Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

15 international travel insurance options for australians in 2024.

Travel insurance can be used to help cover costs associated with the loss or damage to your luggage and belongings.

You can also use it for unexpected medical emergencies, as some insurance companies provide 24/7 support anywhere in the world and may assist with your safe arrival home.

It can be hard to compare international travel insurance policies in Australia because they come in all shapes and sizes, but with flexible options you can find the right balance between benefits and an affordable premium.

We’ve collected information about 15 travel insurance policies for Australians , looking at some of the areas to help you make your insurance policy decision that meet your needs.

Compare International Travel Insurance for 2024:

- Fast Cover Comprehensive For Coverage

- Cover-More Basic For Value Insurance

- NRMA Comprehensive For Frequent Travellers

- Qantas Travel Insurance (70+ Years) For Seniors

- Southern Cross Comprehensive (Family Cover) For Families

- nib Comprehensive For COVID-19 coverage

- Australia Post Basic For Medical Only

- Westpac Altitude Credit Card with Travel Insurance

Great Coverage

Fast cover international comprehensive.

- Unlimited Overseas 24/7 Emergency Medical Assistance & Hospital Expenses

- Unlimited Overseas Emergency Evacuation & Repatriation cover

- Unlimited Trip Cancellation cover

- Trip disruption Expenses up to $50,000

- Travel delay cover up to $2,000.

- Permanent Disability cover up to $50,000

- Accidental death cover of up to $25,000

- Luggage & Personal Effects cover up to $15,000

- Policies can be customised to suit the type of trip you’re taking. This does not include all benefits that are included under the Fast Cover Comprehensive Policy.

Fast Cover International Comprehensive Policy

- Unlimited cancellation cover for non-COVID related cancellations, and up to $5,000 if your trip is cancelled or disrupted because of COVID-19.

- Medical screening available for medical conditions.

- Option to add cover for cruising, snow sports, motorcycle riding, rental vehicle insurance excess and the more adventurous adventure sports.

- Up to $15,000 benefit for luggage and personal effects

- High benefit for permanent disability at $50,000.

Fast Cover tells us that its International Comprehensive policies provide market leading medical coverage. Its Comprehensive policy includes COVID-19 Benefits with unlimited emergency medical expenses cover (including medical evacuations) and trip cancellation and disruption cover due to certain COVID-19 related events up to $5,000.

If you require cover for your existing medical conditions, they offer a simple online or over the phone medical questionnaire to help you obtain cover for those conditions.

Eligibility criteria, terms, conditions, limits and exclusions may apply, please consult the PDS and TMD for further information before you make any decisions to buy.

Good Value for International Travel Insurance

Cover more international basic plan.

- Unlimited overseas medical cover (including COVID-19)

- 37 pre-existing medical conditions covered automatically

- $5,000 cover for luggage and personal effects

- $2000 cover for emergency dental expenses

- Variable excess

- Good value with reasonable cover for a low premium

Cover-More International Basic Plan

- Cancellation cover is additional/extra and choosing a cover to include it will impact your premium

- Claim up to $5,000 if your trip is cancelled or disrupted because of COVID-19. However, you must have cancellation cover to receive this.

- $600 benefit to replace essential personal effects if your baggage is delayed

- Choose to pay an excess of $0, $100, or $200 on all claims. This will affect the amount you pay in premiums.

The Cover-More International Basic Plan offers impressive value with a very affordable premium. It covers the essential benefits a budget traveller needs for peace of mind, such as unlimited overseas medical cover. But there are also generous benefits not usually seen in cheap travel insurance, including $2000 dental cover and $600 for delayed luggage. Many cheaper insurance policies will not cover COVID-19 but Cover-More provides unlimited coverage for COVID-19 medical expenses, along with an optional $5,000 in COVID-related trip cancellation and disruption costs.

Annual Multi Trip Travel Insurance

Nrma international comprehensive plan.

- Annual cover for journeys of up to 60 days

- Optional COVID-19 trip cancellation or disruption cover

- Unlimited overseas medical cover (including COVID-19)

- 24-hour emergency assistance

- Variable excess

- High benefit for loss of income, permanent disability and accidental death

- Year-round cover to destinations over 250 km from your home

- Option to choose up to $10,000 to cover rental vehicle excess

- Claim up to $2,000 if you experience travel delays

- Claim up to $12,000 for luggage and travel documents

- $1,100 benefit to replace essential personal effects if your baggage is delayed

- Cover for loss of income ($45,000), permanent disability ($30,000), and accidental death ($30,000)

The NRMA International Comprehensive Annual Multi-Trip Plan covers an unlimited number of trips (up to 60 days each) for an entire year so you don’t have to take out a new policy for every journey. Cover limits apply to each trip, which means your policy is reset every time you go away.

Choose the policy you need based on your travel habits, including the maximum trip duration (select between 30, 45, or 60 days), excess ($0, $100, or $250), and amount of cancellation cover.

However, NRMA doesn’t provide great automatic cover for pre-existing medical conditions so check the terms and conditions if you have ongoing medical concerns.

Travel Insurance for Seniors

Qantas international comprehensive travel insurance (70+ years).

- 40+ pre-existing medical conditions automatically covered

- Unlimited overseas medical cover (including for COVID-19)

- Unlimited overseas emergency dental expenses

- Unlimited trip cancellation cover

- Low standard excess of $100

- Qantas points can be earned on policy purchase

- 43 pre-existing medical conditions are automatically covered, including Osteoporosis and Osteopenia, Hypertension, and High Cholesterol (conditions apply).

- Claim up to $2,500 on travel expenses related to COVID-19, including trip cancellation or additional travel and accommodation costs.

- Claim up to $15,000 for luggage and personal effects, including $3,000 for replacement passport and travel documents

Qantas is one of the most common travel insurance policies for seniors in Australia , with a policy specifically designed for senior citizens aged 70 and above. You won’t need to declare if you have one of the 43 medical conditions automatically covered but conditions generally require that you have no ongoing complications.

Comfort is assured with $1,500 provided for travel delays, $500 for delayed luggage, and $2,500 for COVID-19 trip cancellation and disruption costs. For those who don’t meet the age requirements, Qantas has similar comprehensive insurance for seniors under 69 years old.

For Families

Southern Cross International Comprehensive (Family Cover)

- Free cover for all dependents under 21

- Choose trip cancellation cover to suit your travels

- Extremely high cover for luggage and personal effects

- Generous cover for travel delays

- Option to select anywhere between $5,000 and unlimited trip cancellation cover (per journey, not per person) — but the amount you choose will impact your premium

- Claim up to $5,000 for trip disruptions or cancellations caused by COVID-19

- The combined cover for luggage and personal effects at $50,000

- $5,000 combined cover for baggage delays

Choose the Family Cover from Southern Cross Travel Insurance (SCTI) if you’re looking for impressive value and plenty of cover for all travellers. This policy automatically covers two adults and any dependent children who are under 21 years, not married or employed full-time, and depend financially on at least one adult listed on the policy. This NZ-based company provides one of the best family travel insurance policies for luggage and comprehensive options for COVID-19 expenses. No pre-existing medical conditions are automatically covered so if anyone in your family has an ongoing medical issue, they will need to apply for cover.

International Travel Insurance with Covid Cover

Nib comprehensive plan.

- 40+ pre-existing medical conditions covered automatically

- $10,000 cover for coronavirus-related travel costs

- No age limit

nib Comprehensive Plan International Travel Insurance

- $1000 emergency dental cover

- Choose your own cancellation cover to suit you

- $12,000 cover for luggage, with $3,000 to replace passports and travel documents

nib Comprehensive is a great option if you’re looking for international travel insurance with thorough covid cover . Receive unlimited medical cover for COVID-19 and an unparalleled $10,000 in travel costs if your trip is affected by the coronavirus. That covers trip cancellation if a close relative or business partner back in Australia is hospitalised or dies due to COVID-19 while you’re away.

