

- First-Time Home Buyer Grants and Assistance Programs

- Types of Houses in Canada

- Types of Mortgages in Canada: Which Is Right for You?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.

Did you know? TD isn’t the only issuer that works with Aeroplan. American Express and CIBC also offer Aeroplan credit cards with their own earn rates and perks.

Aeroplan rewards

Each of the four Aeroplan credit cards offered by TD have slightly different earn rates and reward categories. Learn more about each card’s earn rates and spending categories below:

TD Aeroplan Visa Infinite Card

- 1.5x Aeroplan points on eligible gas, groceries and Air Canada purchases.

- 1x Aeroplan points on everything else.

- Double the points earned when you shop with partner brands and through the Aeroplan eStore.

- 50% more Aeroplan points when you shop at Starbucks (card must be linked to your Starbucks Rewards account).

TD Aeroplan Visa Platinum Card

- 1 Aeroplan point per $1.00 spent on eligible gas, groceries and Air Canada purchases.

- 1 Aeroplan point per $1.50 spent on everything else.

TD Aeroplan Visa Infinite Privilege Card

- 2x Aeroplan points on Air Canada purchases.

- 1.5x Aeroplan points on eligible gas, groceries, travel and dining purchases.

- 1.25x Aeroplan points on everything else.

TD Aeroplan Visa Business Card

- 1.5x Aeroplan points on eligible travel, dining and business purchases.

- 1x Aeroplan points on everything else.

TD Aeroplan card earn rates and categories accurate as of June 22, 2023.

Pros of TD Aeroplan

- Range of cards to choose from.

- Business card available.

- Most cards include travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD Aeroplan

- The redemption program focuses mainly on Air Canada.

- Lower earn rates than similar cards, including the TD First Class Travel card.

TD First Class Travel is another name for one of TD’s rewards cards: the TD First Class Travel Visa Infinite card. It’s the only card from TD with the name First Class Travel, but not the only card that earns TD Rewards Points. The TD Platinum Travel Visa, TD Travel Rewards Visa and TD Business Travel Visa also earn TD Rewards Points.

TD First Class Travel rewards

The TD First Class Travel Visa Infinite card earns between two and eight TD Rewards Points per CAD spent, depending on the purchase category.

- 8x TD Rewards Points on travel bookings made via the Expedia for TD platform.

- 6x TD Rewards Points on groceries and restaurants.

- 4x TD Rewards Points on recurring bill payments.

- 2x TD Rewards Points on everything else.

Pros of TD First Class Travel

- High reward earn rates compared to TD Aeroplan cards.

- Travel TD Rewards Points can be redeemed with multiple booking platforms.

- Includes travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD First Class Travel

- Only one First Class Travel card to choose from.

- Highest earn rate is only for Expedia purchases.

TD First Class Travel vs TD Aeroplan: Which is better?

TD Aeroplan beats out First Class Travel when it comes to points value. Based on NerdWallet analysis, the average value of 1 Aeroplan point is worth 2.23 cents. To compare, you can expect to get around 0.25-0.5 cents per TD Rewards Point, according to NerdWallet analysis. These values depend on the redemption method you choose.

That’s not to say TD Aeroplan cards are better than the TD First Class Travel Visa Infinite card. If you don’t fly with Air Canada, for example, Aeroplan points may not be as practical. Look at features like annual fees , reward categories, redemption options, interest rates and insurance perks when making your decision.

TD First Class Travel and TD Aeroplan cards

Td first class travel® visa infinite* card.

- Annual Fee $139 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 6, 2025. Waived first year

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 2x-8x Points Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†. Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†. Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†. Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

- Intro Offer Up to 135,000 Points Earn up to 135,000 TD Rewards Points†: Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†. Earn 115,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†. Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†. Account must be approved by January 6, 2025.

- Earn up to $1,000 in value†, including up to 135,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by January 6, 2025.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 115,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 6, 2025.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

TD® Aeroplan® Visa Infinite* Card

- Annual Fee $139 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 6, 2025.

- Rewards Rate 1x-1.5x Points Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Intro Offer Up to 40,000 Points Earn up to 40,000 Aeroplan points†: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†. Account must be approved by January 6, 2025.

- Earn up to $1,300 in value† including up to 40,000 Aeroplan points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by January 6, 2025.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Earn big rewards on the little things: Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks® Rewards account. Conditions apply.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Infinite* Cardholder in good standing.

- Travel lightly through the airport and save on baggage fees†: Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lbs) when your travel originates on an Air Canada flight.

- To be eligible, a $60,000 annual personal income or $100,000 household annual income is required. You must also be a Canadian resident and be the age of majority in the province or territory where you live.

TD® Aeroplan® Visa Platinum* Card

- Annual Fee $89 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 6, 2025. Waived first year

- Rewards Rate 0.67x-1x Points Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Intro Offer Up to 20,000 Points Earn up to 20,000 Aeroplan points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†. Conditions Apply. Account must be approved by January 6, 2025.

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by January 6, 2025.

- Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Platinum* Cardholder.

- Flight/Trip Delay Insurance†: Up to $500 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Emergency Travel Assistance Services†: Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

- To be eligible, you must be a Canadian resident and be of the age of majority in your province/territory of residence.

TD® Aeroplan® Visa Infinite Privilege* Credit Card

- Annual Fee $599

- Rewards Rate 1.25x-2x Points Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®). Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases. Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Intro Offer Up to 80,000 Points Earn up to 80,000 Aeroplan points: Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 30,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†. Account must be approved by January 6, 2025.

- Earn up to $2,900 in value† including up to 80,000 Aeroplan points†. Conditions Apply. Account must be approved by January 6, 2025.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 30,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†.

- Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®).

- Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases.

- Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Share first free checked bags with up to 8 travel companions†, and get unlimited access to Maple Leaf Lounges† including complementary access for one guest.

- Plus, primary cardholders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- Get an annual round-trip companion pass from $99 (plus taxes, fees, charges and surcharges)†.

- Get access to Priority Airport Services† like Priority Boarding, Priority Baggage Handling, and Priority Airport Standby & Priority Airport Upgrades†.

- Travel Medical Insurance†: Up to $5 million of coverage for the first 31 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- To be eligible, $150,000 annual personal income or $200,000 household annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

TD® Aeroplan® Visa* Business Card

- Annual Fee $149 Waived first year

- Interest Rates 14.99% / 22.99% 14.99% on purchases, 22.99% on cash advances.

- Rewards Rate 1x-2x Points 2x on Air Canada purchases, including Air Canada Vacations. 1.5x on travel, dining and select business categories, such as shipping, internet, cable and phone services. 1x on everything else.

- Intro Offer Up to 60,000 Points Earn up to 60,000 Points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card. Plus, earn up to 45,000 Aeroplan points when you spend $2,500 in purchases each month for the first 12 months of Account opening. Plus, earn up to 5,000 Aeroplan points when you spend $250 on eligible mobile wallet Purchases within 90 days of Account opening. Account must be opened by September 3, 2024.

- Earn up to 60,000 Aeroplan pointsΓ. Conditions Apply. Account must be opened and approved by September 3, 2024.

- Earn 2 Aeroplan points for every dollar spent on eligible purchases made directly with Air Canada, including Air Canada Vacations.

- Earn 1.5 Aeroplan points for every dollar spent on eligible travel, dining and select business categories, such as shipping, internet, cable and phone services.

- Earn 1 Aeroplan point for every dollar spent on all other eligible purchases.

- Earn points twice when paying with a TD Aeroplan Visa Business Card and providing an Aeroplan number at over 150 Aeroplan partner brands and more than 170 online retailers via the Aeroplan eStore.

- Points can be redeemed for flights, hotels, merchandise, gift cards and more. They can also be used to pay down the card’s balance.

- Linked cards earn 50% more Aeroplan points and Stars at participating Starbucks stores.

- $149 annual fee — rebated in the first year.

- Free first checked bag for up to 9 people travelling on the same reservation on Air Canada flights.

- One free one-time guest pass to Maple Leaf Lounges for every $10,000 in net purchases. Maximum of 4 passes a year.

- Reach Aeroplan Elite Status more quickly by earning 1,000 Status Qualifying Miles and one Status Qualifying Segment for every $5,000 in net purchases.

- Access online reporting, review business expenses, managing existing credit limits and apply spend controls through the TD Card Management Tool.

- Visa SavingsEdge program: save up to 25% on eligible business purchases.

- Travel benefits: travel medical insurance (up to $2 million in coverage for the first 15 days for those under 65; coverage lasts for 4 days for those 65 and older); common carrier travel accident insurance (up to $500,000 for covered losses), trip cancellation insurance (up to $1,500 per insured person; maximum of $5,000), trip interruption insurance (up to $5,000 per insured person; maximum of $25,000), flight/trip delay insurance (up to $500 if a flight or trip is delayed for longer than 4 hours), delayed and lost baggage insurance (up to $1,000 of overall coverage per insured person), auto rental collision/loss damage insurance (covers the full cost of a car rental for up to 48 days), hotel/motel burglary insurance (up to $2,500), mobile device insurance (up to $1,000 in coverage).

- Toll-free emergency travel assistance services.

- Receive a rebate of up to $100 on NEXUS enrolment application/renewal fee costs once every 48 months.

- Save a minimum of 10% on the lowest available base rates in Canada and the U.S., and a minimum of 5% on the lowest base rates internationally on qualifying car rentals at participating Avis and Budget locations.

- Visa Zero Liability protection, Verified by Visa and instant alerts to prevent fraudulent card use.

- Purchase security and extended warranty protection.

- Minimum credit limit of $1,000.

- Interest rates: 14.99% on purchases, 22.99% on cash advances.

About the Author

Georgia Rose is a lead writer on the international team at NerdWallet. Her work has been featured in The Washington Post, The New York Times, The Independent and The Associated…

13 Best Aeroplan Credit Cards in Canada for 2024

The best Aeroplan credit cards in Canada earn points for Air Canada’s loyalty program on every purchase. Aeroplan points have an average value of 2.23 cents per point.

Aeroplan vs. Air Miles: Differences and Alternatives

Aeroplan is usually an ideal choice for those who want to use points for Air Canada flights, while Air Miles is a better choice for those who want flexible point redemption options.

15 Best Travel Credit Cards in Canada for September 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

12 Best TD Bank Credit Cards in Canada for 2024

The best TD Bank credit cards in Canada include several Visa Infinite options as well as co-branded travel credit cards that earn Aeroplan points.

- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel Vs. TD Aeroplan: Which Is Better?

Updated: Jun 25, 2024, 7:41am

Table of Contents

What is td first class travel, earning rewards, what is td aeroplan, td first class travel vs td aeroplan: which to choose, td first class travel and td aeroplan cards comparison, td first class travel vs. td aeroplan.

One bank, two rewards programs. If you’re looking for a travel rewards card with TD Bank, you’ll have the choice between one of the many TD Aeroplan cards they offer and a TD First Class Travel Visa Infinite. But how do you know which one will benefit you the most? We break down the differences between these two types of travel cards.