Other benefits are mid-range or even on the low end. Total permanent disability cover is $12,500 and personal liability is $2.5 million. Most comprehensive policies provide $25,000 and $5 million in cover respectively.

Medical Only

Australia post international basic plan.

- Cover for COVID-19 self-isolation requirements

- 37 pre-existing medical conditions automatically covered

- Permanent disability and accidental death cover

- $5 million for personal liability cover

- Unlimited cover for the cost of medical treatment and emergency repatriation or evacuation.

- Claim up to $2,000 for emergency dental treatment

- $10,000 cover for permanent disability and accidental death

- $2,500 for additional expenses if you test positive for COVID-19 and need to self-isolate (with an additional $250 excess)

Credit Card with International Travel Insurance

Westpac altitude.

- Complimentary with Westpac Altitude Rewards credit cards

- Unlimited medical cover (including COVID-19)

- Luggage cover up to $20,000 per person

- Earn rewards points with every purchase

Westpac Altitude Complimentary International Travel Insurance

- Up to $2000 per person for emergency dental cover

- Up to $1600 cover for luggage delay

- Some of the best cover for accidental death and loss of income

- Provided with Westpac Altitude credit cards, including Altitude Rewards Platinum, Altitude Velocity Platinum, Altitude Qantas Platinum, Altitude Rewards Black, Altitude Velocity Black, Altitude Qantas Black

- Cover for up to 6 consecutive months of travel for Black credit cards and 3 consecutive months for Platinum cards.

- To be eligible for the complimentary travel insurance, you need to be an Australian resident who has purchased a return overseas travel ticket beginning and ending in Australia. You must also charge at least $500 of prepaid travel costs to your card account before leaving Australia.

Westpac Altitude credit cards are perfect for the frequent traveller looking to capitalise on their travel expenses and get comprehensive international travel insurance at the same time. Spouses and dependents (under 25 years old) will also be covered by the insurance if they’re travelling with you.

As a bonus, you can choose from the free Altitude Rewards program or the Qantas or Velocity programs (with a $50 fee) to start earning points on your purchases.

Since Bank of Melbourne, BankSA, and St George are subsidiaries of Westpac, they offer the same benefits in their complimentary insurance policies, though different card fees, interests, and benefits may apply.

Compare other popular international travel insurance policies

While we’ve listed our top 8 international travel insurance policies, there are plenty more choices to consider. We’ve provided a comparison of travel insurance policies from brands you’ll be families with, such as Allianz, Medibank, and Bupa, along with others from less well-known companies like World2Cover.

Here’s an overview of their features, cover, and inclusions:

- Extremely high benefit for permanent disability and accidental death

- $5,000 cover for trip cancellation because of COVID-19

InsureandGo Gold Policy

- $15,000 cover for luggage and personal effects

- Cover available for travellers aged 100 years and under, although a premium surcharge applies for those over 50 years old.

InsureandGo Gold is a great alternative comprehensive travel insurance policy, with generous luggage, trip cancellation, and COVID-19 cover. It has the highest level of cover for permanent disability and accidental death (set at $50,000 each). But the policy has no automatic cover for any pre-existing medical condition and you will need to be assessed to receive cover for any ongoing medical issue.

- 24-hour assistance with registered nurses and doctors available

- Unlimited hospital and emergency evacuation expenses

- Emergency dental included in medical cover

Allianz Comprehensive Travel Insurance

- Claim up to $12,000 for luggage, including $5,000 for travel documents and credit cards

- Apply to have your pre-existing medical condition covered

The Allianz Comprehensive Plan has built-in flexibility so that you can choose the policy that works best for your needs and budget. You can choose the level of cover for trip cancellations and vary the base excess amount. However Allianz does not cover trip cancellations or disruptions caused by COVID-19. No pre-existing medical conditions are automatically accepted — you will need to apply for cover.

- $12,000 cover for luggage and personal effects

- 15% off for Medibank or ahm health members

Medibank International Comprehensive

- Claim up to $5,000 for travel documents and credit cards

- Upgrade to the Annual Multi-Trip policy for annual cover for up to 60 days

- Up to 38 pre-existing medical conditions are automatically covered

- 21-day cooling off period

The Medibank International Comprehensive travel insurance policy is great if you’re already a Medibank or ahm health member since you’ll get 15% off the premium. Otherwise, it’s a mid-range policy for those looking for standard cover. The unlimited travel cancellation cover is its best feature, though it caps out at $5,000 for COVID-19 related cancellations (with an extra $500 excess).

- Australian-based case managers

- 15% off for Bupa Health Insurance members

Bupa Comprehensive Travel Insurance

- 24/7 emergency hotline with access to registered doctors and nurses

- Receive a full or partial refund on your premium if your trip is cancelled before departure because of COVID-19

- Apply for pre-existing medical insurance cover

If you have Bupa Health Insurance, it may be worth looking into Bupa international travel insurance since you’ll get 15% off the premium. The policy provides a 24/7 emergency hotline where you’ll have access to Australian-based case managers, along with registered doctors and nurses. Bupa doesn’t provide cover for trip cancellations caused by COVID-19, although if you’re affected by border closures or mandatory quarantine before departure, you may be able to cancel your policy and receive a full or partial premium refund.

- $3,500 cover for coronavirus-related travel costs

- Unlimited travel cancellation cover

- Generous cover for travel delay

- 38 pre-existing medical conditions covered automatically

World2Cover Top Cover

- $2000 emergency dental cover

- $15,000 cover for luggage, with $3,000 to replace passports and travel documents

- Standard excess of $200 can be reduced to $100 or $0

If you’re looking for a great all-rounder with comprehensive COVID-19 benefits and generous cover for luggage and travel delays, you might want to look into World2Cover. Their Top Cover plan provides a combined $3,500 cover for cancellation costs, travel delays, and additional expenses due to COVID-19.

- Unlimited cover for cancellation fees and lost deposits

- At least 38 pre-existing medical conditions covered automatically

1Cover Comprehensive International Travel Insurance

- $1,000 emergency dental cover

- Claim up to $15,000 for luggage and $5,000 for important travel documents

- Standard excess of $200 can be reduced to $100

- 2022 Experts Choice at the Mozo Awards

Awarded Mozo’s 2022 Experts Choice Award for high-quality travel insurance, 1Cover has great benefits for trip cancellation and disruption costs, with unlimited cover for cancellation fees and lost deposits, $5,000 for alternative travel expenses, and $2,000 for additional accommodation and travel expenses. However it provides no cover for trip costs (such as cancellations and disruptions) caused by COVID-19.

- Up to $20,000 trip cancellation cover

- Up to $2,000 cover per person for trip delay expenses

- Cover for up to 6 consecutive months of travel

- 24/7 support through Allianz Global Assistance

ANZ Complimentary International Travel Insurance

- Luggage benefit up to $12,000 per cardholder or spouse (dependants are included in the limit available to the cardholder or spouse)

- $50,000 benefit per person for permanent disability

- Complimentary international travel insurance is provided with ANZ Frequent Flyer Platinum, Frequent Flyer Black, Rewards Platinum, Rewards Travel Adventures, Rewards Black, and Platinum credit cards.

- To be eligible for the complimentary travel insurance, you will need to be an Australian resident who has purchased a return overseas travel ticket before leaving Australia. You must also charge at least $250 of prepaid travel costs to your card account before leaving Australia.

ANZ offers complimentary travel insurance on its Platinum and Black personal credit cards. Spouses and dependents (under 25 years old) will also be covered by the insurance if they’re travelling with you.

If extensive medical cover is important to you, this complimentary travel insurance might serve you well. Along with unlimited cover for medical expenses and evacuations, you can also claim up to $10,000 per person for loss of income, up to $50,000 per person for accidental death, and an unparalleled $50,000 for permanent disability — a benefit usually excluded from credit card travel insurance.