Featured Partner Offer

TD® Aeroplan® Visa Infinite Privilege* Card

On TD’s Secure Website

Welcome Bonus

Up to $2,900 in value† including up to 80,000 Aeroplan points†

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

American Express® Aeroplan®* Card

On American Express’s Secure Website

Up to 50,000 Aeroplan points

Regular APR

30% (charge card)

- TD® Aeroplan® Visa Infinite* Card

Up to $1,300 in value† including up to 40,000 Aeroplan points†

$139 (rebated the first year)†

TD First Class Travel isn’t really the name of a rewards program with TD. Rather, it refers to a specific credit card TD issues: the TD First Class Travel Visa Infinite . This card and several others from TD earn TD Reward points.

TD Reward points are exclusive to TD and are specifically linked to TD credit cards , meaning you won’t find them anywhere else. TD Reward points use a fixed-value points system, ensuring they can be redeemed consistently across various redemption options. This feature makes them good for covering incidental travel expenses like boutique hotel bookings, vacation rentals and other travel-related expenses.

How Many TD First Class Travel cards does TD offer?

TD only offers one TD First Class Travel card: the TD First Class Travel Visa Infinite Card.

It does offer a few other credit cards that earn TD Rewards points, including:

- TD Platinum Travel Visa

- TD Travel Rewards Visa

- TD Business Travel Visa

TD First Class Travel Rewards

Pros of td first class travel.

- Earn up to 8 points per dollar on select spending

- Points can be redeemed through multiple travel booking sites, including Expedia for TD

- Includes travel insurance

Cons of TD First Class Travel

- TD Rewards points are exclusive to TD Bank

- Must earn either $60,000 in annual personal income or $100,000 in annual household income to be eligible for this card

Redemption Options for TD First Class Travel

TD Rewards points can be redeemed for Amazon.ca purchases, Starbucks Rewards Stars and gift cards. You can also redeem TD Rewards points for travel bookings, like flights , hotels and car rentals, on any site through the TD Book Any Way option on any travel booking website or on Expedia For TD. You can also use your TD Reward points for a statement credit or for continuing education credits.

TD Aeroplan refers to credit cards issued by TD Bank that earn Aeroplan points. Aeroplan was originally designed as a loyalty program for Air Canada customers but changed hands several times over the years. 2018 Air Canada repurchased the program and reintroduced it in 2020.

Following its relaunch, Aeroplan focused on flexible rewards and expanded, adding a wide range of airline and retail partners to its network and removing fuel surcharges. Aeroplan credit cards are issued by TD Bank but are also issued by CIBC and American Express .

How Many TD Aeroplan cards does TD offer?

TD currently offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite

- TD Aeroplan Visa Platinum

- TD Aeroplan Visa Infinite Privilege

- TD Aeroplan Visa Business

TD Aeroplan Rewards

Pros of td aeroplan.

- Generous welcome bonus

- Points can be used for various items, including travel, merchandise, gift cards, and statement credit.

- Many partner retailers earn more points

- Business card option

- Cards include other travel perks, like travel insurance

Cons of TD Aeroplan

- The most benefits for redemption are with Air Canada

- All TD Aeroplan cards have an annual fee

- Lower earn rates than the TD First Class Travel card.

- Some Aeroplan cards have income eligibility requirements.

- You must fly Air Canada when redeeming Aeroplan Points.

Redemption Options for TD Aeroplan Credit Cards

Aeroplan points can be used for everything from booking flights and vacations with Air Canada to flights on partner airlines, hotel rooms, and car rentals. You can also redeem your Aeroplan points for merchandise, gift cards, and statement credit.

In order to take a closer look and help us choose between choose a TD First Class Travel Visa and a TD Aeroplan card, let’s review some of the facts.

Best for frequent flyers

Td first class travel® visa infinite* card.

Up to $1,000 in value†, including up to 135,000 TD Rewards Points†

Think of the TD First Class Travel Visa Infinite Card as a cheaper step down from its higher-flying cousins on this list. Packed with travel benefits, but lacking a heavyweight rewards program, this card is really aimed at frequent fliers rather than high spenders who also like to travel.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 115,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your first Additional Cardholders by January 6, 2025.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

Best for earn rates

Thanks to the TD Aeroplan Visa Infinite Card ’s robust Aeroplan rewards program, cardholders can earn roughly twice what they’d net through any of the other cards on this list, although its travel insurance coverage leaves something to be desired.

- Great rewards program earnings

- Plenty of perks, including comprehensive travel insurance and a NEXUS rebate

- High annual fee

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Plus, share free first checked bags with up to 8 travel companions†.

- Get an annual fee rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 6, 2025.

- This offer is not available to residents of Quebec.

Best For Aeroplan Points with Low Annual Fee

Td® aeroplan® visa platinum* card.

Up to $500 in value†, including up to 20,000 TD Rewards Points†

$89 (rebated the first year)†

The TD Aeroplan Visa Platinum Card shares many lots of the same features seen in premium cards that cost five times the annual fee. However, it does lack a bit in the insurance department.

- Decent travel and consumer protection benefits

- Allows cardholders to earn Aeroplan Points twice

- Low annual fee that’s rebated the first year

- Lower insurance coverage than other Aeroplan cards

- Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†.

- Get an annual fee rebate for the first year†

Best For Exclusivity

True to its name, the TD Aeroplan Visa Infinite Privilege Card is exclusive and expensive, but brings to bear a broad array of perks and benefits, along with a surprisingly accessible credit score threshold.

- Extensive travel perks, insurance and consumer protections

- Low credit score threshold for such a powerful card

- The most expensive annual fee on the list

- Requires minimum personal income of $150,000 a year or $200,000 in annual household income

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†

- Earn an additional 30,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†

- Share first free checked bags with up to 8 travel companions† and get unlimited access to Maple Leaf Lounges†, including complementary access for one guest.

- Plus, primary card holders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- †Terms and conditions apply.