The best international travel insurance for Australians depends on a range of factors, including the level of cover you want and your budget. For comprehensive cover, it’s Fast Cover International Comprehensive . Cover-More’s Basic Plan offers the good value with extensive cover at an affordable premium while Australia Post International Basic Plan is excellent for medical-only cover.

For frequent travellers, consider NRMA’s Comprehensive Annual Multi-Trip policy . For seniors, look at Qantas Comprehensive Insurance for 70+ years and for families, Southern Cross International Comprehensive Family Cover .

While insurance isn’t always mandatory for international travel, the Australian Department of Health says it is “as important as a valid passport”. Some countries, including those in the Schengen Zone, require proof of travel insurance as part of the visa application or a condition of entry. Since the pandemic, it is a requirement in many countries that your travel insurance covers COVID-19 medical costs.

One of the best Australian travel insurance for COVID-19 claims is nib Comprehensive , which provides unlimited medical cover for COVID-19, along with $10,000 cover for trip costs if your travels are affected by coronavirus.

Travel insurance may help cover any medical costs, trip delays or cancellations, and missing or delayed baggage, all of which can arise from international flying. While travel insurance isn’t a mandatory condition for flying, many countries require proof of travel insurance for entry.

A number of factors influence the cost of your travel insurance, including:

- Your travel itinerary (the destinations and the types of activities planned)

- The level of cover (such as Essentials or Comprehensive)

- The excess you choose

- The number of people listed on the policy

- Pre-existing conditions you may want covered

- Extra cover you choose, such as ski cover or cruise cover.

This means with most policies, you have a degree of control over how much you want to cover and how much you pay in premium.

Before making any purchase of any Travel Insurance product you should always read the relevant Product Disclosure Statement and Target Market Determination and see whether the products considered suit your needs. Products compared do not show all features that may be relevant to you and your trip.

We don’t act for or give any advice on the service provider or product and whether they are right for you generally or personally. Please directly visit the relevant website of the above Travel Insurance provider for more information.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

Travel Insurance Quotes

Compare quotes and read reviews from Australia's leading travel insurance brands. Do your comparison online to save time, worry and loads of money.

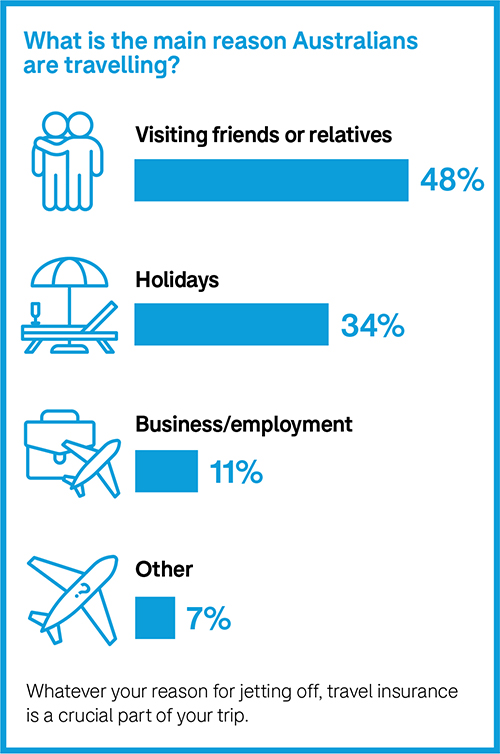

why aussies love .css-w6rwrx{color:var(--chakra-colors-primary);display:inline;} compare travel insurance

No hidden fees.

Travel agents and airlines charge huge commissions. We don’t! Our travel insurance comparison is free to use. You'll be directed to the insurer's website to buy travel insurance without any sneaky charges.

On-board medical cover

Whether you're looking for cheap travel insurance or fully comprehensive cover for a domestic or international trip, you'll find the prices on our site are the same great prices you get buying travel insurance direct!

Data Protection

We promise to keep your data secure and not to sell your information to other companies. And we only ever send you relevant emails you have subscribed to.

Using our comparison is easy-peasy! One simple form makes it quick and easy to compare travel insurance quotes for your holiday. You'll get quotes online for your trip in seconds.

Rest Assured

All the policies we compare have 24/7 overseas emergency assistance to help in time of need. All brands are underwritten by reputable insurers like Allianz Australia Insurance Limited, Auto & General, Chubb, Great Lakes, Lloyds, QBE & more!

Product Choice

We compare heaps of policies for all types of travellers from some of Australia’s most reputable travel insurers. We compare 25+ insurance brands including, 1Cover, Fast Cover, Budget Direct, Insure and Go, Zoom & more!

travel insurance extraordinaire .css-1eehdh8{color:var(--chakra-colors-bananaLight);display:inline;} at your service

Need some help? Check out handy FAQS to help with all your curly travel insurance questions.

why .css-w6rwrx{color:var(--chakra-colors-primary);display:inline;} buy travel insurance?

We’re not silly, we know that plenty of Aussies go on holiday and have an amazing time exploring new and exciting places without buying travel insurance. But taking a gamble on your much-needed break can be risky. Here’s why!

Trust me, I'm not crackers!

Exxy Medical Costs

If you buy a policy for just one reason, this is it! Falling ill or being injured while travelling overseas can be extremely costly. Hospital costs in the USA can reach up to $10,000 per day, while emergency transport home for treatment can easily exceed $100,000! Ouch!

Disasters Can Strike

The excitement of getting on that plane has you knotted up like a pretzel. Picture your dismay if you had to cancel last minute. Worse still, imagine you’re mid-martini when bad news breaks. Should you need to return home, you’ll be covered for unforeseen events like injury or illness of a close relative.

Your Stuff Is Important

Loss, theft or damage to your prized possessions can be a common, yet gut-wrenching experience. If your personal belongings go AWOL while you’re away the right policy will pay to replace or repair them. Win!

Peace Of Mind

Travel insurance comes with 24/7 emergency assistance services which includes a team of doctors, nurses, travel agents and translators ready to support you in your time of need. ...Aaaand relax.

Because You Have To

Still not convinced? We hate to be the fun police, but some countries simply won’t let you in without cover! For example, it is mandatory to take out travel insurance when travelling to Thailand or Cuba.

trending trip cover .css-w6rwrx{color:var(--chakra-colors-primary);display:inline;} tips and guides

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Coronavirus, Travel Disruptions and Your Insurance

The rapid spread of covid-19 around the globe has thrown international travel into chaos. Find out what's covered if you're travelling during the coronavirus outbreak.

travel insurance .css-w6rwrx{color:var(--chakra-colors-primary);display:inline;} review

Not sure which policy to pick? Our travel insurance reviews are here to help! Thousands of Aussies have reviewed their travel insurers to give you the inside story on everything from claims handling to customer experience. Or perhaps you want to have your say? Whether you love or loathe your travel insurer rate and review them to help other Aussies pick the right policy for their holiday.

travel insurance .css-w6rwrx{color:var(--chakra-colors-primary);display:inline;} frequently asked questions

Have a travel insurance question? Here are some of the most common questions we get from our customers.

Does travel insurance cover coronavirus (covid-19)?

It depends! Unfortunately, the answer isn't a straightforward one. There are some situations where cover is available, and others where it is an exclusion. It largely depends on which insurer you bought your policy with ; when you bought it; where you're travelling to; when you're travelling; and, the reason for your claim. As travel continues to open up around the world, most (but not all) insurers provide cover for overseas hospital & medical expenses if someone named on the policy was positively diagnosed with COVID-19. Some insurers also provide cover for additional expenses and cancellation benefits.

Which is the best travel insurance in Australia?

The best travel insurance depends entirely on your planned trip and your circumstances. If you're a backpacker on a strict budget, you might want a no-frills medical-only policy, while if you've paid a lot in deposits or if you have pre-existing health conditions, a more comprehensive policy might be best for you. While there's no single best travel insurance that's right for everyone, finding a policy that works for you is easy when you use our quote comparison to start comparing prices and features. With Compare Travel Insurance, you can also read up on travel insurance reviews from customers to learn about their customer service and importantly claims experience.

What does comprehensive travel insurance cover?

Comprehensive travel insurance includes coverage for unexpected medical expenses overseas in the event of injury or illness, as well as cover if your luggage is lost or stolen, cancellation and disruption benefits if you need to cancel or are delayed for unforeseen reasons, as well as public liability cover. Go to our comprehensive travel insurance guide to learn more.

What do medical-only policies cover?

Medical-only trip insurance a.k.a basic policies generally only offer coverage for unexpected medical expenses overseas. Some basic policies also include a small amount of coverage for luggage or cancellations. Our website allows you to filter quotes for basic, mid-range and comprehensive travel insurance policies and their features to help you find the policy which is right for you.

Is it too late to buy travel cover?

Although we recommend buying a policy as soon as you've started paying deposits for flights, accommodation and tours, you can buy travel insurance at any point, even if you are already overseas . Exclusions often apply though, so be sure to check the PDS before you buy.

Can I purchase travel insurance at the airport?

Yes, you can. Generally speaking, you can purchase travel insurance up to a year before your trip, right up to boarding at the airport. With comprehensive travel insurance, you are covered for cancellation benefits from the moment you buy your policy, so we recommend buying it as soon as you start paying for flights, tours and accommodation.

Can I get travel insurance if I'm already overseas?

You can buy cover if you are already overseas, although each travel insurer has different rules on age limits and waiting periods. Check out our already overseas travel insurance guide to learn more.

Does travel insurance cover pregnancy?

You can buy travel insurance to cover you when you're pregnant, but every brand has different rules depending on how many weeks gestation you are, whether you've had complications, and whether you're looking for cover in case of emergency birth. Check out the handy table on our pregnancy guide for more information.

Do I need cover in Australia?

If you're an Australian resident, a domestic policy covers you for cancellations, luggage cover and often rental vehicle excess, but as you're covered by Medicare, medical coverage is not included. International visitors to Australia are currently not required to have travel insurance by law, but it is highly recommended to protect you from eye-watering medical bills and more.

Which is the cheapest policy?

The cost of travel insurance depends on a range of factors including your destination, duration of travel, age of travellers, planned activities, whether or not you have any medical conditions and the type of cover you choose (medical only, mid-range or comprehensive). The cheapest travel insurance is generally to less risky parts of the world - places with cheaper healthcare and less risk of injury, illness or theft - and policies which offer less coverage - so ones without benefits for adventure activities or pre-existing conditions. To get cheap travel insurance from Australia for your trip, create a quote and compare prices, but remember that the cheapest isn't always the best. You should consider your trip and what you require cover for.

Why should I buy travel insurance direct online?

Comparing prices and features online makes it easier to find the policy that's right for you and your circumstances. With comparetravelinsurance.com.au , the price you see is the same price direct from the insurer. Sometimes you're not after the best policy but rather the best bang for your buck and comparing prices and features online can save you time, worry and loads of money.

Our Travel Insurance Comparison Helps You Save Time, Worry And Loads Of Money!

Stay up to date with our latest news, deals and special offers.

Let's connect:

Rated 4 stars on:

Comparetravelinsurance.com.au is Australia’s leading comparison site solely focused on travel insurance.

Our comparison is a free service that allows users to compare quotes in a few simple steps based on limited personal criteria. Comparisons supplied are not a recommendation or opinion about the suitability of a policy for a user. Comparisons are default ranked according to price and users have the ability to sort by popular cover levels. Whilst we compare a vast range of policies, we do not compare all providers in the market. Get free travel insurance quotes from Australia’s most trusted brands in just one search, including 1Cover, Fast Cover Travel Insurance, InsureandGo, Ski-Insurance, Travel Insurance Saver, Tick, Zoom Travel Insurance. Compare online and save today! The directors and shareholders are common with companies Zoom Travel Insurance and 1Cover Pty Ltd including it’s subsidiary brand Ski-insurance. CoverDirect takes all reasonable care when preparing this information but does not warrant its accuracy. Pricing information is supplied by the providers who participate on this site and should be verified with the insurer before you purchase. This site links users to the website of the provider to verify quotes and access the relevant PDS to understand what is, and is not, covered by a policy prior to purchase.

CoverDirect Pty Ltd owns and operates this website under AFS Licence 383590. 332 Kent Street, Sydney, NSW 2000 Australia.

Search Smartraveller

Choice travel insurance buying guide.

Do you need travel insurance? How do you choose the right cover? What are you covered for?

CHOICE answers all the questions you need to know before leaving the country.

Download the CHOICE travel insurance buying guide [PDF 3.52MB] Download the CHOICE travel insurance cheat sheet [PDF 587KB] Who is CHOICE? Set up by consumers for consumers, CHOICE is the independent consumer advocate that provides Australians with information and advice, free from commercial bias. Visit choice.com.au .

Why travel insurance?

- Does travel insurance cover COVID-19?

How to get travel insurance

Before you buy, how to save money on travel insurance.

- How to read the product disclosure statement

What are you covered for?

- Credit card insurance

How to make a complaint

If you’re leaving Australia, travel insurance is just as essential as a passport.

Holidays don’t always go as planned.

If you’re leaving Australia, travel insurance is just as essential as a passport. Medical expenses are the number one reason to get insurance, but sometimes other things can go wrong, such as trip cancellations, delays, lost luggage or even the big stuff like natural disasters and pandemics. If you end up out of pocket because of these things, insurance can make up for that.

The Australian Government won’t pay your medical bills.

In an emergency, the Australian Government can only help so much. The Consular Services Charter describes what the government can and can’t do to help Australians overseas.

If you end up injured or sick while overseas, you’ll be footing the hospital bill and the cost of flying home. If you’re really unlucky, that could cost you or your family hundreds of thousands of dollars.

68% of travellers mistakenly believe the Australian Government would ensure they get medical treatment if they need it overseas, and 43% believe the government would pay their medical bills.

Some countries won’t let you in if you don’t have insurance.

Singapore and the UAE require you to have travel insurance. Not to mention all 26 European countries in the Schengen Area if you’re applying for a visa to visit. Read the Smartraveller travel advice for information about your destination.

Reciprocal healthcare Australia has reciprocal healthcare agreements with several countries: Belgium, Finland, Italy, Malta, the Netherlands, New Zealand, Norway, the Republic of Ireland, Slovenia, Sweden and the United Kingdom. If you have Medicare, you can get subsidised treatment for essential services only in these countries, which often leads people to ask whether they still need travel insurance. The answer is yes, for the following reasons. You’re usually only covered for urgent care that can’t wait until you get home. If you’re very ill, travel insurance can pay for a medical escort to bring you home to Australia. You still may have to pay fees for treatment and medication. For example, in New Zealand reciprocal health care doesn’t cover you for free or subsidised care by a general practitioner or ambulance. Travel insurance can cover you for cancellations, delays, stolen items and more.

Remember to take your Medicare card with you. You’ll need it, along with your passport, to prove you’re eligible for reciprocal health care. For more information, visit servicesaustralia.gov.au .

Marco* had breathing difficulties on his way home from Europe, causing his flight to be diverted to the UAE. Hospitals in the UAE won’t admit you unless you have insurance or can pay an upfront fee. Marco’s family had to pay thousands of dollars for his treatment. *To protect privacy we have changed names and some details

Do you need domestic travel insurance?

Most of us already have medical cover at home, be it Medicare or private health insurance or both. But there are still a few key reasons to consider domestic travel insurance.

- Cancellation: If you’ve spent a lot on your holiday, then it’s not too much extra to buy travel insurance in case of the unforeseen.

- Baggage cover: If you’re travelling with valuables, think about whether you want them covered for theft, loss or damage.

- Car hire excess: You can save money using travel insurance to cover your collision damage excess, rather than paying the car hire company’s extra charge.

Does international travel insurance cover COVID-19?