Best Aeroplan Card for Business Owners

Td® aeroplan® visa* business card.

Up to 65,000 Aeroplan points

This card is a must for business owners , especially those who travel. With exclusive perks and benefits starting at the airport, insuring you at take-off and at your destination with a robust travel insurance package and even providing discounts when you rent a car, you’ll feel like someone’s rolling out the red carpet for you on every business trip.

- High earn rate, especially on essential categories for business

- Travel perks like travel insurance and priority check-in and boarding

- $149 annual fee

- Limited travel benefits compared to other premium cards

- Limited acceptance outside of Aeroplan and Air Canada partners

- Earn up to $1,850 in value† including up to 65,000 Aeroplan points, no annual fee for the first year, and additional travel benefits†. Accounts must be opened by January 3, 2024.

- Get an annual fee rebate for the first year for the primary cardholder and two additional cardholders†.

- Share free first checked bags and get access to Maple Leaf Lounges†.

- Earn 2 points for every dollar spent on eligible purchases made directly with Air Canada® including Air Canada Vacations®.

- Earn 1.5 points for every dollar you spend on eligible purchases for travel, dining and select business categories such as shipping, internet, cable and phone services made on your Card.

- Earn 1 point for every dollar you spend on all other eligible purchases on your Card.

- Earn 50% more points at Starbucks when you link your TD card with your Starbucks® Rewards account.

With this in mind, the decision comes down to how you want to book travel, what you’re using the card for, what the decision comes down to is how you want to book travel, what you’re using the card for and how you like to redeem your points.

If you prefer to book travel through Expedia or other platforms, you’re better off choosing the TD First Class Travel card. If you prefer to book through Air Canada, you’ll likely get more value from an Aeroplan card.

The TD First Class Travel Visa Infinite Card is better if you prefer to redeem points for Amazon purchases or at Starbucks. However, if you’d rather redeem points for merchandise, an Aeroplan card might be worth considering.

That said, if you plan to use this card for business purposes, the TD Aeroplan card is best since the TD First Class Travel Visa Infinite is a single card you’re planning to use this card for business purposes, the TD Aeroplan card is best since the TD First Class Travel Visa Infinite is a single card and is meant for individuals, not businesses.

- Best Travel Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Aeroplan Credit Cards

- Best Air Miles Credit Cards

- Best Hotel Credit Cards

- Best No Annual Fee Credit Cards For Travel

- Best Credit Cards for Travel Insurance

- Best Credit Cards for Roadside Assistance

- Best Credit Cards For International Travel

- Best Credit Cards for Road Trips

- American Express Cobalt Review

- American Express Centurion Black Card Review

- TD Aeroplan Visa Infinite Privilege Review

- TD First Class Travel Visa Infinite Card

- RBC Avion Visa Infinite Review

- MBNA Rewards World Elite Mastercard

- Scotiabank Passport Visa Infinite Review

- TD Aeroplan Visa Platinum Card Review

- Cathay World Elite Mastercard Review

- BMO Air Miles World Elite Mastercard Review

- Platinum Card From American Express Review

- TD Platinum Travel Visa Card Review

- American Express Aeroplan Card Review

- American Express Green Card Review

- Scotiabank Gold American Express Card

- Scotiabank Platinum American Express Card

- American Express Gold Rewards Card Review

- Scotia Momentum Visa Infinite Review

- Marriott Bonvoy American Express Card Review

- National Bank World Elite Mastercard Review

- Brim World Elite Mastercard Review

- RBC Avion Visa Infinite Business Review

- National Bank Platinum Mastercard

Air Canada Aeroplan: The Ultimate Guide

- How To Redeem Aeroplan Points

- Foreign Transaction Fees: How To Avoid Them

- How Much Is The Amex Platinum Foreign Transaction Fee?

- How To Use Google Flights To Find Cheaper Flights

- Credit Card Travel Insurance Vs. Separate Travel Insurance

- The Amex Platinum Travel Insurance Guide

- American Express Fine Hotels + Resorts: Everything You Need To Know

- All You Need To Know About The New Air Miles

- Expedia For TD: Is It Worth It?

- Are Travel Credit Cards Worth It For Non-Aspirational Travellers?

- How To Pick A Hotel Credit Card

- Credit Cards With A Free Hotel Night

- Transfer Holiday Debt to Credit Card

More from

A guide to the air miles reward program in canada, everything you need to know about the new air miles, 5 ways to save money on your next airfare purchase, what’s the best day & time to book flights, what is premium economy (and is it worth it).

Courtney Reilly-Larke is the deputy editor of Forbes Advisor Canada. Previously, she was the associate editor of personal finance at MoneySense. She was also managing editor of Best Health Magazine and has contributed to publications such as Cottage Life and Blog TO. She currently lives in Toronto.

Aaron Broverman is the lead editor of Forbes Advisor Canada. He has over a decade of experience writing in the personal finance space for outlets such as Creditcards.com, creditcardGenius.ca, Yahoo Finance Canada, Nerd Wallet Canada and Greedyrates.ca. He lives in Waterloo, Ontario with his wife and son.

Priority Pass App

- Accessibility

- Français | French

- $139 annual fee – First year free

- Earn 20,000 TD Rewards points after your first purchase

- 115,000 additional points when you spend $5,000 in the first 180 days

- Annual $100 travel credit (accommodations & vacation packages)

- Birthday bonus of up to 10,000 points

- Earn 8 points per $1 spent when you book on Expedia for TD

- Earn 6 points per $1 spent on groceries and dining

- Earn 4 points per $1 spent on recurring bills

- Earn 3 per $1 spent on all other purchases

Welcome bonus and earn rate

The TD First Class Visa Infinite Card is one of TD’s most popular cards. The welcome bonus is typically quite generous and hovers between 80,000 – 145,000 TD Rewards points. The welcome bonus is comparable to cards on my list of the best travel credit cards in Canada .

As for the earn rate, you’ll get 8 points per dollar spent on Expedia for TD purchases. 6 points per dollar spent on groceries and dining. 4 points per dollar spend on recurring bills and 3 points on all other purchases.

To give you some perspective, when using TD Rewards points on Expedia for TD purchases, 1 point is worth $0.50. That means the base earn rate gets you 1.5% back in travel rewards, which is quite good.

Although the card has an annual fee of $139, it’s usually waived for the first year. You can also get the annual fee waived every year if you have a TD All-inclusive bank account.

Benefits and perks

If you’re reading my TD First Class Travel Visa Infinite Card review, then you’ll want to know about all the benefits. What’s interesting is that this card recently had an update and now comes with some pretty fun perks.

$100 annual travel credit

When you book accommodations or vacation packages on Expedia for TD worth at least $500, you’ll get a $100 credit back on your credit card. This is a pretty unique benefit that puts money back in your pocket, but it does not apply to all travel categories. In addition, this benefit only applies to individual bookings and is not cumulative.

10% birthday bonus

One unique perk is the birthday bonus worth up to 10,000 TD Rewards points. To earn this bonus, TD will give you 10% of the points you’ve earned in the year leading up to your birthday. Welcome bonuses don’t count. For example, if you earned 93,000 TD Rewards points in the year leading up to your birthday, you’d earn 9,300 extra TD Rewards points on your birthday.

Save on rental cars

Cardholders get at least 10% off the base rate when renting vehicles in Canada and the U.S at Avis or Budget and paying with your TD Aeroplan Visa Infinite Card. If you’re travelling internationally, you’ll save at least 5% at participating locations.

Travel insurance

- Travel medical – $2,000,000 for 21 days / 4 days if you’re 65 or older

- Trip cancellation – up to $1,500 per person / $5,000 total

- Trip interruption – up to $5,000 per person / $25,000 total

- Flight/trip delay insurance – $500 per person – 4 hours

- Delayed and lost baggage – up to $1,000 / 6 hours

- Auto rental collision/loss damage – 48 consecutive days / $65,000

- Hotel/motel burglary insurance – $2,500

- Common carrier travel accident – $500,000

The travel insurance included is competitive and comparable to my list of the best credit cards with travel insurance , but it does lack two major types of travel insurance.

The 21 days of travel medical insurance is pretty good, but like many other credit cards, it only gives 4 days if you’re 65 or older. You’ll obviously need more coverage if you fall into that age range.

Note that was this card, you only need to charge 75% of your trip costs for your flight/trip delay and hotel/motel burglary insurance to apply. However, for trip cancellation and auto rental collision, you need to charge 100% of the cost to your card.

Mobile device insurance

Many people aren’t aware that the TD First Class Travel Visa Infinite Card comes with mobile device insurance. When you charge at least 75% of the total device or monthly plan cost to your card, you’ll be insured for up to $1,000. That said, like other mobile device insurance plans, depreciation applies when making a claim. Both cellular phones and tablets count as mobile devices.

Purchase insurance

- Purchase security – 90 days

- Extended warranty – Up to 1 additional year

The purchase security insurance covers your good from theft, loss, and damage for 90 days. With extended warranty, you your warranty doubled up to one additional year.

Visa Infinite benefits

- Concierge service – The Visa Infinite Concierge is available 24/7 and can help you secure concert tickets, make dinner reservations and more.

- Luxury Hotel Collection – You’ll get exclusive benefits such as resort credits and room upgrades when booking accommodations through the Visa Luxury Hotel Collection.

- Dining Series – Get access to some culinary events, such as celebrity chef meetups and tasting menus.

- Wine Country program – Your Visa Infinite Card gets you discounts and free wine tastings at participating wineries in British Columbia, Ontario and Sonoma Valley.

- Entertainment access – Throughout the year, cardholders get invites and exclusive access to the Toronto International Film Festival.

- Troon Golf – Troon Rewards Silver Status is given to cardholders. With your status, you’ll get 10% off green fees, merchandise and lessons.

How to redeem your points

TD Rewards allows you to book travel in multiple ways, giving you more options. Given the flexibility, many people love TD Rewards. However, your points will have a different value depending on how you redeem them.

Expedia for TD

Expedia for TD is TD’s main travel redemption option. 200 TD Rewards points get you $1 off Expedia for TD travel bookings. This essentially makes one TD Reward point worth .5 cents. Expedia for TD is nearly identical to Expedia.ca. That means you’ll get access to a large inventory of flights, hotels, car rentals, all-inclusive packages and attraction tickets.

To redeem TD Rewards points on Expedia for TD, you have to log in to TD Rewards and click on the Expedia for TD link. When you’re ready to pay, you’ll be given the option to use your TD Rewards points. Generally, Expedia has very competitive prices.

Booking on your own

TD Rewards points can also be used to offset travel expenses you charge directly to your TD First Class Travel Visa. The redemption rate is 250 points = $1 (or a value of .4 cents per point). That means you get 20% less value than using your points on Expedia for TD. That said, when you make a travel purchase on your own that’s more than $1,200 in value, any amount that’s $1,201 or above would have a redemption value of 200 points for $1.

Even though you get less value by booking on your own, there are a few reasons to consider this option. The first reason is that you are not restricted to what is available on Expedia for TD, so you can use points for bookings on Airbnb or booking.com. The second reason why booking on your own travel is handy is that most hotel chains will require that you book directly with them to enable loyalty membership status and perks.