Many travel insurers now offer limited cover for COVID-19, but the available cover varies quite a lot. Some policies only cover medical and repatriation costs if you get COVID-19 overseas, while other policies provide limited cover for cancellation costs in addition to medical and repatriation costs.

You should always check the details of your insurance coverage, particularly how it applies to COVID-19 and travel disruptions.

Over 90% of travellers will look for insurance that covers them for cancellation and medical expenses caused by COVID-19.

If you’re planning to go on a cruise, be extra careful. Some travel insurers may not offer COVID-19 cover for multi-night cruises or they may restrict the cover provided on cruises.

Also, don’t rely on the travel insurance on your credit card unless you check it closely – it may not cover claims related to COVID-19.

There are cooling-off periods for COVID-19 cancellation cover, so it’s best to buy your travel insurance at the same time as you book your trip. Some insurers may only cover cancellation if you test positive to COVID-19 and the policy was purchased more than 21 days before your scheduled departure date.

Make your travel plans COVID-safe

You need to be prepared for your travel plans to be interrupted at short notice. As travel insurance may not protect you from government border closures, general lockdowns or quarantine requirements in your destination country, the key is to book only with providers that allow you flexibility should things change.

- Check the rules for travelling to your destination. For example, are there any entry requirements? What are the vaccination requirements? And what type of travel insurance do you need?

- Read the terms and conditions of your airline, accommodation and travel tours before you book. Will they refund you if you can’t travel due to COVID-19? If they only offer a reschedule or a credit, will you be in a position to redeem the credit in future?

- You can book flexible tickets for flights but be aware you usually have to pay the difference between the prices for the tickets you bought and the new tickets. So changing your flight dates at short notice can be very expensive.

- If you book through a travel agent or booking site, what are their terms and conditions? Will they refund you or provide a credit? Are there cancellation fees?

- If you pay by credit or debit card (and you selected ‘credit’ when you paid), you may have access to credit card chargebacks if something goes wrong.

- Keep on top of the latest travel advice and requirements at smartraveller.gov.au . Travel restrictions can change at short notice.

- If you do have to cancel, your travel insurer will ask you to claim what you can back from travel providers first. Read the CHOICE advice on how to get your money back on travel cancellations and ask your travel insurer if you can get a refund or partial refund of your travel insurance premium.

You can buy travel insurance from a travel insurer, travel agent, insurance broker, credit card provider, or even from your health, home or car insurer.

You can buy travel insurance online (direct from the insurer’s website, from a comparison site or through an airline booking site), over the counter or over the phone.

Buy travel insurance as soon as you know your travel dates. That way you’re covered if your trip is cancelled before you even leave or if you’re unable to travel at all.

You can certainly buy travel insurance quicker than it will take you to read this guide, but do you know what you’ll be covered for? Will you be covered if you trip over after having a drink? If you crash your scooter in Thailand? If you lose your wallet during a stopover? If you need to isolate because you contract COVID-19?

There are a lot of ‘what ifs’ to consider, depending on where you’re going and what you’ll be doing, so it’s worth reading the product disclosure statement (PDS) first to make sure you’ll be covered.

Will you use it? Hopefully not, but research by Smartraveller found that one in 4 Australian travellers experienced an insurable event on their last overseas trip. Most common insurable events Flight or tour cancelled Flight delayed more than 12 hours Received medical treatment Lost, damaged or stolen luggage Missed a connecting flight Lost, damaged or stolen cash or personal items Forced to cancel trip before departure What if the insurers don’t pay out? Australian travellers lodged almost 300,000 insurance claims in 2018–19, the last financial year before COVID-19 travel bans. Almost 90% of those were paid out. Top four reasons for declined claims Due to policy exclusions, or not included in the policy conditions Claim amount was below the excess Claim was due to a pre-existing medical condition Claim was for an item that was stolen while it was unattended

1. Where are you going?

The level of cover and the cost of travel insurance can vary depending on the region you’re travelling to, and some risks may be of greater concern than others. Not all travel insurance policies cover COVID-19 and other pandemics or epidemics such as SARS. And not all policies cover you for changing your plans due to a riot or civil commotion, for example. Travel insurance also may not be available for countries with travel alerts.

- Look up your destination on smartraveller.gov.au and make sure you’re aware of any risks or safety advice.

- Buy a policy that covers you for every country you’re travelling to or transiting through. If you’re going to Europe via a one-night stopover in the US, then get cover for the US and Europe. Usually a worldwide policy will cover this.

86% of travellers say they’re more cautious after the COVID-19 pandemic about travelling to places where it could prove harder to return home in a crisis.

You need different cover for different regions

Insurers sometimes apply policies to regions rather than having a policy for each destination.

Asia Pacific: Destinations such as New Zealand, Bali, Fiji and Papua New Guinea.

Asia: Destinations such as India, Indonesia, Thailand, Singapore and Malaysia.

Europe: Destinations such as the United Kingdom, Ireland and Western Europe.

Worldwide: All of the above as well as regions such as North America, South America, Japan and Africa.

These definitions differ for each insurer. For example, several insurers cover travel to Bali under their Pacific policy, while some will only cover travel to Bali under their Asian region policy.

2. How long are you going for?

Just a quick trip? Simply buy a standalone travel insurance policy for a set number of days.

Travel often? Consider an annual multi-trip policy or a credit card with complimentary travel insurance, but make sure it gives you the cover you need.

Tip: Annual multi-trip policies and credit card policies can restrict the length of each trip you take – anywhere from 15 to 365 days depending on your policy. Some allow you to pay for extra days.

3. What are you going to do there?

Cruising the open road on a moped? Carving up the ski slopes? Partying at a wedding? These things aren’t necessarily included in a travel insurance policy.

Scan the insurer’s list of included activities and those that you’ll have to pay extra for. And take it easy on the grog – if your alcohol or drug intake is the cause of an adverse event, it won’t be covered by your policy.

4. Are you taking any valuable items?

Do you need cover for a digital SLR camera or an expensive tablet or laptop? Cover for such valuables can vary from a few hundred dollars to thousands, and higher cover will often mean a higher premium.

Consider adding cover for portable valuables to your home insurance policy instead, but check on the excess and if the policy will cover you worldwide and not just in Australia.

Policies also vary when it comes to how they cover valuable items. Valuables in your check-in luggage often aren’t covered, while cover for baggage stored in your hire car is inconsistent. And baggage left unattended is never covered, which can include a bag that is stolen from the seat beside you in a restaurant while you’re looking the other way.

Make sure you have receipts for your valuables as travel insurance will not pay if you can’t prove you own them.

5. Do you have any medical conditions?

If you have a medical condition that existed before you bought your policy, it may not be covered. This can range from something as common as allergies or asthma through to diabetes, heart conditions and knee replacements.

If you’re not sure, the best thing to do is contact the insurer to ask whether they’ll cover your condition automatically or whether you need to do an assessment.

The Massoud family* was holidaying in Singapore when 13-year-old Nazreen had a recurrence of severe bronchitis, which had affected her in Australia before their trip. The family’s travel insurer refused to pay any hospital bills as Nazreen’s bronchitis was a pre-existing medical condition. As a result, the Massouds had to ask their friends to transfer the $17,000 they needed to cover Nazreen’s hospital expenses, additional accommodation and the cost of changing flights. *To protect privacy we have changed names and some details

It’s important to compare policies for cost and cover. Some travel insurance premiums increased by as much as 30% between March and June 2022.

Three-quarters (77%) of travellers are willing to pay more for insurance that covers pandemic-related claims.

The further out from your departure date that you buy travel insurance, the more you’re likely to pay for it, but you’ll be covered from the moment you buy your policy. For example, if you buy insurance 2 months before you fly, you effectively have cheap cover for any events that affect your travel plans in those 2 months.

If you pay for your trip in full 6 months in advance, but you only buy an insurance policy 2 weeks before you depart, you may not be covered for any cancellation costs if you contract COVID-19.