TD First Class Travel Visa Infinite Card eligibility

- You’re a Canadian citizen, or you’re a permanent resident

- You’re at least the age of majority in the province or territory where you reside

- You have a minimum annual personal gross income of $60,000 or a household income of $100,000

As a Visa Infinite card, there are very specific eligibility requirements. Even though there’s no formal credit score requirement listed, you’ll likely need your credit score to be at least 700 to be approved. That’s because a credit score of at least that number would put you in good standing or higher.

How the TD First Class Visa Infinite compares

As a mid-tier travel rewards credit card, the TD First Class Travel Visa Infinite Card has a lot of competition. Not only does it compete with other bank credit cards, but there are also airline credit cards worth looking at too.

TD First Class Visa Infinite Card vs. Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite Card is a very popular travel credit card since it gives you get six free annual airport lounge passes and has no foreign transaction fees. The earning rate of this card is similar to what TD offers. The overall insurance package offered by TD is slightly better.

TD First Class Visa Infinite Card vs. American Express Gold Rewards Card

Another great mid-tier travel card is the American Express Gold Rewards Card . Although the card has an annual fee of $250, you get an annual $100 travel credit and a Priority Pass Membership with four free annual Plaza Premium airport lounge passes. What makes this card stand out is the fact that you earn American Express Membership Rewards points. These points can be transferred to Aeroplan at a 1:1 ratio.

TD First Class Visa Infinite Card vs. TD Aeroplan Visa Infinite Card

If your goal is to travel for less, then the TD Aeroplan Visa Infinite Card should also be considered. With this card, you’ll earn Aeroplan points on all eligible purchases. This is relevant because Aeroplan is Air Canada’s loyalty program and one point can easily be worth between 1.5 – 2 cents each. In addition, by having this card, you get your first checked bag free and preferred pricing on Aeroplan redemptions.

Final thoughts

My TD First Class Travel Visa Infinite Card review is positive. It’s an ideal card for people in the following situations:

- You want to save on travel – TD Rewards points are highly flexible and best used via Expedia for TD.

- You bank with TD – If you have an All-Inclusive Banking Plan, the annual fee is waived for this card.

- You want insurance – The included travel and purchase insurance with this card is excellent.

Although Expedia for TD may not be the best rewards program out there, it’s easy to understand and there are no blackout dates. Plus, the overall insurance package you get with this card is excellent. That said, the earn rate for this card is not as good as other cards out there.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

Hi Barry! Thanks for another great post. I currently use the AMEX cobalt as my everyday card and wanted to get a supplementary card to use when AMEX is not accepted. I currently have an All-Inclusive banking plan with TD, which would waive the annual fee for the TD First Class Travel Visa Infinite Card & the TD Aeroplan Visa Infinite Card. Which one would you recommend between the two?

Hey Sylvia.

It sort of depends on your goals. If you got the TD Aeroplan VI card, you could pool the points with your Cobalt since those points can be converted to Aeroplan. The TDFCTVI is good if need to make non-Aeroplan bookings such as car rentals or hotel bookings.

You state the following: “Note that was this card, you only need to charge 75% of your trip costs for your travel insurance to be valid.” However, my review of the wording indicates that under Trip Cancellation, you must charge the full cost of your trip to the card to get coverage. This is under the definition of Covered Trip.

You’re right. the 75% only applies to hotel/motel burglary and trip delay.

Calculating rewards with the new and improved TD First Class Travel makes it a good competitor to the Aeroplan card. I feel like it’s hard to get a good value with Aeroplan (2 cpp). More than often international travel gives around 1.4 cpp making the First Class card more valuable (if booking something via Expedia to get the $100 credit that is. Am I missing something? Would the Aventura or RBC Avion otherwise be better?

Hey Philippe,

I haven’t had too much trouble finding Aeroplan value between 1.8 – 2 CPP. Then again, I booked most of my travel before there was crazy demand.

Aventura and Avion both have a fixed travel program where you can get a higher CPP, but I personally find Aeroplan to be more valuable. I typically try to collect American Express Membership Rewards points and then transfer them to whatever program gives me good value when I need to make a redemption.

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- Small Business

- English Selected

Home / Canadian Credit Cards / TD Travel Credit Cards in Canada / TD Platinum Travel Visa* Card

TD Travel Credit Cards in Canada

Your region is currently set to

TD Platinum Travel Visa* Card

- Annual Fee $89

- Interest: Purchases 20.99%

- Interest: Cash Advances 22.99%

- Additional Cardholder 2 $35

$35 for the first Additional Cardholder; $0 for subsequent Additional Cardholders.

Limited Time Offer

Earn up to $370 in value 18 , including up to 50,000 TD Rewards Points 1 and no Annual Fee for the first year 1 . Conditions apply. Account must be approved by January 6, 2025.

- Welcome Bonus of 15,000 TD Rewards Points when you make your first Purchase with your Card 1 .

- 35,000 TD Rewards Points when you spend $1,000 within 90 days of Account opening 1 .

- Get an Annual Fee Rebate for the first year 1 .

To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by January 6, 2025.

At a glance

Earn TD Reward Points on all the things you normally do, whether you use your card for groceries, dining, paying bills or booking travel. The rewards will add up quickly so you can enhance your travel experience or enjoy a wide variety of rewards. Your card also allows you to enjoy:

- Flexibility to redeem your TD Rewards Points on a wide variety of rewards at Expedia® For TD, Starbucks® and more.

- Booking your travel through Expedia® For TD 6 to maximize the TD Rewards Points you can earn on your travel purchases.

- An extensive suite of travel insurance coverages which helps you travel prepared.

- No travel blackouts 7 , no seat restrictions 7 and no expiry 20 for your TD Rewards Points as long as your account is open and in good standing.

Every purchase counts

Earn 6 TD Rewards Points 3

for every $1 you spend when you book travel through Expedia® For TD 6

Earn 4.5 TD Rewards Points

for every $1 you spend on Groceries and Restaurants 4

Earn 3 TD Rewards Points

for every $1 you spend on regularly recurring bill payments set up on your Account 4

Earn 1.5 TD Rewards Points

for every $1 you spend on other Purchases made using your Card 5

Recurring Bill Payments, Groceries and Restaurants (Yearly spend cap of $15,000 each)

† This chart is for illustrative purposes only. Welcome Bonus applies only in the first year.

†† Total TD Rewards Points and corresponding dollar value equivalent assumes no redemption of TD Rewards Points towards any travel purchases made during the year. Maximum dollar value of TD Rewards Points shown, only applies to TD Rewards Points redeemed for travel purchases charged to your Card and booked through Expedia For TD.

††† TD Rewards Points must be redeemed in minimum 200-point increments for travel purchases charged to your Card that are booked online or by phone through Expedia For TD. For travel purchases charged to your Card that are not booked through Expedia For TD, TD Rewards Points must be redeemed in minimum increments of 200 or 250 points.

Credit Card Reward Perks

Use TD Rewards Points at Expedia For TD

Redeem your TD Rewards Points for your next trip at ExpediaForTD.com and get access to exclusive deals. Conditions apply.

Earn more at Starbucks

Link your eligible Card to earn 50% more TD Rewards Points and Stars. Redeem points for even more Stars. Conditions apply.

Use TD Rewards Points at Amazon.ca

Redeem your TD Rewards Points towards purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

Redeem your TD Rewards Points how you want, for what you want

Every purchase you make with your TD Rewards Credit Card earns you TD Rewards Points. With the flexibility to choose how to redeem your TD Rewards Points for the rewards you want, you can use your points on everyday perks, eGift cards, education credits, cash credits or travel. Learn more .

More Card Benefits and Features

Td rewards program benefits.

The TD Rewards Program lets you earn TD Rewards Points on your everyday purchases and gives you the freedom and flexibility to redeem them how and when you want. Discover the possibilities at TDRewards.com

Go places on Points Your Points are worth more when you redeem through Expedia For TD : Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem 8 your TD Rewards Points towards your travel purchase right away. Or Book Any Way: 8 You can also choose to book your trip through any other travel agency or website. This gives you the flexibility to use your TD Rewards Points towards all kinds of travel expenses – including excursions and taxes – within 90 days of your purchase.

Shop online through TDRewards.com Redeem your TD Rewards Points for great deals on a wide selection of merchandise and gift cards.

Financial Rewards Pay With Rewards : Redeem TD Rewards Points to help pay down your credit card balance.

Travel Benefits

Flight/Trip Delay Insurance 9 Up to $500 in coverage if your flight/trip is delayed more than 4 hours.

Delayed and Lost Baggage Insurance 9 Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothing and toiletries if your baggage is delayed more than 6 hours or lost.

Common Carrier Travel Accident Insurance 10 Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, or train).

Auto Rental Collision/ Loss Damage Insurance 14 Use your eligible Canadian TD Credit Card to charge the full cost of a car rental and get the Auto Rental Collision/Loss Damage Insurance at no additional cost

Emergency Travel Assistance Services 11 Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

Check your TD credit card travel insurance benefits Learn about what travel insurance benefits are available on your TD credit card with our Credit Card Travel Insurance Verification Tool .

Hotel/Motel Burglary Insurance 19 Up to $2,500 of coverage per occurrence for eligible personal items stolen from your hotel or motel room that belong to each Cardholder on the Account and eligible family members travelling with the Cardholder.

Review the Benefit Coverages Guide for more details.

Additional Benefits & Features

TD Payment Plans Easily turn purchases of $100 or more into manageable 6, 12 or 18 month Payment Plans. Conditions apply. Learn more .

Save with Avis Rent A Car and Budget Rent A Car Use your Canadian TD Credit Card to save a minimum of 10% off the lowest available base rates 12 , 13 in Canada and the U.S., and a minimum of 5% off the lowest available base rates 12 , 13 internationally, on qualifying car rentals at participating Avis and Budget locations.

Use Apple Pay , Google Pay or Samsung Pay wherever contactless payments are accepted These Digital Wallets are accepted in a growing number of shops, restaurants, and other retailers, making it convenient and easy to use for everyday business payments with just a tap of your device.

Optional Benefits

Optional TD Credit Card Payment Protection Plan 18 : Optional TD Credit Card Payment Protection Plan is designed to help you deal with your TD Credit Card payment obligations in the event of a covered Job Loss, Total Disability or loss of Life. To learn more about optional TD Credit Card Payment Protection Plan products, call 1-866-315-9069 or visit tdcanadatrust.com/BP

Option to purchase TD Auto Club Membership 15 and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

- Mobile Device Insurance 19 Up to $1,000 of coverage in the event of loss, theft, accidental damage, or mechanical breakdown for eligible mobile devices.

- Chip & PIN technology TD Visa* Cards with Chip and PIN technology provide an added level of security through the use of a Personal Identification Number (PIN).

- Visa Secure* Visa Secure provides you with increased security and convenience when you shop online.

- Instant Alerts. Added convenience, with TD Fraud Alerts: You can now automatically receive TD Fraud Alerts to your mobile phone any time we suspect suspicious activity on your Canadian TD Platinum Travel Visa * Credit Card, or on any Additional Cardholder's Card on your Account. Learn more Learn more .