Left it until the last minute, or even later? Only a few insurers let you buy insurance once you’re already overseas (look for the ‘Have you already left Australia?’ checkbox when viewing policy options).

While not all policies offer online discounts, plenty do. Make sure you understand the policy and what it covers. Sometimes (but not always) a reduced price may mean reduced cover.

Tip: Check asic.gov.au/afslicensing to find out whether the agent has an Australian financial services (AFS) licence or is an authorised representative of a licence holder. Take the usual precautions when giving your credit card and other details over the internet.

Member discounts

Does your health, car or home insurance provider also sell travel insurance? Some companies give 10–15% discounts to existing members.

Shop around

Trying to negotiate with a website will probably get you nowhere, but if you’re buying over the phone or through a travel agent, give it a go. Travel agents pocket a commission when they sell you insurance, so if you find a better deal elsewhere, ask them if they can beat it.

Almost two-thirds (62%) of overseas travellers who buy insurance do so on or before the day of booking travel.

Use your credit card

Some credit cards come with ‘free’ travel insurance when you use them to buy a ticket, pay for other travel expenses or otherwise activate it (we say ‘free’ because you’ll pay a premium in fees for the card itself).

This type of insurance can sometimes be a money-saver, and the level of cover can be just as good or even better than standard insurance, but make sure it gives you the cover you need.

Compromise on cover

While good medical cover is always essential, you could save money on your premium by choosing a policy with lower or variable cover for cancellation, delays and lost baggage, especially if you aren’t spending big on your holiday or taking expensive items with you.

Have you read the Product Disclosure Statement (PDS)? According to research conducted in 2022, of those who bought travel insurance: 45% have skim-read the PDS 43% have read the PDS in detail 8% have left the PDS to another person on the policy to read 2% have not and will not read the PDS 2% don’t know

About that fine print

You’re about to click ‘buy’, so you may as well just tick this ‘I acknowledge I’ve read the product disclosure statement’ checkbox and bon voyage…

But wait – have you checked the fine print? In the insurance world, that ‘fine print’ is contained in the product disclosure statement, or PDS (that thing you said you’d read).

How to read the PDS

There are hundreds of policies out there and if you tried to read all the paperwork that comes with each policy, you’d have to extend your holiday just to recover.

If you don’t have time to read the whole PDS cover to cover, at least look for the following.

- The table of benefits is an overall summary of your cover.

- The policy cover section is essential reading and is generally split into ‘what we will pay for’ and ‘what we won’t pay for’.

- General exclusions are also essential reading – these are events that aren’t covered by any section of the policy.

- Pre-existing conditions can remind you of forgotten ailments and are essential reading for anyone with any kind of medical condition, no matter how mild.

- The word definition table might contain a few surprises – it’s a good place to check on the definition of a ‘relative’ or a ‘moped’, for example.

- The claims section lists some further pointers to be aware of (e.g. it’s a good idea not to admit fault or liability in the case of an accident) and the paperwork you may need to collect while you’re away if you need to make a claim, such as police reports.

- COVID-19 cover section – many policies have a special section listing medical, cancellation and other cover available for COVID-19.

- The 24-hour emergency assistance contact number (write it down and keep it handy).

The Weaver* family was relieved to have travel insurance when they needed to cancel their holiday. The family wanted to go skiing in New Zealand, but a few days before they were due to depart, 12-year-old Ruby had cold symptoms. A COVID-19 test showed she was positive. Ruby and her whole family had to isolate and their travel insurance paid their cancellation costs. *This is a fictitious but realistic example

The list of travel insurance disputes taken to the Australian Financial Complaints Authority (AFCA) reveals a battlefield of unread or misinterpreted terms and conditions. Between 1 July 2020 and 30 June 2021, AFCA received more than 2,000 travel insurance complaints related to COVID-19.

Not all travel insurance policies are the same, and the wrong policy can be almost as bad as none at all.

Peter* and his business partner had booked a business trip to South Korea and Japan from 21 February 2020 to 2 March 2020. On 20 February, Peter cancelled the trip on advice of his GP who said that due to the uncertainty of the extent of the COVID-19 outbreak, he should postpone the trip until it is safe to travel. Peter’s travel insurer denied his claim, saying the policy does not provide cover for cancellation due to medical advice. Peter made a complaint and AFCA ruled in his favour as COVID-19 had been publicly announced as an epidemic prior to Peter cancelling the trip and the doctor’s advice not to travel was prudent and reasonable. *To protect privacy we have changed names and some details

Checklist – Are you covered for COVID-19? Are your medical costs covered if you contract COVID-19? Are your extra expenses such as accommodation covered if you can’t travel or your stay gets extended because you or your travelling companion tests positive to COVID-19? What happens if you were going to stay with someone but they’ve contracted COVID-19? Or your accommodation or tour company gets closed down because of COVID-19? Are your additional expenses covered? If the Smartraveller alert level is raised to ‘Reconsider your need to travel’ or ‘Do not travel’ due to a COVID-19 outbreak at your destination after you took out travel insurance, are you covered if you cancel your trip? Are your cancellation costs covered if you can’t travel or can’t return on your booked flights because you or your travelling companion contracted COVID-19? Are you covered for cancellation costs if your business partner or a relative back home gets sick with COVID-19 and you need to return earlier than planned? If you’re planning to go on a cruise, be extra careful. Some travel insurers may not offer COVID-19 cover for multi-night cruises. Are you covered for claims caused by government travel bans, border closures, or mandatory quarantine or self-isolation requirements at your destination?

And what are the catches?

Cancellations, baggage and personal items, sports and activities.

This is the number one reason to buy international travel insurance. Look for the insurer’s benefits table, usually on the quotes screen online or near the front of their PDS, for a quick overview of what they’re offering. Most policies have an ‘unlimited’ sum insured.

Pre-existing conditions

Some insurers don’t cover pre-existing conditions at all. Some will only cover pre-existing conditions with an extra fee and sometimes a medical assessment. Some automatically cover pre-existing conditions listed in their PDS, although few will cover mental illnesses such as depression or anxiety.

Insurers exclude cover for certain pre-existing medical conditions and generally don’t provide cover for any illnesses or incidents that arise from these. This includes terminal illness or any illness that shortens your life expectancy as well as organ transplants.

Minor pre-existing medical conditions such as asthma, hypertension, diabetes, epilepsy, osteopenia and more are usually covered if:

the condition has been stable for more than 12 months

there is no planned surgery

you have not received treatment in the past 12 months.

Pre-existing condition spoiling your holiday plans? findaninsurer.com.au lists insurers that may provide cover for pre-existing conditions. Still having trouble finding cover? Enlist the help of an insurance broker.

Examples of conditions that usually need to be assessed before getting cover are coronary problems, lung disease, epilepsy, stroke or any surgeries in the last 2 years.

If in doubt, declare your condition to your insurer.

A disability shouldn’t prevent you from buying travel insurance, but it might make finding a good policy trickier and more expensive.

Is a disability a pre-existing condition?

It depends on the disability and the insurer. Many insurers will automatically cover travellers with limited mobility, cognitive impairments or vision/hearing impairments. But in some cases, this cover may come at an extra cost.

Check with the insurer, as some conditions will need to be assessed on a case-by-case basis.

Having trouble getting cover?

Under the Disability Discrimination Act, insurers must assess the actual risks, rather than make assumptions about disabilities. If you’re having trouble getting insurance, a letter from a medical professional might help, particularly if they can state that you’re not likely to need medical or hospital treatment while on your trip.

Cover for your equipment

If you’re travelling with a wheelchair, mobility aid or hearing aid, you’ll need to insure that as well. Check single item limits, which are usually between $750 and $1,000 per item. If you have a piece of medical equipment that exceeds this, you’ll need to specify it and insure it separately.

Many insurance policies exclude hearing aids, so check the fine print and take out extra insurance if necessary.

Cover for your carer

If you’re travelling with a carer, it’s a good idea to be on the same policy in case travel plans change for either of you – that way you’re both covered. If you have a paid carer, ask your insurer whether they’ll cover the cost of a replacement carer should yours be unable to travel.

Babymooning

If you’re travelling while pregnant, be sure to check the following.

- Are you covered for pregnancy complications? Some insurers don’t cover pregnancy at all.

- Up until which stage of pregnancy? Pregnancy complications are usually only covered up until a certain stage (often between 23 and 32 weeks, depending on the insurer).

- Childbirth: Not all insurers will cover childbirth. A premature birth in the US with intensive care and treatment could end up costing hundreds of thousands of dollars.

- IVF: Not all insurers will cover IVF pregnancies.

- Do you have to pay extra to be covered?

- Do you need medical approval to be covered?

Mental health

Many travel insurers won’t provide cover of any kind for hospitalisation, medication or missed travel caused by a mental health condition, whether that’s depression, anxiety or a psychotic episode.

Others will provide cover if you declare mental illness as a pre-existing condition and pay a higher premium. Check the PDS carefully; insurers may use different terms to describe the same mental health conditions, giving them wriggle room to deny a claim.

Insurers are highly unlikely to pay a mental health-related claim if they discover it was a pre-existing condition that you didn’t declare. The trouble is, an insurer might view a single visit to a therapist many years ago because of work stress, for example, as a pre-existing mental health condition.

Mental health and travel insurance have been a contentious issue for consumer rights groups including CHOICE – and it’s one that’s still evolving from a legal standpoint.

To find out if a travel insurance product includes mental health cover, check choice.com.au/travelinsurance , filtering for ‘mental illness related claims’. Then put the PDS under the microscope.

A woman in Victoria won a court case against her insurer after they declined her claim for the cancellation of an overseas trip due to depression. ‘We took out the travel insurance well in advance of the travel, and well before my depression. I was certainly under the impression that I was covered,’ she told CHOICE. ‘They just sent back a letter that said no.’ But her win (the Victorian Civil and Administrative Tribunal awarded her $4,292 for economic loss and a further $15,000 for non-economic loss) was an isolated ruling. It’s still being debated whether or not a general exclusion for mental health claims is legal.

Most policies have an age limit, ranging right up to the 100-year-old seasoned adventurer. There are quite a few catches for older travellers, though.

- Higher premiums: Insurers often charge older travellers more, and in some cases ‘older’ can be as young as 50.

- Higher excess: Travellers as young as 60 but more commonly over 80 may be subject to a higher excess because of their age. The normal excess of around $100 to $200 is often increased to an excess of $2,000 to $3,000 for travellers 80 years and over for claims that relate to injury or illness.

- Restricted conditions: Subject to medical assessment’, ‘reduced medical cover limits’, ‘reduced travel time’, ‘policy to be purchased 6 months in advance’ – all of these conditions can apply to travellers over a certain age.

You’ll probably want to be covered if your travel plans are cancelled for any reason, but be aware that insurers will come up with plenty of excuses to avoid paying up.

- Terrorism: Most insurers cover medical expenses but very few cover cancellation expenses in the event of terrorism.

- Pandemic or epidemic: Commonly excluded.

- Military action: Commonly excluded.

- Natural disaster: Covered more often than not.

- Travel provider/agent insolvency: Commonly excluded.

- Cancellation due to travel provider’s fault: Insurers commonly exclude cover for delays or rescheduling caused by the transport provider.

John* and his partner’s scheduled train service was delayed, seriously diverted, then terminated, which meant they missed their flight home by several hours. Re-booking fees, emergency accommodation and related fees cost them between $1,000 and $1,500, but the insurer wouldn’t pay the claim as it wasn’t in the policy. *To protect privacy we have changed names and some details

‘Unforeseen’

When an insurer refers to cover for ‘unforeseen circumstances’, it means something that wasn’t publicised in the media or official government websites when you bought the policy. Check the Smartraveller travel advice when you buy your travel insurance. If it became known before you bought the policy, you’re not covered. So the earlier you buy travel insurance, the more likely you are to be covered for the unexpected.

Exclusions and inclusions

When the Australian Financial Complaints Authority (AFCA) looks at a complaint about an insurer, they expect you to prove the claim is covered by the policy, while the insurer must prove the claim is excluded by the policy. Specifically, AFCA expects you to ‘establish on the balance of probabilities that you suffered a loss caused by an event to which the policy responds’. That is, do you have a valid claim?

This means that you need to understand if your claim is covered under the listed events of the policy, or that it is not specifically excluded by the policy.

If, for example, you have cover for COVID-19, you aren’t covered for every event caused by the pandemic, but just by what is specifically stated in the PDS.

Margaret and Peter* booked a cruise departing from Darwin in March 2021. Shortly before departure, the Northern Territory Government issued a directive no longer allowing cruises to depart from the NT. Margaret and Peter’s cruise company arranged for the cruise to depart from Broome and flew the passengers to Broome for a cost of $300 per person. As Margaret had bought a policy that included some cover for COVID-19, she made a claim for $600. But this was denied by her travel insurer and her subsequent complaint to AFCA was unsuccessful. AFCA said, ‘The cause of the loss was a government directive to not permit the cruise to operate through the NT port. The insurer’s policy provides no cover for these circumstances. It also excludes losses arising from government intervention, prohibition or regulation.’ *To protect privacy we have changed names and some details

Travel insurance and Smartraveller advice Smartraveller, managed by the Department of Foreign Affairs and Trade (DFAT), assigns an overall advice level to more than 175 destinations. This advice level can affect your travel insurance cover. The advice levels are: Level 1 – Exercise normal safety precautions. COVERED. Level 2 – Exercise a high degree of caution. COVERED. Level 3 – Reconsider your need to travel. CHECK. Level 4 – Do not travel. USUALLY NOT COVERED. Travel warnings can work in your favour. If an insurer excludes cover for an event, they may still cover you to change your plans in response to updated advice from Smartraveller. But beware when travelling to a destination that has a ‘Do not travel’ warning. Most standard policies won’t cover you for ‘Do not travel’ destinations, including for COVID-19. A week after a volcanic eruption made world news, Sameer* booked a trip to Bali. He assumed the emergency would be over by the time he was due to fly a month later. Unfortunately, the volcano continued to erupt and Sameer’s flight was cancelled. His insurer declined his claim because he’d bought the flight and insurance after Smartraveller issued a travel alert about the volcanic eruption, and after it had been in the news. *To protect privacy we have changed names and some details

Delays can be expensive, particularly if you have to pay for alternative transport or accommodation. And those extra expenses won’t always be covered.

- Transport delay is only covered after a certain number of hours, usually 6, but you may have to wait as long as 12 hours before your cover kicks in.

- Cover limits for transport delays are typically lower than other cover limits and are often limited per 24-hour period.

- Insurers often exclude cover for rescheduling caused by the transport provider but some may cover additional accommodation and travel expenses in this scenario for travellers who are en route.

Baggage cover varies widely, with travel insurance policies ranging from $0 to $30,000. So, if you’re not carrying expensive items, you may be able to save on your premium by selecting a policy that provides lower coverage.

- Individual items are subject to sub-limits that range from around $250 to as much as $5,000.

- Higher item limits usually apply for electronic items like laptops, cameras, smartphones and tablets.

- You can pay extra to specify items you want extra cover for (insurers are always happy for you to pay extra).

- Valuables locked in a car or checked in on an airline, train or bus may not be covered.

- Generally, any items left unattended may be excluded from cover, so keep your belongings close.

Jing* sat down to try on a pair of shoes in a busy London shoe shop, placing her handbag next to her on the seat. When she stood up to leave, she discovered her bag was gone. Her insurer refused to pay up because she had left her bag unattended in a public place. *To protect privacy we have changed names and some details

Lost luggage

If an airline loses your luggage temporarily and doesn’t compensate you for that loss, you may be able to claim expenses for clothing, toiletries and other necessities, depending on your policy.