- Purchase Security and Extended Warranty Protection 16 You automatically have access to Purchase Security and Extended Warranty Protection, which includes coverage for most eligible new items you’ve purchased with your Card, should they be stolen or damaged within 90 days of purchase.

- Manage your credit card in the TD app Set transaction limits, block international purchases or lock your credit card. Learn more .

Frequently asked questions

Why should you get a td platinum travel visa card.

If you’re looking for a travel credit card that gives you amazing travel rewards and benefits, then the TD Platinum Travel Visa Card is just the card for you. With this card, you can earn TD Rewards Points on everyday purchases and earn extra Points on eligible purchases and travel bookings. You can also access a range of travel benefits like Flight Delay Insurance, Emergency Travel Assistance services, and more!

What is the minimum credit score for the TD Platinum Travel Visa?

When you are ready to apply for the TD Platinum Travel Visa Card, or any TD Credit Card, bear in mind that having a higher credit score will always improve your chances of getting approved for the credit card. This card does not have a minimum annual income requirement which means it is accessible by any travel enthusiasts looking for a travel credit card that not only makes travel affordable but also comes with travel perks and benefits.

How do you earn and redeem TD Rewards Points with this TD Credit Card?

Earn and redeem TD Rewards Points when you travel or shop with the TD Platinum Travel Visa Card. Use it to book your travel through Expedia® for TD to earn 6 TD Rewards Points for each dollar spent 5 . Pay for groceries 3 and restaurants to earn 4.5 TD Rewards Points on each dollar spent with recurring bill payments earning you 3 TD Rewards Points for every $1 spent. All other eligible purchases earn you 1.5 TD Rewards Points for each dollar spent 6 . Visit ExpediaforTD.com to redeem Points on travel bookings. You can also redeem TD Rewards Points to pay down your account balance or to shop online at TDrewards.com. You can redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points as well.

Find out more about our credit cards in Canada

Get started with my credit card.

Everything you need to know to start using your Canadian credit card.

Use my credit card features

Get to know the features that come with your Canadian TD Credit Card.

Get the most out of my Canadian credit card

From paying bills to credit limit, take advantage of all your card's benefits.

Start my application

How to Apply

Apply online.

Complete an online application and receive an instant response

Our banking specialists are ready to answer any questions you may have

Book an appointment

Meet with a banking specialist in person at the branch closest to you

Locate a branch

Speak with a banking specialist at the branch closest to you

Have a question? Find answers here

Popular questions, helpful related questions, did you find what you were looking for.

Sorry this didn't help. Would you leave us a comment about your search?

Compare cards

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

Your province is set to

Annual interest rates, fees and features are current as of September 4, 2024 unless otherwise indicated and subject to change.

- $124: Annual Fee Rebate for the Primary ($89) and first Additional Cardholder ($35) for the first year;

- Welcome Bonus of 15,000 TD Rewards Points earned when you make your first Purchase with your Card (travel value at Expedia For TD of $75;

- Additional Bonus of 35,000 TD Rewards Points earned when you spend $1,000 within 90 days of Account opening (travel value at Expedia For TD of $175;

2 Primary Cardholder remains liable for all charges to the Account, including those made by any Additional Cardholder. Maximum of 3 Additional Cardholders on the Account.

3 Earn 6 TD Rewards Points for every $1 in Purchases of travel made online through Expedia For TD or travel made by phone through Expedia For TD (“Phone Travel Purchases”) (“Online Travel Purchases”) and charged to your TD Platinum Travel Visa* Card (“Account”). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Online Travel Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

4 Earn 4.5 TD Rewards Points (“Grocery Rebate" & "Restaurant Rebate”) for every $1 in Purchases of groceries or grocery items (“Grocery Purchases”) and for every $1 in Purchases at restaurants including fast food restaurants (“Restaurant Purchases”) . Earn 3 TD Rewards Points (“PAP Rebate”) on each $1 in payments made on a monthly or other regularly recurring basis for merchant bills, including insurance premiums, magazine/newspaper/online streaming subscriptions, membership fees and telecommunication fees, that are set up by the merchant with your consent to be automatically charged to your TD Platinum Travel Visa* Card (“Account”) and that are classified through the Visa network as “recurring payments” (“Pre-Authorized Payments”) . Rebates are only available to a $15,000 maximum net annual spend (“$15,000 Cap”) . $15,000 Cap : Once the $15,000 Cap has been reached for either Grocery Purchases, Restaurant Purchases, or Pre-Authorized Payments then any further Grocery Purchases, Restaurant Purchases, or Pre-Authorized Payments made on the Account will earn TD Rewards Points at the standard rebate rate of 1.5 TD Rewards Point that applies to all other Purchases on the Account as set out in your TD Rewards Program Terms & Conditions (“Standard Rebate”) . Applicability of Grocery Rebate and Restaurant Rebate: Each of the Grocery Rebate and the Restaurant Rebate is in place of, and not in addition to, the Standard Rebate. Merchant Category Codes: To earn the Grocery Rebate and/or the Restaurant Rebate, the Grocery Purchases and/or Restaurant Purchases must be made at merchants classified through the Visa network with a Merchant Category Code (“MCC”) that identifies them in the “grocery”, “restaurant” or “fast food” category. If you have questions about the MCC that applies to a Purchase, contact TD at 1-800-983-8472 . Other Conditions : Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

5 Earn 1.5 TD Rewards Point (“Standard Rebate”) on every $1 on all other Purchases (“Other Purchases”) charged to your TD Platinum Travel Visa* Card Account (“Account”). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

6 Expedia For TD is operated by Expedia, Inc. at ExpediaForTD.com and 1-877-222-6492. The Toronto-Dominion Bank and its affiliates are not responsible for any of the services and products offered/provided by Expedia, Inc.

7 Subject to carrier/space availability.