- Cover usually only applies to luggage lost for more than 12 hours, though the minimum time limit varies per insurer, as does the level of cover.

- If your policy has an excess (a fee that’s deductible from your payout), remember that this applies once per claimed event, and items below the excess level can’t be claimed.

Angelo and Diane* tried to claim $112 for meals and drinks when their connecting flight to Hawaii was delayed by 8 hours. Although their policy technically covered them for the cost, they were liable for an excess of $250, so their claim was denied. *To protect privacy we have changed names and some details

If you don’t feel like paying the ‘extra insurance’ the car hire company charges, then use the collision damage excess cover in your travel insurance.

Tip: Stick with recognised car rental companies in this case since this cover only applies if the car hire company already has its own comprehensive insurance.

Do you have the right licence?

Some countries require you to have an international driving permit. If you have an accident while driving on the wrong licence (or breaking that country’s law in any other way), you may not be covered.

Cruise-specific insurance

Cruises aren’t automatically included in all travel insurance policies. If you’re going on a cruise, make sure you have the right cover.

The Department of Health says: ‘Cruise ships carry a higher risk for spreading disease compared to other non-essential activities and transport modes. COVID-19, influenza and other infectious diseases such as gastroenteritis spread easily between people living and socialising in close quarters.’

Check travel insurance policies to make sure medical cover for COVID-19 is included, as some policies exclude this cover. Erica* stumbled and broke her femur during stormy seas while on a cruise. Her insurer covered the cost of evacuation and a partial hip replacement at a hospital in Noumea. They also organised and paid for her son to fly to Noumea to help her recover and return home to Australia. Five months later, the well-travelled 82-year-old was boarding a plane to Croatia for her next (fully insured) adventure. *To protect privacy we have changed names and some details

Not leaving Australian waters?

You still need insurance. Doctors working on cruise ships don’t need Medicare provider numbers, so if they treat you, you can’t claim on Medicare or your private health insurance, even if you’re still in Australian waters.

Domestic travel insurance doesn’t cover medical costs, so you need either international travel insurance (check that it covers domestic cruises) or a domestic cruise policy.

Kerry* thought she’d done the right thing buying an annual multi-trip international travel insurance policy for a number of upcoming holidays, one of which was a round-trip cruise departing from and returning to Fremantle, Western Australia, with no port stops. When she had to cancel due to ill health, she discovered her policy wouldn’t cover her because the trip wasn’t considered an international one. *To protect privacy we have changed names and some details

When CHOICE compares travel insurers, we look at who covers which sports and adventure activities, such as skiing, ballooning, bungee jumping and scuba diving, to name a few.

But as always with insurance, the PDS may include some surprises. For example, several insurers we’ve reviewed will cover canyoning but they won’t cover abseiling, often a necessity in canyoning. Other policies in our comparison will cover abseiling, but not into a canyon.

If you’re planning on doing anything adventurous, check to make sure you’re covered. It’s not enough to simply look for the tick next to your chosen activity – you also need to check the definitions in the PDS.

Motorcycles and mopeds

Hiring a motorcycle or moped? Depending on which country you’re in, you might need a local or international motorcycle licence. You probably won’t be covered if you aren’t obeying the local law. And even if you are doing the right thing under local law, some policies still won’t cover you unless you have a motorcycle licence.

Are you wearing a helmet? Most countries say you need one by law, but that doesn’t mean it will be included in your hire. No helmet means no cover (in more ways than one).

Nhung* was injured after she rented a moped in Thailand only to find out the engine size was not covered by her insurance policy. Most insurers adopt the national standard for the definition of a moped – an engine capacity under 50cc. If the engine is bigger than that, it’s a motorcycle and you’ll need an Australian motorcycle licence. *To protect privacy we have changed names and some details

Skiing and snowboarding

Some insurers cover skiing, often for an extra premium, but not so many cover skiing off-piste (away from the groomed runs). So, if you’re tempted to slide off the beaten path next time you hit the slopes, make sure you have a policy that covers off-piste ski runs (or pay for the optional extra cover).

Otherwise, if you run into a tree and have to be evacuated from the mountains, you may need to think about selling your home to pay for it.

It’s worth remembering that travel insurance only covers overseas costs. So if you break a leg while you’re abroad, your insurer will likely pay your hospital fees, but they won’t cover your ongoing physiotherapy once you’re back home.

Marianna* fractured her leg in 3 places while skiing with her partner and children in Japan. Because the family had bought additional cover for winter sports, they were reimbursed $35,466 for medical expenses, additional transport and accommodation, the cost of a nanny to look after the children, and business class flights back to Australia. *To protect privacy we have changed names and some details

Alcohol and drugs

Overdoing it on vodka and float-tubing down a river isn’t likely to be covered by any policy. Insurers simply won’t pay for costs arising from you being under the influence of alcohol or drugs (except where taken under the advice of a doctor).

Even one or 2 drinks could be enough of an excuse for insurers to get out of paying.

Relatives can be relative Many policies cover the costs to travel home if one of your relatives dies or becomes sick. Bear in mind: an insurer’s definition of a ‘relative’ may differ from yours cover is usually dependent on the age of that relative, so the death of your 84-year-old grandma may not be covered your relatives are subject to the same pre-existing condition exclusions as you, so if your 84-year-old grandma died from a known heart condition, you may not be covered. you may be able to apply for your relative’s pre-existing condition to be assessed before you buy the policy. cover is limited to relatives that live in Australia, or in some cases New Zealand. So if your 84-year-old grandma is in China, you won’t be covered to fly there for her funeral. Amanda* and her husband had booked an overseas diving trip, but shortly before the trip Amanda’s mum passed away from pneumonia. They cancelled their trip and incurred cancellation costs and lost deposits of nearly $13,000. As the death of a parent was covered in their policy, Amanda made a claim. Their insurer denied the claim as Amanda’s mum lived in the United States and was undergoing treatment for lung cancer, so the insurer concluded that her death was caused by a pre-existing condition. *To protect privacy we have changed names and some details

So you’ve booked and paid for your holiday through a travel agent, but then the travel agent goes broke. You’ll get your money back, right? Not necessarily.

Only a few insurers will cover you for the insolvency of a travel provider, and that includes hotels, airlines and other transport companies that might go broke overnight (remember Ansett?). But there are a few ways to safeguard your hard-earned holiday.

- Check whether your insurer covers you for insolvency.

- Check whether your travel agent has insolvency insurance (this isn’t compulsory, so only some will have it).

- Pay with your credit card. Some banks allow a chargeback if you pay for something on your credit card and don’t end up actually getting it.

Tip: Don’t accept any dodgy contract terms that require you to give up your chargeback rights.

2 out of 3 travellers assume their travel insurance will cover insolvency, but in 2017 less than a third of insurers actually provided this cover.

Credit card travel insurance

Some credit cards come with complimentary travel insurance. They’ll cover you for all the usual things like medical emergencies, cancellation and protection for baggage and items. But they do differ from standalone policies, so it’s essential you check the fine print.

- Fees: You’ll pay a premium for these credit cards, usually between $100 and $450 per year.

- Excess: The excess on credit card policies tends to be fixed at a higher rate (usually around $250), whereas it’s more variable on standalone policies.

- Age limits: Some credit card policies have no age limit, which can be handy for older travellers.

- Regions: Credit card travel insurance is not based on location, which means you can travel from Europe to the US without having to worry if your policy covers both areas. Bear in mind though that some regions (such as countries under United Nations embargo) may be excluded, and sometimes with US underwriters, travel to Cuba is excluded.

- Baggage cover: Credit card insurance often offers higher coverage for baggage loss and damage.

- Trip duration: Credit card insurance policies vary in how many days of coverage they’ll give you per trip – anywhere from a few weeks to 365 days – so check your limit if you’re going on a long holiday.

- Pre-existing conditions: Chances are your credit card insurance won’t automatically cover your pre-existing condition. You’ll need to call your insurer and see if you need to pay an extra fee or premium.